The last 12 months have been a time of incredible growth in the crypto sector, with the global cryptocurrency market cap reaching almost $2 trillion. As well as a plethora of exciting new projects and developments, 2020 also saw a historic level of adoption, with more than 100 million new users joining the crypto scene.

Given the huge gains that cryptocurrencies have made, no doubt a lot of these new users are wishing they’d got involved sooner. This time last year as quarantines were being announced and states of emergency declared, the crypto market crashed in a dramatic event that became known as Black Thursday.

However, scary though it was, this incident presented a fantastic buying opportunity, and today, many are left wondering: “What if I’d invested back then?”

Well there’s no need to wonder any more with the help of the Profit Time Machine. Using this handy calculator tool, we’ve worked out which coins would have given you the best returns over the past year.

Chainlink

Chainlink is a decentralised network of oracles that provide real-world data, such as price or temperature, that trigger smart contract executions on the Ethereum blockchain. This is an invaluable service for any number of crypto applications as blockchains can’t access data outside their network.

The developments show no signs of slowing — Chainlink recently announced the launch of Off-Chain Reporting on mainnet, which represents a major scalability upgrade. It also recently released plans to integrate with Avalanche and expand the Chainlink Labs team, which has already grown to three times its size at the start of 2020.

On 12 March 2020, when the market crashed, LINK was worth $2. It experienced a drop of 65% around the start of September along with the rest of the crypto market but then went on to set a new all time high of $37.45 last month. Its current value of $29.52 represents an increase of 1,357.95% since Black Thursday, meaning that $1,000 invested then would now be worth $14,759.50.

