Bitcoin (BTC) has “at least one more upward impulse to come” before reaching this halving cycle’s all-time high, new research maintains.

In a series of tweets about the current state of BTC price action, popular analyst TechDev argued that contrary to many opinions, there is nothing unusual about BTC/USD in 2022.

Bitcoin in 2021: Nothing to see here

With a drawdown of 40% from November’s all-time highs of $69,000 still ongoing, sentiment has likewise taken a hit — “extreme fear” still characterizes both Bitcoin and altcoin markets.

For TechDev, known for his optimistic takes on the Bitcoin outlook, there is nonetheless nothing to worry about.

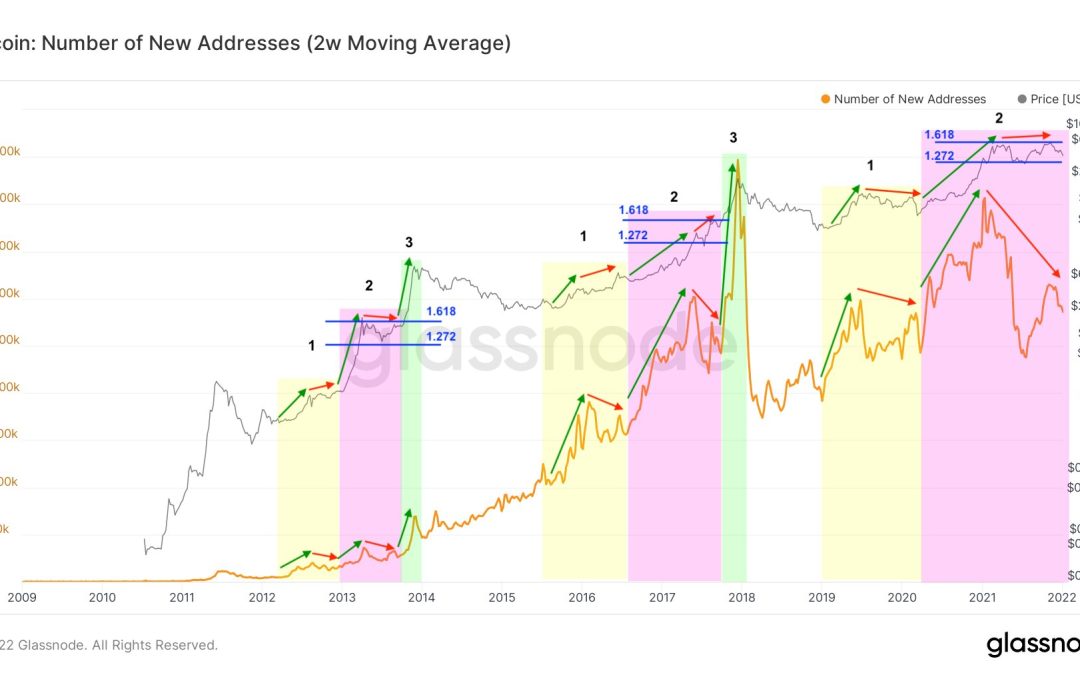

Analyzing new wallet addresses relative to price behavior, he showed that last year’s scenario — new address numbers making lower highs while price makes higher highs — is far from unique.

“In 4 out of the 6 corrections we saw divergence where price made higher highs and new addresses made lower highs,” comments on two posts read.

“…To me, all 6 are running corrections, also supported by declining volume.”

That low volume has previously made headlines as part of concerns that BTC/USD may see unduly significant moves thanks to a lack of liquidity.

Overall, however, price behavior relative to Fibonacci levels has stayed well within historical norms, TechDev added, and there is thus no reason to assume that another all-time high will not come before a bearish phase ensues.

“Our current correction (since Feb 2021) is taking place between the same two-cycle log fibs as a running correction has always taken place, with locally declining volume and new addresses,” he concluded.

A recovery in waiting

As Cointelegraph reported, interest has broadly fallen away from Bitcoin throughout the past year, specifically when it comes to retail investors.

Related: Top or bottom? Traders at odds over whether Bitcoin will keep rising

Seasoned traders remain primed, however, with leverage still near all-time highs and institutions tipped to begin reentering the market.

Meanwhile, in Q4, TechDev began highlighting trends in Bitcoin’s relative strength index (RSI), which again showed that a higher all-time high should be due.

RSI remains significantly “oversold” for BTC/USD, data from Cointelegraph Markets Pro and TradingView shows, something which in times past has unanimously resulted in a reversal and upside price pressure.