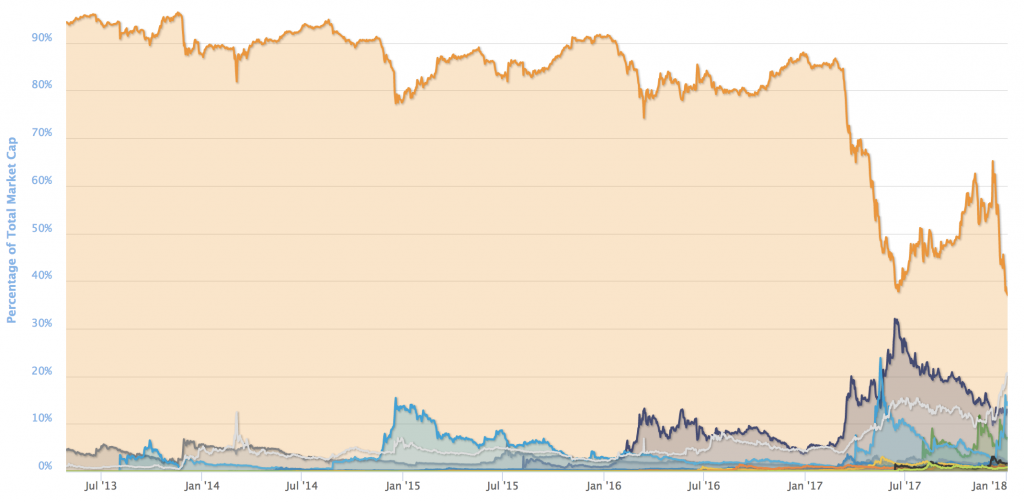

First came ethereum, which threatened to unseat bitcoin as the dominant cryptocurrency in an event dubbed The Flippening. Then came bitcoin cash, which lay a glove on bitcoin core in The Cashening. Now, a revitalized ripple (XRP) is eyeing bitcoin’s top spot. Could the centralized cryptocurrency usurp bitcoin’s market cap, heralding The Rippening?

Also read: Is the Centralized Ripple Database With the Biggest Pre-Mine Really a Bitcoin Competitor?

Big Ripple in a Small Pond

Scarcely a month passes when an alternative cryptocurrency doesn’t make huge inroads on bitcoin’s dominance. Percentage gains are easy – any coin outside of the top five can realistically double or triple in price within a week. Overtaking bitcoin’s market capitalization however is significantly harder, and while ETH and BCH have both given it their best shot, they’ve yet to achieve that feat.

The Numbers Behind the Letters XRP

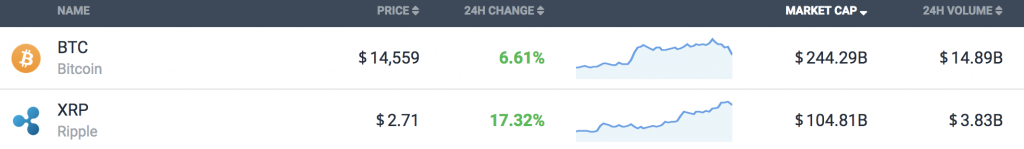

Despite bitcoin making gains of 14% in the last 24 hours off the back of news on Peter Thiel’s involvement, XRP has outperformed BTC, recording gains of 16%. Ripple at the time of writing had a market cap of $104 billion versus bitcoin’s $245 billion. In other words, ripple is worth 40% of bitcoin’s valuation. Each XRP token is currently trading at around $2.70. If XRP were to reach $6.75 while BTC stood still, it would overtake bitcoin to become the world’s most valuable crypto asset.

It is much easier for a sub-$10 coin to double in value than it is for one costing well into five figures. On December 29, ripple soared from $1.52 to a high of $2.50. If another similar ripple run were to occur, it could send XRP above bitcoin in the space of a week. One ripple will never achieve parity with one bitcoin, as there are a lot of ripples out there – around 39 billion as it stands. Put them all together and, priced at $6.75 a coin, you would be looking at the new cryptocurrency market leader.