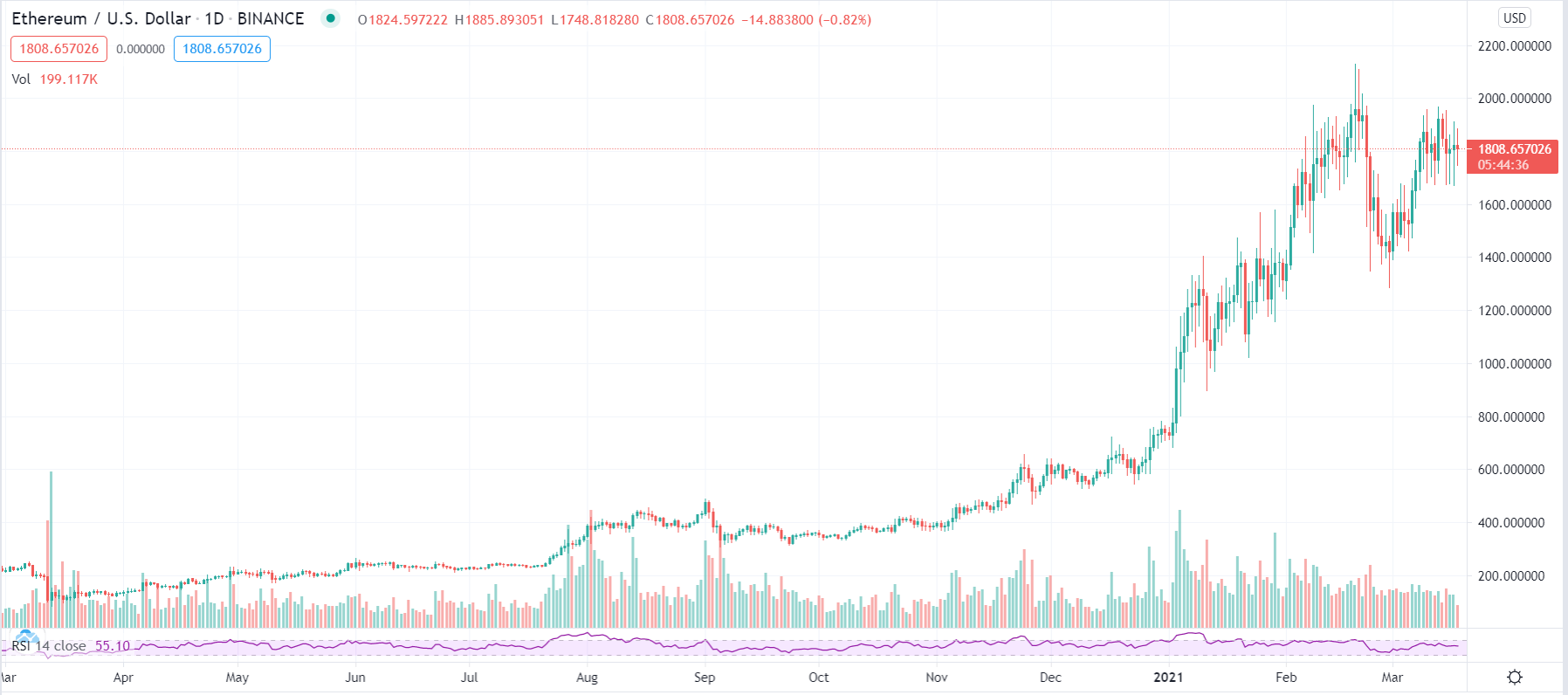

Ethereum

Another top gainer of the last 12 months was Ethereum. Despite average transaction fees on the blockchain increasing since last year and hitting an all time high of almost $40 last month, users don’t seem to be put off.

The decentralised finance (DeFi) sector is built almost exclusively on Ethereum and experienced a boom in 2020 despite congestion issues. SushiSwap, Balancer and Badger DAO are just some of the hugely successful DeFi projects to be built on Ethereum since last March. In fact, the DeFi space as a whole grew by more than 7,100% over the last year and now has over $44 billion in total value locked.

Ethereum’s price has likely been influenced by optimism around the rollout of ETH 2.0, which will be much more scalable and therefore reduce congestion and gas fees. More than $6 billion worth of ETH is now locked into ETH 2.0, representing over 3% of ETH’s total supply which is currently off the market.

ETH had a price of $107.58 on Black Thursday, but has since seen a rise of 1,504.06% to now be worth $1,725.68. This means that if you’d bought $1,000 worth of ETH a year ago, you would now have $16,040.60.

