The Securities and Exchange Commission (SEC) is the U.S.’s independent exchange gatekeeper: without its blessing mainstream trading is not possible. It continues to frustrate would-be bitcoin exchange applicants who are now withdrawing. Even its former head has doubts about the SEC’s competence when it comes to bitcoin.

Also read: Bitcoin Core Developer Appeals to SEC Regarding BIT

SEC Pushes Bitcoin Listings Back to OTC

Companies seeking exchange equity volume and prestige come to the New York Stock Exchange (NYSE). The Big Board, as it’s known, is the world’s most important exchange by the metric of market capitalization. NYSE is also the traditional home to the Dow Jones Industrial Average (DJIA) – which comprises 30 representative companies that are used popularly as a barometer for the US economy at large.

Intercontinental Exchange Inc. (ICE) is its parent company, and at the turn of the century it unknowingly created an ideal venue for bitcoin-related stock and fund speculation: the NYSE Arca exchange (Arca).

Arca became the first solely electronic exchange, and also ranks first in exchange-traded funds (ETFs). With a few hiccups along the way, Arca proved to be sufficiently anonymous, open, and fast.

Grayscale Investment LLC (GIL), a Digital Currency Group company, hoped to bring its Bitcoin Investment Trust (BIT) to Arca. Currently the Trust lists on OTCQX, a quantified review, over-the-counter (OTC) exchange. OTCQX is considered prestigious among OTC exchanges, but not on par with the NYSE in terms of mainstream credibility.

Grayscale Investment LLC (GIL), a Digital Currency Group company, hoped to bring its Bitcoin Investment Trust (BIT) to Arca. Currently the Trust lists on OTCQX, a quantified review, over-the-counter (OTC) exchange. OTCQX is considered prestigious among OTC exchanges, but not on par with the NYSE in terms of mainstream credibility.

At the time of writing, BIT currently is trading at over 600 USD, up from just 92 USD a year ago.

BIT’s design is also a first for bitcoin, as it allows traders to speculate on price fluctuations without downloading a wallet, storage, or even owning bitcoins.

According to Reuters, ICE “withdrew an application with the [SEC] to list [the BIT].” The article insists “the regulatory agency has expressed doubts over the bitcoin market being unregulated.”

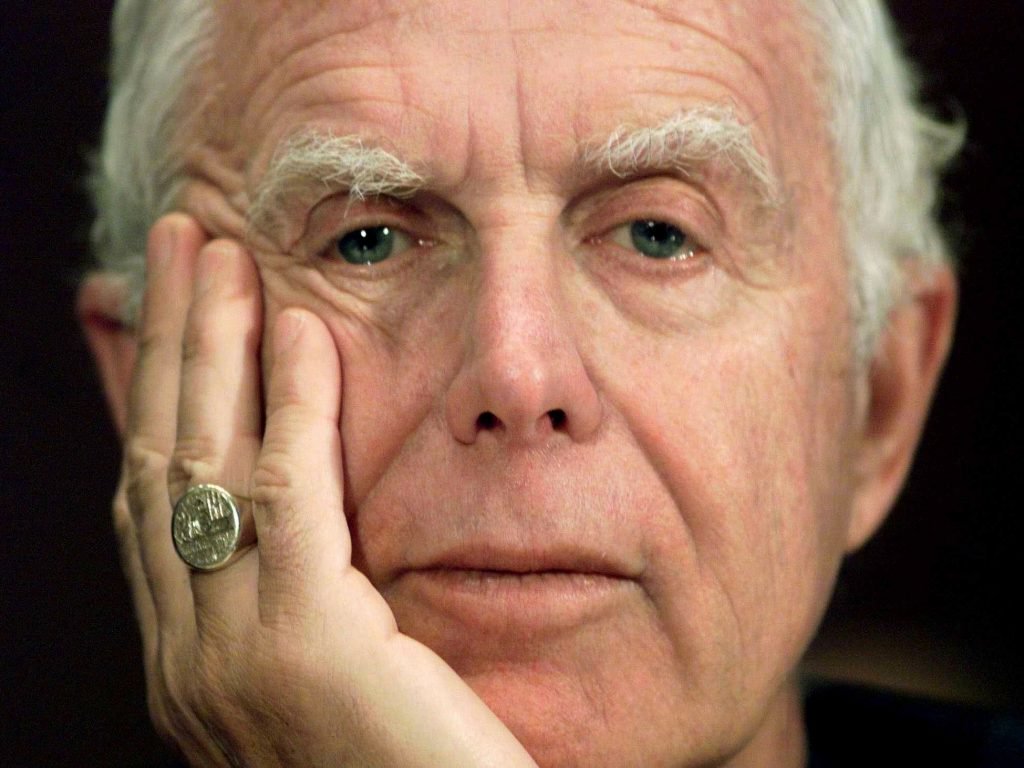

Arthur Levitt Scolds the SEC

“Although digital currency market regulation continues to rapidly evolve,” GIL commented on the withdrawal, “at this time Grayscale does not believe there have been enough regulatory developments to prompt the SEC to approve” their application.

Grayscale also recalled how this year alone the SEC flat out refused two other cryptocurrency projects.

The GIL statement was measured, overall. However, the phrase “does not believe there have been enough regulatory developments” is Wall Street speak for frustration over the SEC’s lack of preparedness at bitcoin’s obvious potential.

A less cloudy point was struck by the SEC’s former head regarding his previous employer. When prompted about bitcoin and the SEC, Arthur Levitt answered he believes “the tendency of the [SEC] has been to stay away from bitcoin.”

It appears, Mr. Levitt continued, the SEC doesn’t “want to take on something as complex from a regulatory point of view as bitcoin is.”

Controversy swirls in the bitcoin community about the value of mainstream and OTC speculation. Some are concerned such moves violate the basic principles of bitcoin by essentially appealing to the same entities, banks, bitcoin was designed to subvert.

Other bitcoiners are confident mainstream adoption will ensure a vibrant future for bitcoin.

What do you think? Would a NYSE Arca listing be good for bitcoin? Is there danger in traders never holding bitcoin, only looking at its price? Tell us in the comments below.

Images courtesy of: REUTERS/Kevin Lamarque, NTEU, MarketWatch.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.