This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum 2.0 and its sweeping impact on crypto markets. Subscribe to Valid Points here.

The term “DeFi Summer” was coined after the birth and success of governance tokens and “yield farming” in the dog days of 2020. Ethereum as a network found success in hosting decentralized exchanges, lending markets and the occasional “ponzi.”

New platforms used liquidity mining, or distribution of their token to users, to acquire capital and create larger and more efficient markets. Unsustainable yields and token distribution were met with increased usage and crazy speculation that grew decentralized finance (DeFi) to a $7 billion-dollar market by September 2020.

Read more: What Is DeFi?

Aave, Compound, Uniswap and Sushi all quickly established themselves as blue chips in the space and in turn gained billions of dollars in total value locked (TVL) and market capitalization. Value quickly accrued to the platforms’ governance tokens, and the assets soared against both the dollar and ether.

Sentiment has since changed, however, with most major DeFi tokens losing their allure and finding themselves in a seven-month downtrend relative to ether. Now investors are seemingly questioning whether DeFi can recover and whether the space can outperform the market as it did during DeFi Summer.

The lackluster performance of governance tokens brings me to a series of questions about whether investors are doubting the value accrual of tokenized applications or whether they are betting on a larger value accrual to the network itself. Does the market doubt the sustainability of DeFi revenue? Is it easier to bet on the success of the overall ecosystem than any one specific project? Has Ethereum Improvement Proposal (EIP) 1559′s burn mechanism secured ether’s outperformance of DeFi?

Aave’s market size has grown from $3.6 billion to $27.5 billion since Feb. 1, but its governance token is down 69% relative to ether. Uniswap’s UNI token is also trading down 67% relative to ether from its highs in March.

I am excited to continue to watch this narrative play out. Will we see the return of DeFi, or is this another case of “token not needed”?

Welcome to another edition of Valid Points.

Pulse check

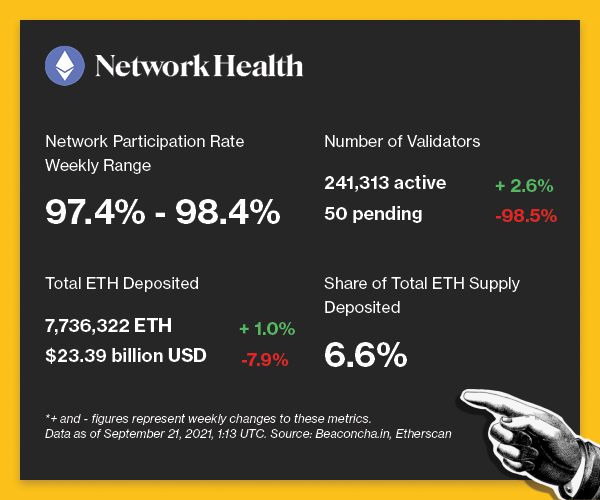

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

- OpenSea’s head of product stepped down after being accused of profiting on insider information. BACKGROUND: The transparent nature of blockchains allowed users to catch an in-house trading scandal at OpenSea and led to the departure of Nate Chastain. He purchased non-fungible tokens (NFTs) before OpenSea listed them on their front-page and sold them for a profit of 19 ETH.

- ‘0xMaki’ stepped down as the project lead of Sushi and moved into an advisory role. BACKGROUND: 0xMaki played a large role in keeping Sushi alive after a humble beginning and a rug-pull from founder, Chef Nomi. The market reacted poorly to 0xMaki’s announcement, highlighting his importance to the DeFi project.

- Coinbase moved away from crypto lending products after a dispute with the U.S. Securities and Exchange Commission (SEC). BACKGROUND: The SEC warned that a crypto-based lending product could be deemed a security. The SEC’s disapproval highlights the need for decentralized lending markets and could drive further adoption of lending applications like Compound and Aave.

- OpenSea “soft launched” a mobile app that will allow users to interact with their own collections and the marketplace. BACKGROUND: OpenSea has undoubtedly helped progress NFT adoption and drive new users into crypto. Further improvements in user experience will continue to grow the crypto and NFT markets. The OpenSea team has made no official announcements regarding the launch of the app.

- Layer 2 scaling solution Arbitrum One suffered 45 minutes of downtime on Sept. 14. BACKGROUND: The Arbitrum Sequencer went offline and briefly paused the submission of transactions on Arbitrum One. The team announced that the downtime was the result of a “large burst in transactions in a short period of time” and that user funds were never at risk.

Factoid of the week

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CoinDesk Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site.