Millions of American television viewers, including those watching the NBA Finals, will soon see a new national ad campaign run by Coinbase. Titled “Moving America Forward,” the campaign is focused on explaining crypto and illustrating how it can help “update the system.” The ads add to the increasing pressure the company is putting on the United States Securities and Exchange Commission for clarity on digital assets. But no company can operate without a backup plan, which explains why Coinbase also secured a license in Bermuda in April to operate an offshore exchange.

However, not every crypto company has millions to spend on advertising and lobbying costs, and they are seeking escape from the U.S. while avoiding the “offshore” tag. Where can they go without being watched, or regulated out of existence?

Europe is an alternative, but a word of warning: The alternative to the U.S. approach is neither a full embrace of crypto nor regulatory freedom. Europe has plenty of rules for crypto, but it is still preferable to the uncertainty of the United States.

Related: Elizabeth Warren is pushing the Senate to ban your crypto wallet

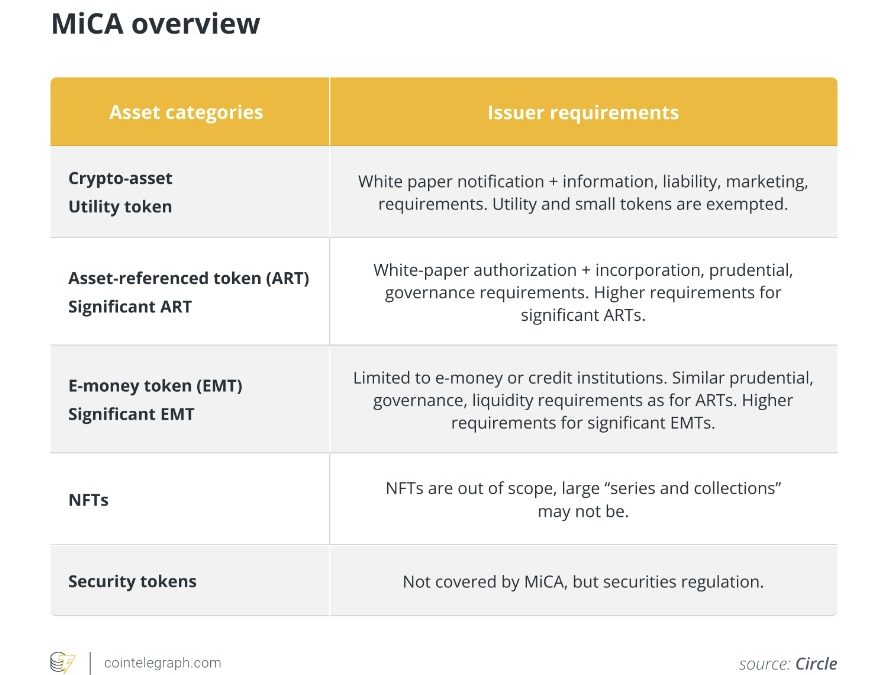

Europe’s seismic shift after Brexit left the continent uncertain about its economic future. Technology of all kinds, including artificial intelligence, became the focus of the parliament. The timing was ideal — the UK was mired in its own post-Brexit issues and has yet to solidify its position as a crypto hub. And Europe did what it does, which is to regulate. Introduced in September 2020, its Markets in Crypto-Assets (MiCA) legislation was confirmed just this year. Countries like France are already positioning themselves to welcome companies under these new regulations.

MiCA isn’t perfect. It took so much time to be confirmed that it’s already out of date, and there’s more it could do to embrace the crypto sector. As just one example, the regulations stipulate wallet restrictions. The “Travel Rule” for hosted or custodial wallets requires licensing for exchanges and wallet providers. That means they must document the names of senders and recipients who use their wallets, irrespective of transaction size. If you want crypto asset transactions without this tracking — or want to offer it to your customers — Europe is not the home for you.

However, this only applies to hosted or custodial wallets. Noncustodial players still have room to maneuver in Europe — which tracks with the European mindset. If you take responsibility for someone’s assets (even data), you have obligations. If you don’t, then you prove less of a risk. Data, which is one of the most valuable assets we have, has its own “MiCA” regulation — you know it as the General Data Protection Regulation. And even for GDPR’s blindspots, Web3 tech is already evolving it.

Tracking data isn’t exactly aligned with the free-market-for-all approach that crypto has championed, but it is a step forward to making it more mainstream. And for whichever parts of MiCA don’t suit your fancy, Europe remains open to experimentation and has a dedicated sandbox for crypto initiatives. From Switzerland, I can also say that Europe’s largest financial institutions are quietly but powerfully moving into this space.

Related: 3 takeaways from the European Union’s MiCA regulation

That’s because regulatory clarity has always been preferable to ambiguity, especially in a sector as novel and volatile as cryptocurrency. Straightforward, professional pathways to enter and exit the crypto market — the on- and off-ramps — are fundamental to a healthy, profitable ecosystem.

These on- and off-ramps, anchored in robust regulatory frameworks in mature and well-regarded geographies like Switzerland, offer the crypto community a reliable route to service. And a European expansion could help the industry access markets that may not be interested in — or able to sign up for — services based in the Caribbean.

As the home of the most organized (if not the most ideal) regulation, Europe is a promising setting for the future of crypto. While its regulations aren’t everything they could be, they do bring clarity that no number of advertising campaigns can provide. Even though the European Union might be keeping a close eye on your crypto wallet, it’s still offering a map for navigating this stormier bear market.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.