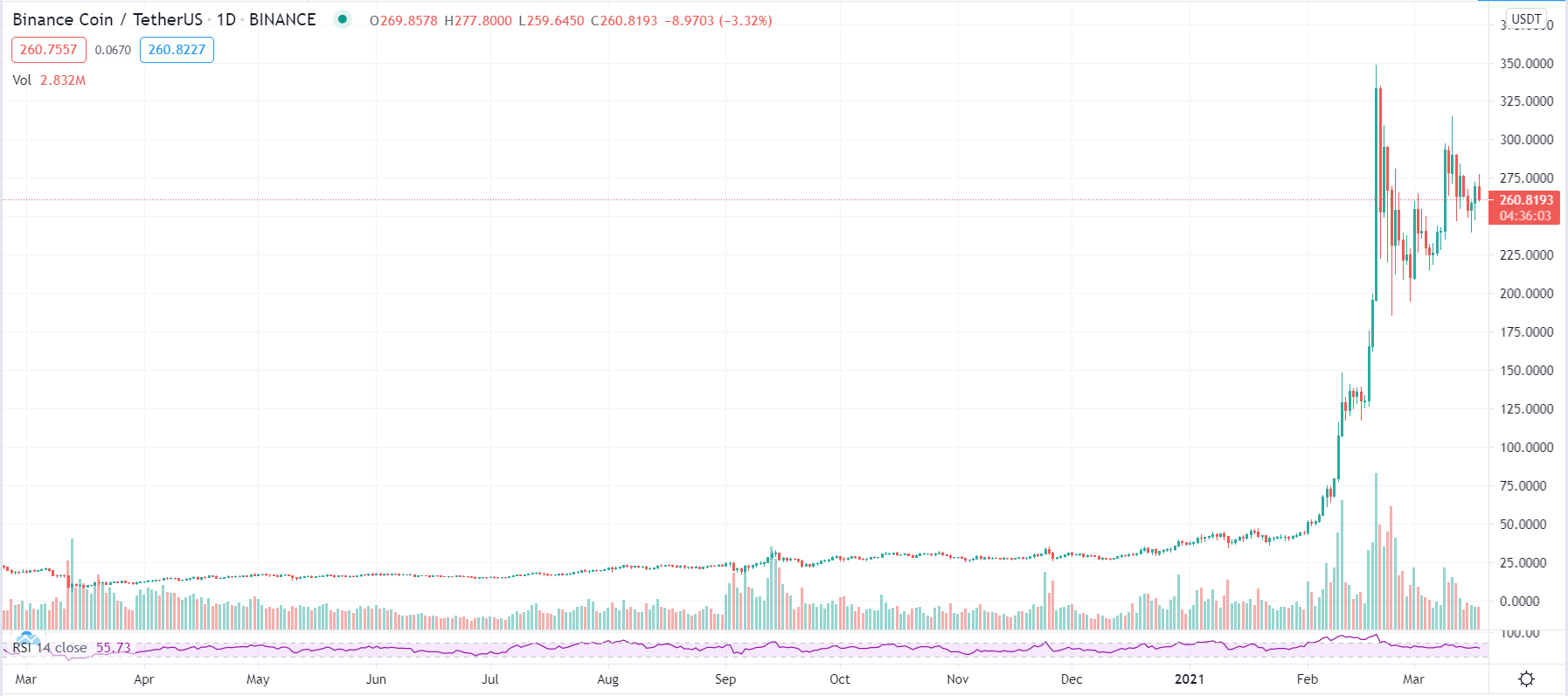

Binance Coin

The average daily trading volume on Binance was up 36% last year at $3.88 billion, and 2020 also saw the exchange list more than 30 new tokens, around 200 new trading pairs and around 350 new pairs for Margin Trading. Other notable milestones since last March include the release of the Binance Card, Binance’s acquisition of CoinMarketCap and the launch of Binance Smart Chain.

Many Binance users hold Binance Coin as it has utility for paying fees and trading in over 100 BNB trading pairs. Binance also offers the opportunity to stake BNB in return for new project tokens through Launchpool, or deposit it in the BNB Vault which works as a yield aggregator.

BNB’s price increase since Black Thursday when it was worth $9.28 has been mostly steady, until it suddenly shot up in February to hit an all time high of $348.70. It has since fallen to $264.32 which still represents a gain of 2,747.68%, and means that $1,000 of BNB bought last March would today be worth $28,476.80.

