For investors trying to predict market movements, the more data that can be analyzed the better. Trend analysis and fundamental analysis are a starting point, but there are other clues scattered across the web which lie outwith conventional search parameters. One of these, social analysis, involves discerning the general sentiment towards cryptocurrencies on public networks such as Twitter. One bot does just that on an hourly basis, revealing which coins are feeling the love and which are receiving hate.

Also read: More than Half of Russians Know About Bitcoin Now

Social Analysis Reveals Market Sentiment

Twitter is full of bots. While some of of them are malevolent, spamming users and spreading fake news, others are extremely nifty. Watson’s Reports is a bot that provides hourly updates on what people are saying about cryptocurrencies on Twitter. The trend analysis bot, developed by data analyst Crypto Watson, highlights the most talked about cryptocurrencies. It also analyzes the prevailing sentiment to reveal which coins have the most positive and negative mentions.

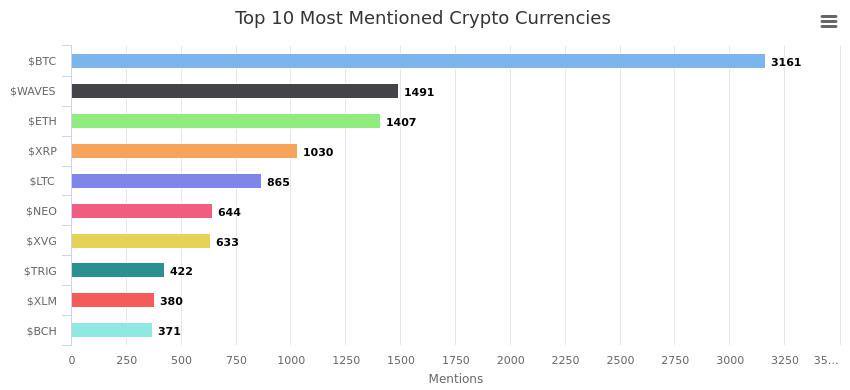

The most recent hourly at the time of publication shows bitcoin predictably out in front with over 3,000 mentions. Waves (1,491), ethereum (1,407), and ripple (1,030) follow. Below that come the likes of litecoin, neo, verge, tron, stellar, and bitcoin cash. While bitcoin invariably leads, other cryptos enter and exit the top 10 depending on whether they’re in the news. But just because someone’s talking about a cryptocurrency doesn’t mean they’re holding it or planning to invest. In fact, several of the most popular coins are also the most hated.

A research paper published in December called “Market Sentiment Helps Explain the Price of Bitcoin” examines this trend in more detail. Its author concludes:

By combining the concept of Metcalfe’s law the variation of the BTC price can be accurately explained by using a market sentiment volume about BTC that is positively scored on social networks. The assumption is that the price of BTC is predominantly a result of the demand-supply balance of buyers and sellers, which is greatly influenced by market sentiment. It is likely that market sentiment is also highly affected by the price itself, forming a circular and bidirectional reflexivity.

It’s Better to Be Hated Than Ignored

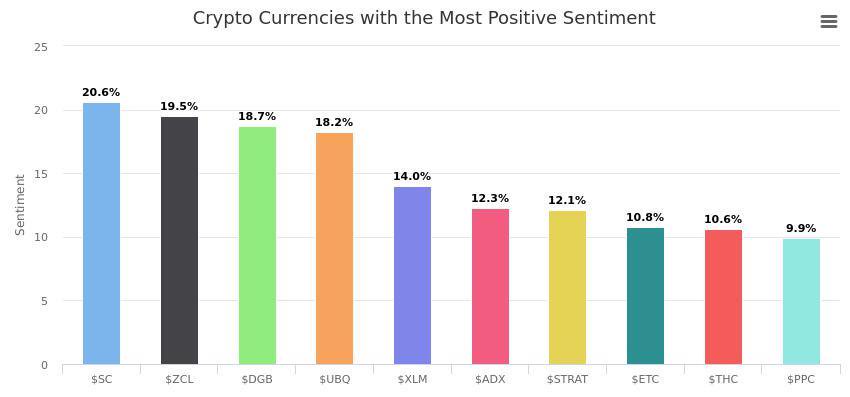

According to the Watson’s Reports bot, bitcoin has the highest amount of negative hourly sentiment (11.5%). That’s to be expected given bitcoin’s dominance; haters gonna hate after all. A look at the runners-up in the positive and negative categories reveals some interesting entrants. The most positively mentioned coins are sia (20.6%), zclassic (19.5%), and digibyte (18.7%). Ubiq and stellar complete the top five.

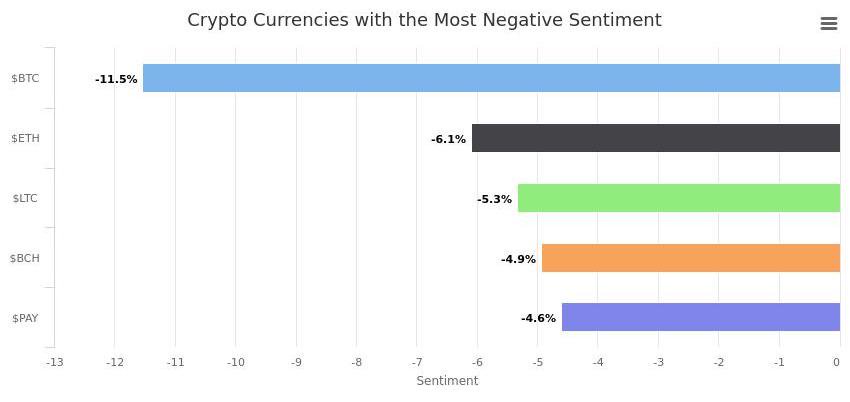

In terms of negativity, after bitcoin it’s ethereum (6.1%), litecoin (5.3%), bitcoin cash (4.9%), and tenx (4.6%). Because the bot updates its analysis each hour, these trends are quite dynamic, with many cryptocurrencies, save for bitcoin, regularly trading places. Whether social analysis is an arbiter of market trends is a matter for investors to agonize over.

A Whole Lotta Bots

Public databases such as Twitter, which provide gigabytes of scrapable data in real-time, are ideal for bots to trawl. Coders have developed bots to analyze an investor’s returns if they were to automatically buy and sell on the advice of Twitter traders, for example. Other bots will tweet when the buy volume for a coin suddenly increases, or in the case of Telegram bot Crypler when a coin is added to an exchange. As AI and the use of bots increases, traders will increasingly take their signals from computers. For the time being, at least, the best traders still rely on a good dose of intuition and gut instinct, attributes which no bot can detect.

Do you think social media analysis can indicate imminent price movements? Let us know in the comments section below.

Images courtesy of Shutterstock, and Watson’s Reports.

Need to calculate your bitcoin holdings? Check our tools section.

The post Trend Analysis Reveals the Most Loved and Hated Cryptocurrencies appeared first on Bitcoin News.