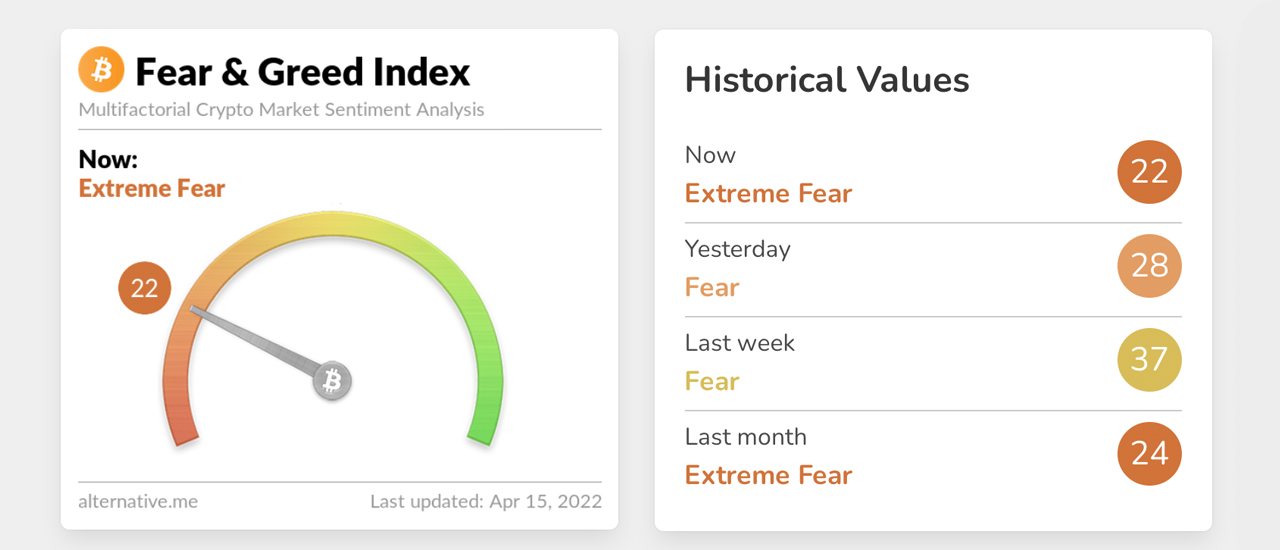

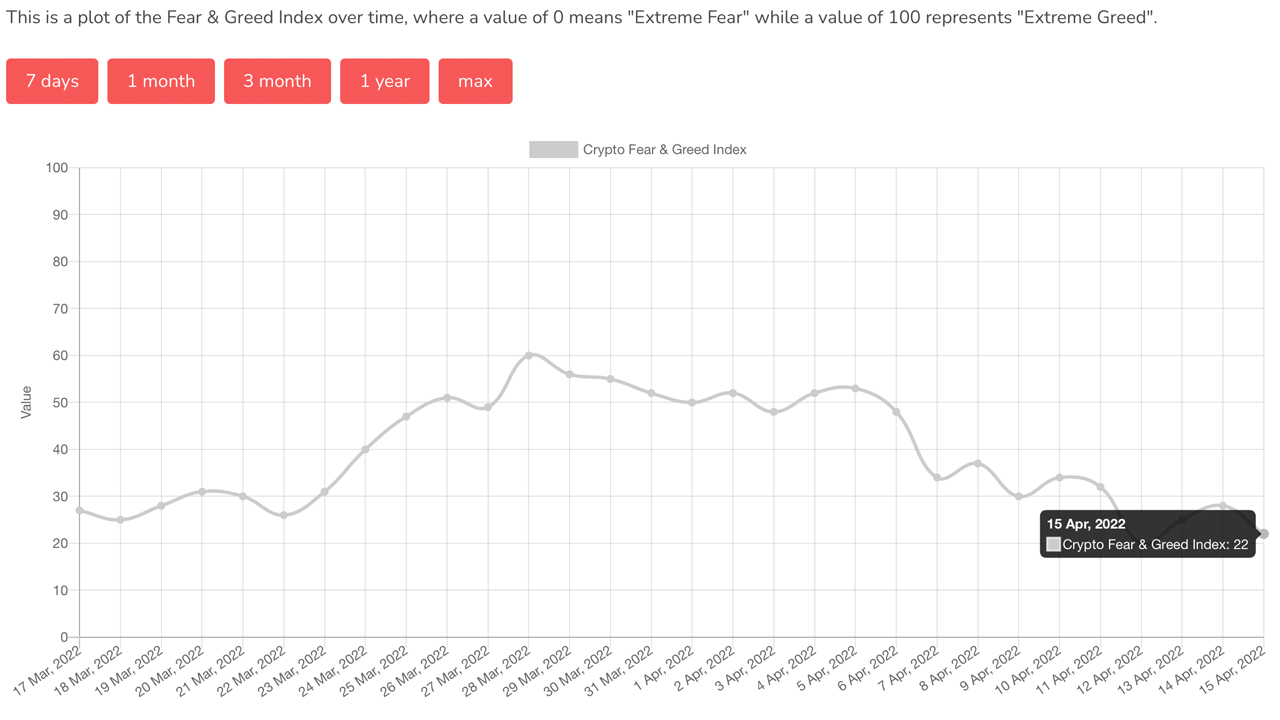

18 days ago on March 28, the Crypto Fear and Greed Index tapped the “greed” position, scoring a 60 for the first time in four months. Since that day, bitcoin has lost more than $7,500 in USD value, and hit a low of $39,200 per unit on April 11. The downturn has pushed the Crypto Fear and Greed Index back down to the “extreme fear” position with a score of 22.

Crypto Sentiment Index Slides to ‘Extreme Fear,’ Bitcoin’s USD Value Is Down 35.7% Year-to-Date

On Friday, April 15, 2022, the price of bitcoin (BTC) has consolidated for now, after reaching a low four days ago. BTC’s 24-hour range on Friday has been between $39,823.77 to $40,709.11 per unit, with roughly $22 billion worth of global trading volume.

Bitcoin is down 7.2% this past week and two-week statistics show the leading crypto asset has lost roughly 11.3%. Year-to-date, bitcoin’s price against the U.S. dollar is 35.7% lower than a year ago today.

While bitcoin’s market capitalization on Friday is around $767 billion it represents 38.91% of the current $1.97 trillion crypto economy. Today’s top trading pair with BTC is tether (USDT) with 60.88% of all trades worldwide. Tether is followed by USD (12.27%), BUSD (7.88%), JPY (4.09%), and KRW (3.28%).

On April 15, the Crypto Fear and Greed Index tapped the “extreme fear” position and has a current score of 22. Yesterday, it was 28 which represents “fear” and the week prior, the score was 37, which also means “fear.”

The Crypto Fear and Greed Index leverages market sentiment and crunches it down into a simple number and description. Sentiment indexes are used in traditional financial markets as well. Financial businesses, universities, and media organizations like CNN, the University of Michigan, Nasdaq’s ISEE Index, and more use these sentiment indexes to gauge how the market feels.

Bitcoin is the ninth-largest global asset today, in terms of market capitalization, above Berkshire Hathaway’s market valuation ($760.36B), and below Tesla’s capitalization ($1.018T).

The last time the Crypto Fear and Greed Index tapped a 22 was March 22, or 24 days ago. The Crypto Fear and Greed Index hosted on alternative.me explains extreme fear and greed can have two meanings.

“’Extreme fear’ can be a sign that investors are too worried. That could be a buying opportunity,” the website explains. “When Investors are getting too ‘greedy,’ that means the market is due for a correction.”

What do you think about today’s Crypto Fear and Greed Index data reaching extreme fear? Let us know what you think about this subject in the comments section below.