This week’s the U.S. regulatory agency, the Securities and Exchange Commission (SEC), announced in a report the organization conducted research on the current state of Initial Coin Offerings (ICO) and last year’s DAO debacle. From the letters perspective, the days of all these token sales and the “Wild West” ICO period is likely coming to an end.

Also read: ICO Hype Attracts Investors but Also Skeptics and Regulators Worldwide

‘The Market Anticipated This Announcement’

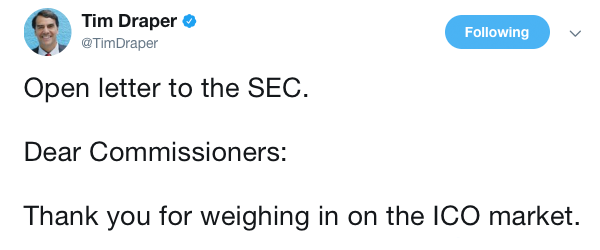

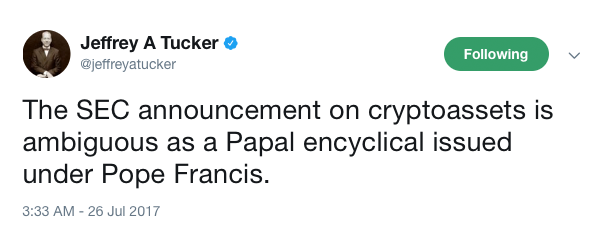

Bitcoin.com recently reported on the SEC announcement on July 25 detailing the agency’s opinions concerning last year’s Ethereum-based DAO crowdfund and the current ICO hype happening right now. The report conveyed a few key statements that established that U.S. federal securities laws would apply to ICOs and digital token sales. Due to the past six months of ICO excitement, raising millions of dollars in crowdsales based off of the Ethereum protocol, some within the cryptocurrency community seemed to welcome the SEC’s news. Many cryptocurrency and blockchain proponents believe the ICO market was getting out of hand, while others believe regulators need to step aside.

Bitcoin.com recently reported on the SEC announcement on July 25 detailing the agency’s opinions concerning last year’s Ethereum-based DAO crowdfund and the current ICO hype happening right now. The report conveyed a few key statements that established that U.S. federal securities laws would apply to ICOs and digital token sales. Due to the past six months of ICO excitement, raising millions of dollars in crowdsales based off of the Ethereum protocol, some within the cryptocurrency community seemed to welcome the SEC’s news. Many cryptocurrency and blockchain proponents believe the ICO market was getting out of hand, while others believe regulators need to step aside.

This week a few members of the bitcoin and blockchain community reached out to Bitcoin.com to make a statement about the SEC’s recent announcement. Ari Meilich, Project Lead at Decentraland, a blockchain-based virtual world, said the market was expecting the SEC’s statements.

“The SEC weighing in represents public acceptance of blockchain instruments,” explains Meilich. “They said that the DAO tokens were a security, and that all securities must be registered according to the law. The market was anticipating this, and the price of non-security tokens, like Ethereum, did not fluctuate when the SEC report came out.”

Any Organization Failing to Comply With U.S. Securities Laws Will Be Held Responsible

Steven Nerayoff an early Ethereum advisor and lawyer who came up with the name “Gas” for the digital currency said the industry already knew this regulatory proclamation was coming.

“The SEC’s decision reinforces what the blockchain industry already knew: Federal securities laws apply to all new types of technologies,” Nerayoff told Bitcoin.com.

If anything sold has the characteristics of a security, one must follow U.S. securities laws. This is the case for all technologies. And it should be expected that any organization that fails to comply with the requirements of U.S. securities laws will be held responsible.

‘Significant Fallout for Companies That Have Conducted ICOs’

The largest bitcoin automated teller machine (ATM) network Coinsource’s General Counsel member Arnold Spencer believes the SEC’s statements cannot be said enough and it is clear to him the regulatory agency will be enforcing these guidelines soon.

“It is now clear that some digital currencies will be viewed as securities, depending on how the tokens or coins are structured,” Spencer details. “Secondly, and more importantly, it is now clear that the regulators and law enforcement in the United States will be enforcing these laws. The pipeline for ICO’s just got a lot smaller.”

I predict some significant fallout for the companies that have conducted ICOs in the past six months that are structured similarly to the DAO. Many ICOs are out there that will now be viewed definitively as securities, and yet are unregistered.

The ‘Wild West’ Crowdfunding Period May Be Coming to an End

Perry Woodin CEO of Node40, a blockchain accounting and masternode hosting service, also was not surprised by the SEC’s report on the DAO and token sales. “The number of businesses supporting blockchain applications has exploded over the past couple of years, and with them, we’ve seen new tools for raising capital,” Woodin explained to Bitcoin.com.

Perry Woodin CEO of Node40, a blockchain accounting and masternode hosting service, also was not surprised by the SEC’s report on the DAO and token sales. “The number of businesses supporting blockchain applications has exploded over the past couple of years, and with them, we’ve seen new tools for raising capital,” Woodin explained to Bitcoin.com.

“The SEC’s report on ICOs was not a surprise,” the Node40 founder adds. “Many of the ICOs were aiming for that compliance gray area. They wanted their offerings to be considered ‘crowdfunding’ even though they could not meet the requirements of the Regulation Crowdfunding exemption. Now we’ll see what happens as companies attempt to fit within the SEC’s guidelines.”

The SEC’s announcement on ICO investments and its recent research into the DAO project suggests that regulators found lots of red flags involved with the DAO crowdfund but have chosen to let that particular project slide. However, it seems the past six months of “Wild West” ICOs and token sales may be subject to these securities laws and many projects may fall by the wayside for not meeting SEC requirements.

What do you think about the SEC’s recent announcement? Do you agree with members of the industry that this was to be expected? Let us know in the comments below.

Images via Shutterstock, Pixabay, Twitter, and Bitcoin.com.

Need to calculate your bitcoin holdings? Check our tools section.