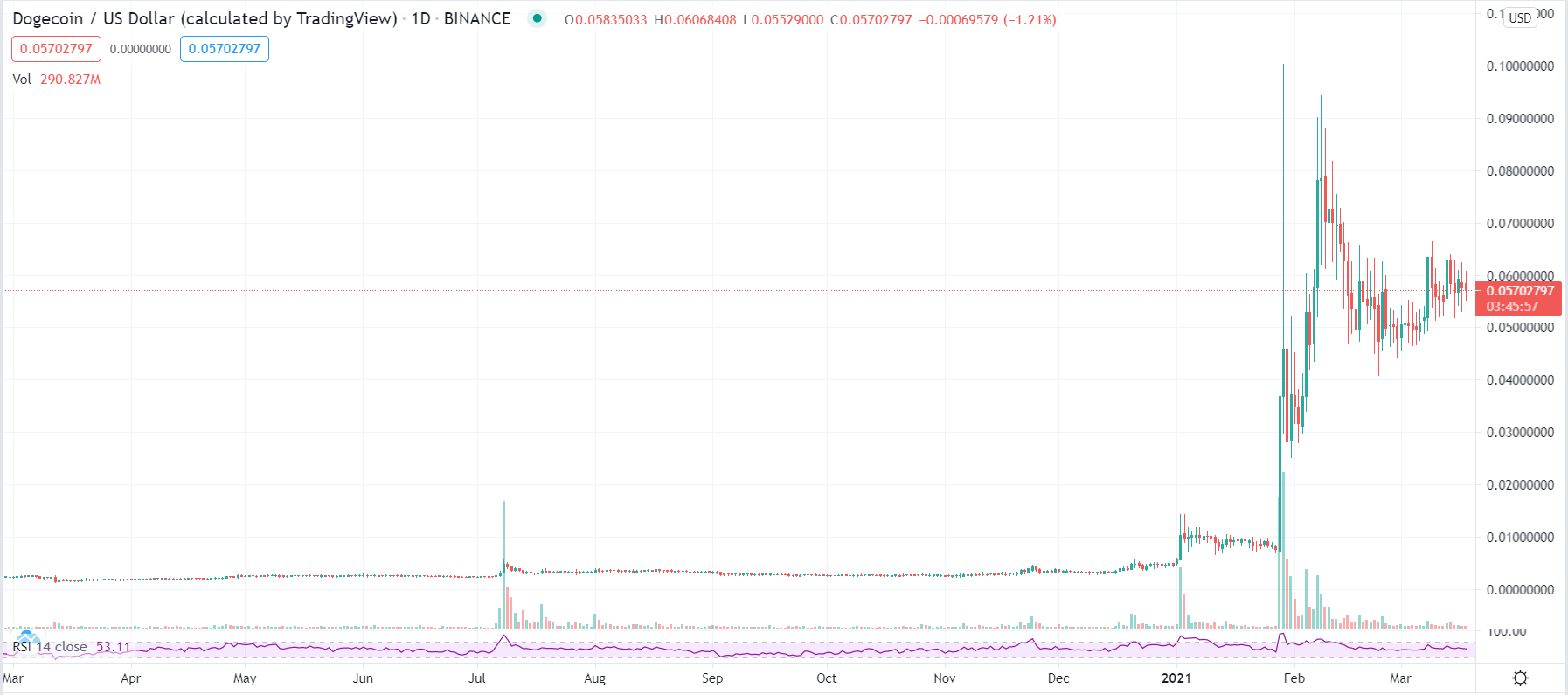

Dogecoin

In July 2020, Dogecoin increased in popularity as the result of a TikTok trend that aimed to boost the coin’s price to $1. This was followed by a much greater surge in interest in January 2021 on the back of celebrity encouragement on Twitter from Snoop Dogg, Gene Simmons and especially Elon Musk.

At the start of this year, there had been no significant project updates since July 2019, but then at the end of last month, Dogecoin announced the release of a new version of the protocol’s core that promised important performance improvements.

DOGE price movement in 2020 was fairly undramatic except for the 140% upsurge in July driven by the TikTok campaign. Its price really took off in 2021 when Redditors inspired by the GameStop saga and Musk’s endorsement pumped the price 800% in 24 hours to an all time high of $0.10. Its price has since dropped to $0.06, but if you’d invested $1,000 in DOGE on Black Thursday when it was valued at $0.0016, your current capital would be $37,602.10 – that’s a 3,660.21% increase.

