European cryptocurrency card holders are awakening to discover that their plastic is now worthless. A Visa-led crackdown has seen several crypto card issuers forced to call an end to their services across Europe. Visa subsidiary Wavecrest is being blamed for the withdrawal of service, which affects scores of crypto card issuers including Bitwala, Tenx, Bitpay, and Xapo.

Also read: French Entrepreneur’s Case to Overturn the Bitlicense Dismissed

Visa Issues a Veto

Seemingly overnight, Visa, acting via Wavecrest, has put an end to cryptocurrency cards. The prepaid cards, which have become extremely popular in the crypto community, provide a means of indirectly paying for goods and services using cryptocurrency. The cards are a means of bridging the gap between the fiat and crypto worlds, preventing hodlers from needing to cash out to spend their digital assets.

As a result of the surprise crackdown, companies such as Cryptopay, Bitwala, and Bitpay have been left with no choice but to end their European services and return funds to users. Upon news of the clampdown emerging, the price of the PAY token linked to the Tenx card dropped by 15%. With the Tenx wallet on Bittrex still offline, seemingly as a result of the Spectre bug being patched, many token-holders have been unable to transfer PAY from their mobile wallets to their normal exchange. The Tenx PAY token was trading at $5 hours ago, but is now sitting at around $4.30.

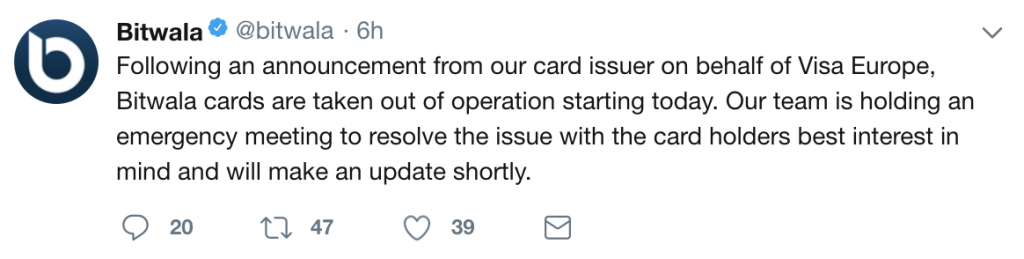

Bitwala were one of the first card-issuers to break the story to their customers, tweeting:

Cryptopay tweeted: “Unfortunately, our card issuer instructed us to cease all Cryptopay prepaid cards starting January 5th, 2018. All funds stored on cards are safe and will be returned to your Cryptopay accounts ASAP. Sorry for all the inconvenience caused, we’re working on the solution!” Other crypto card companies have yet to pass comment, but it appears that the vast majority of European cryptocurrency cards are reliant on the Gibraltar-based Wavepay including Uquid, Coinsbank, Spectrocoin, Advcash, and Wirex.

Xapo’s European Service is Zapped

In an email sent to its customers today, Xapo explained: “Unfortunately, Xapo did not receive any anticipated notice to prepare for – and have our cardholders prepare for – the cancellation of our Card program.” It continued:

Your Xapo Card has been deactivated, and you will not be able to use it for further payments or withdrawals. The rest of your Xapo account remains active, and you can continue to access your Xapo wallet balance and funds without interruptions. All other Xapo services are available for your use, as always.

The email finished: “As a token of our appreciation for being a loyal Xapo customer, once we are able to service Xapo Cards in your country again, we will offer you a new card free of charge. We are hard at work to find alternative card solutions for you. The past years have shown what a powerful product a cryptocurrency payment card can be, and we are already in discussions with potential card issuers allowing Xapo to continue serving customers in Europe and beyond.”

Legacy Finance Lashes Out

The reasons for Visa electing to wield the banhammer are unclear, though the company has long been regarded as hostile to bitcoin. Given that bitcoin threatens to disrupt the status quo, of which Visa is a firmly entrenched part, that tallies. Visa has stated that the cards have been suspended due to “continued non-compliance with our operating rules”, and insists the move isn’t part of a targeted campaign against cryptocurrency. It also claims that Visa cards which convert Bitcoin into fiat currency won’t be affected by the decision, stating:

The reasons for Visa electing to wield the banhammer are unclear, though the company has long been regarded as hostile to bitcoin. Given that bitcoin threatens to disrupt the status quo, of which Visa is a firmly entrenched part, that tallies. Visa has stated that the cards have been suspended due to “continued non-compliance with our operating rules”, and insists the move isn’t part of a targeted campaign against cryptocurrency. It also claims that Visa cards which convert Bitcoin into fiat currency won’t be affected by the decision, stating:

Visa has other approved card programmes that use fiat funds converted from cryptocurrency in a number of jurisdictions. The termination of WaveCrest’s Visa membership does not affect these other products.

Web-users who value their financial freedom have long been been wary of Visa. This is the company, after all, which facilitated the financial blockade of Wikileaks in 2011. That decision ultimately proved to be Wikileaks’ salvation, with Julian Assange later crowing that the switch to bitcoin caused a windfall as the cryptocurrency began to multiply in price.

The repercussions of the Wavepay edict are still being felt, and it is too early to say whether the affected crypto companies will be able to find an alternative payment processor. Whatever the reason for the ban, the case illustrates something bitcoiners have known for years: too much centralization is a dangerous thing.

Do you think Visa has valid reasons for shutting down crypto cards, or is it simply hostile to cryptocurrency? Let us know in the comments section below.

UPDATE: This story has been updated to include fresh information from Xapo.

Images courtesy of Shutterstock. Additional sourcing for this story by Luis Barreto.

Tired of those other forums on the subject of Bitcoin? Check forum.Bitcoin.com.

The post Visa Veto Leaves Several European Cryptocurrency Cards Locked Out appeared first on Bitcoin News.