The year is only weeks old and Wall Street analysts are already trying to predict 2022 winners and losers. But Mike McGlone, Bloomberg’s senior commodity strategist, is going back to the basics: supply and demand.

This week, McGlone, who won plaudits in crypto markets last year for being one of the first prominent Wall Street analysts to accurately predict that bitcoin’s price would hit $50,000, penned a pair of reports this week comparing the dynamic in the bitcoin market with that of raw materials oil and copper.

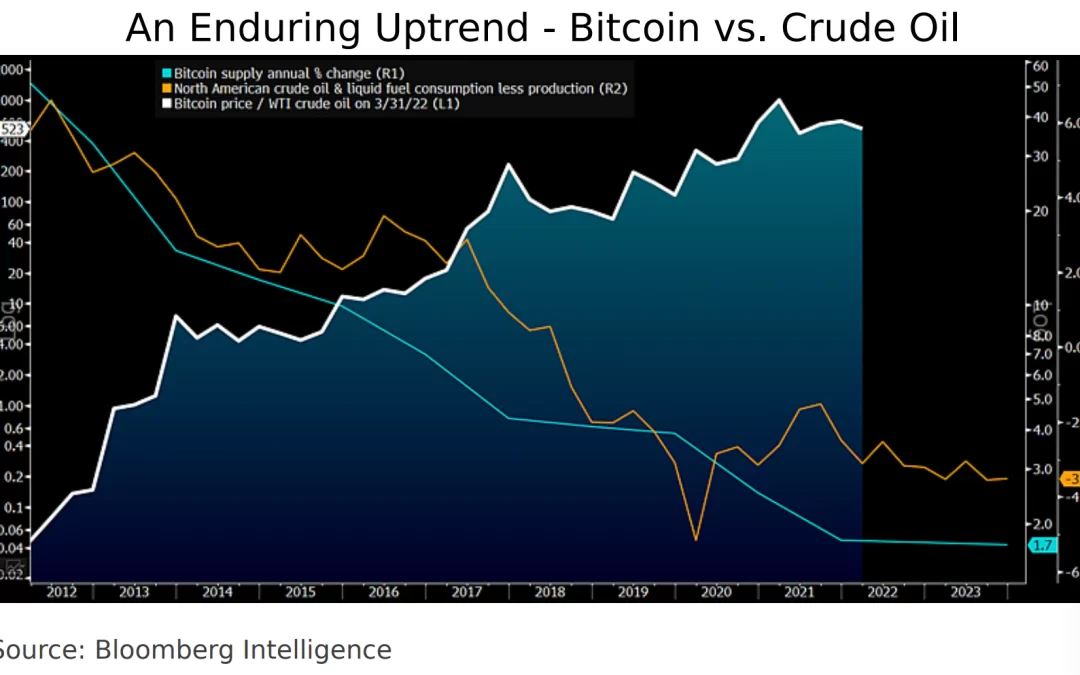

Taking a look at oil, McGlone pointed out that prices for the benchmark U.S. crude variety West Texas Intermediate are down about 20% over the past year because of shifts in the supply-demand balance. In 2012, demand exceeded supply by 6 million barrels a day in North America, but there’s now a supply surplus of 3 million barrels a day, according to his report. A driving force is that more oil can be extracted for less money.

Then there’s copper. McGlone predicts copper prices have peaked and are facing headwinds because Chinese demand has slowed.

What’s different about bitcoin, according to McGlone, is the top cryptocurrency by market cap comes with a “lack of supply elasticity.” Because the pace of new bitcoin production is already set by the underlying blockchain’s programming, a higher price won’t automatically lead to more supply.

According to the analyst’s calculations, one bitcoin is now worth more than 500 barrels of oil, up from “a mere fraction” of what a barrel of oil was worth in 2012.

“Supply, demand, adoption and advancing technology point to the crypto continuing to outperform fossil fuel in the next 10 years,” McGlone wrote.

Similarly, one bitcoin is now worth about 4.4 tons of copper, compared with a mere fraction a decade ago.

“Copper may be a good example of the low potential for a commodity supercycle, notably versus an advancing bitcoin,” McGlone wrote. “It’s not that profound to expect one of the best-performing assets of the past decade to keep outpacing the old-guard industrial metal, and we see bitcoin’s upper hand gaining endurance, and maturity, versus copper.”

One caveat is how challenging it can be to predict the future trajectory of the blockchain industry – not to mention cryptocurrency prices.

It bears mentioning that McGlone in mid-2021 was forecasting a bullish bitcoin market, with a price target of $100,000. He reiterated that confidence in December.

But bitcoin is currently changing hands around $43,000, well off the all-time high price near $69,000 reached in November.

Read more: What Advisors Should Know About Bitcoin and Inflation