Cryptocurrencies are gauged by the size of their market cap. It’s a crude reckoner, but it’s good enough for most purposes. But what about projects that have yet to issue their coins or host their token sale? Increasingly, investors are turning to one metric that’s hard to fake and indicative of widespread support – Telegram followers.

Also read: 80 Percent of the Total Bitcoin Supply Have Now Been Mined

Social Proof is the New Market Cap

Telegram has long been the playground of crypto traders and enthusiasts. The great migration began sometime last summer, after ICO teams tired of running Slack channels that were filled with spam and spoofing. As a side effect of The Grammening, Telegram channel numbers became a useful metric for gauging a project’s support. Twitter followers can be bought, and no one in crypto uses Facebook, creating the perfect storm for Telegram to rise to the top.

Telegram has long been the playground of crypto traders and enthusiasts. The great migration began sometime last summer, after ICO teams tired of running Slack channels that were filled with spam and spoofing. As a side effect of The Grammening, Telegram channel numbers became a useful metric for gauging a project’s support. Twitter followers can be bought, and no one in crypto uses Facebook, creating the perfect storm for Telegram to rise to the top.

Gone are the days when researching new coins and tokens was an esoteric art limited to a handful of crypto traders. Now everyone’s trying to catch the next Bitcoin, Ethereum, or Raiblocks, and that means getting in on the ground floor. Buying a coin as soon as it’s listed on a small exchange is no longer enough. Nor is buying a coin at the ICO stage. These days, true profit comes from getting in at the pre-sale stage, which means getting onto the whitelist – and that isn’t always easy.

Today, for example, registration for Apex Network, which is holding its ICO on the NEO blockchain, closed in 15 minutes – and not before demand had crashed the website and forced Apex to issue an alternate registration link. With even the average ICOs oversubscribed, whitelist places are being offered to supporters who’ve already demonstrated their willingness to get involved with the project – such as by joining the Telegram channel in advance. ICOs are fast becoming an exclusive nightclub. Getting beyond that gilded rope calls for proving to the bouncer that you’re a VIP.

Two Channels, One Project

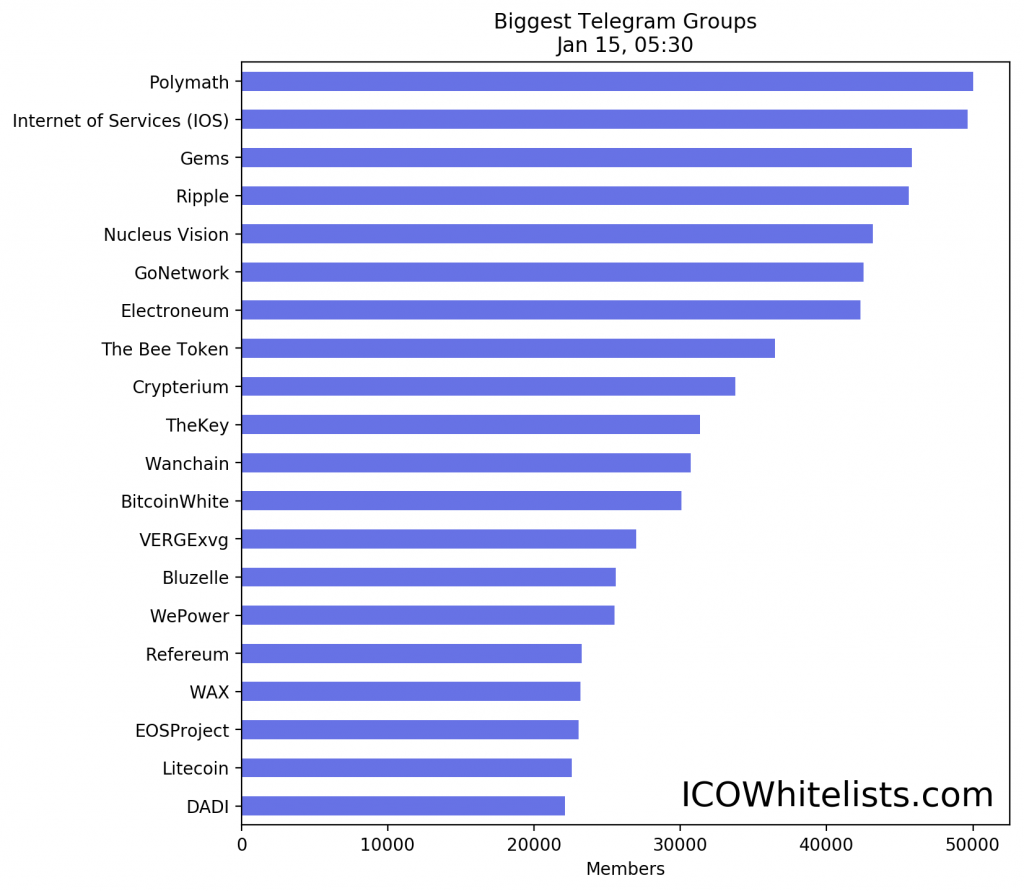

To help investors gauge which ICOs are gathering the most momentum, ICO Whitelists has set up a tracker page that records which crypto projects have added the most followers in the past 24 hours. As the site explains:

To help investors gauge which ICOs are gathering the most momentum, ICO Whitelists has set up a tracker page that records which crypto projects have added the most followers in the past 24 hours. As the site explains:

99% of all ICOs use Telegram as a channel to interact with their communities. This means that we can measure the strength of ICO communities by measuring how big these ICO Telegram groups are.

For the most popular projects, one Telegram group is no longer enough. Securities token platform Polymath, this year’s most hyped project, has already hit Telegram’s 50,000 channel limit. Its solution? Open another channel. With many crypto projects still months away from distributing tokens and being listed on exchanges, Telegram popularity has become traders’ estimator tool of choice. When there are 50,000 investors baying to buy in, it’s immaterial what’s in the white paper – hype and FOMO win out every time.

Do you think Telegram popularity is a useful metric for gauging ICOs? Let us know in the comments section below.

Images courtesy of Shutterstock, and ICO Whitelists.

Tired of those other forums on the subject of Bitcoin? Check forum.Bitcoin.com.

The post Telegram Followers – The New Metric for Cryptocurrency Success appeared first on Bitcoin News.