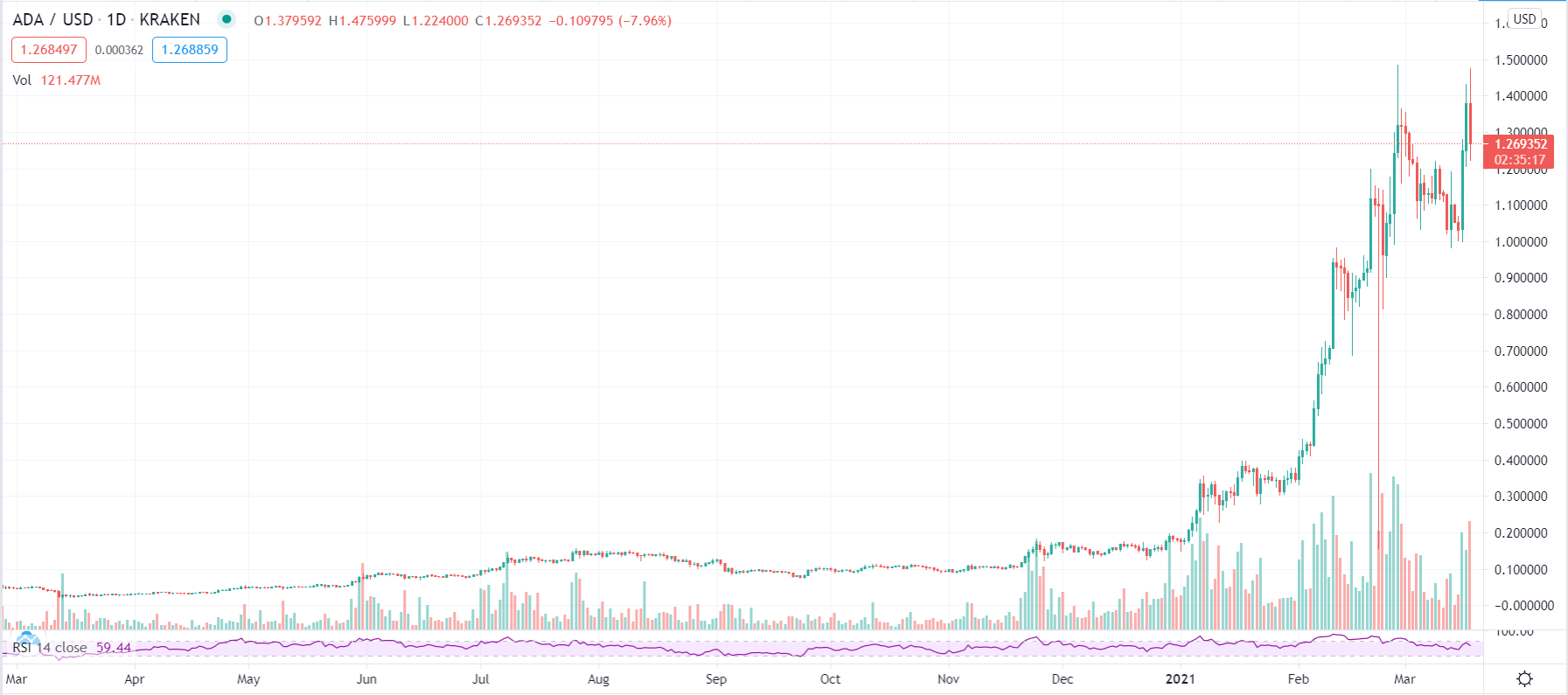

Cardano

Finally, our top crypto investment of the last year is Cardano, one of the biggest blockchains to successfully use a proof of stake consensus mechanism. This is what Ethereum is gradually working towards, but in the meantime, Cardano’s blockchain makes an attractive destination for decentralised projects and many investors choose to hold ADA as a hedge against potential problems with Ethereum.

Cardano is in the middle of a multiyear five phase launch, and in July 2020, the second phase of the mainnet, dubbed Shelley after Mary Shelley, was launched. This brought with it staking rewards and better decentralisation.

The next stage of development, Goguen, is due to be rolled out this month and provides a whole host of features such as the ability to build decentralised apps. Cardano also recently launched native assets on its blockchain that allow users to issue their own tokens.

Excitement around project updates has seen a surge in the price of ADA in 2021, as it set a new all time high above $1.48 at the end of February, and it’s now trading at around $1.40. On Black Thursday, ADA was just $0.02, meaning that $1,000 of ADA bought then would by now have grown by 5,958.23% to be worth $60,582.30!

The post Top 5 Altcoins to Invest in the Coming Year appeared first on Coin Journal.