The psychological effect of bitcoin being toppled, for the first time in cryptocurrency history, would be huge. It would be the equivalent of a rival search engine overtaking Google. The mainstream media would have a field day and the crypto community would be up in arms, but beyond that, not much would change. Bitcoin would retain its use as a store of value, medium of exchange, and pseudonymous digital currency, and ripple would retain its use as, well…what is ripple’s use?

The psychological effect of bitcoin being toppled, for the first time in cryptocurrency history, would be huge. It would be the equivalent of a rival search engine overtaking Google. The mainstream media would have a field day and the crypto community would be up in arms, but beyond that, not much would change. Bitcoin would retain its use as a store of value, medium of exchange, and pseudonymous digital currency, and ripple would retain its use as, well…what is ripple’s use?

Who’s Buying Ripple?

Ripple was designed as a SWIFT alternative, providing banks with a means to send funds across borders quickly and at low cost. Like many assets, however, it is primarily used as a speculative instrument. It is the users who determine how an asset is purposed, but it is the markets that set the price – and right now the markets are buying a whole lot of XRP.

Most of the trading volume is coming from Korea, although that holds true for the majority of cryptocurrencies. Anecdotal evidence suggests there’s something about ripple that’s alluring to non-traditional cryptocurrency investors. An increasing number of women seem to be taking an interest in XRP, and mainstream coverage has been extensive, with ripple surfacing in the unlikeliest of publications including British tabloid newspapers.

Investors are piling into ripple because they see it as a profitable purchase, and thus far they’ve been vindicated. But what happens when the music stops and ripple drops? Naysayers have been predicting a major correction ever since ripple approached the dollar mark, and yet the coin is showing no signs of slowing down.

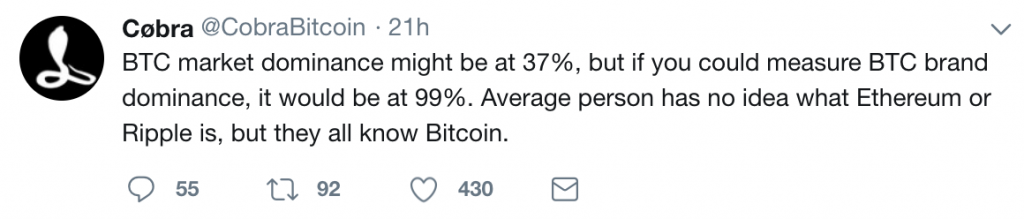

Many crypto newcomers know and care little of Satoshi, decentralization, full nodes, and Bitcoin Improvement Proposals, but they recognize profit when they see it, and right now XRP is providing that. The question that would-be investors should be asking themselves is not who’s buying ripple now, but who bought it back in the day when it was trading for cents. The answer to that question includes a number of crypto billionaires. Cofounder and former CEO Chris Larsen owns 5.19 billion XRP, around 13% of the total circulating supply. Forbes reports that this makes ripple’s executive chairman the 15th richest man in America.

Whales Making Ripples

Current ripple CEO Brad Garlinghouse also holds a significant number of ripple tokens, with Forbes calculating his net worth to be at least $9.5 billion. Then there’s the 5.3 billion XRP cofounder Jed McCaleb owns. These are held in a fund and released on a monthly basis to prevent the former ripple boss from cashing out and crashing the market. Finally, there’s the additional 55 billion XRP that ripple holds in escrow, over and above the 38.7 billion tokens currently on the market.

Add that together and you get a whole lot of ripples, with as much as 35% of the total circulating supply in the hands of just three people. Realistically, Larsen, Garlinghouse, and McCaleb aren’t about to offload 20 billion ripples onto the market. It is not in Larsen’s or Garlinghouse’s interests to do so, while McCaleb, who now runs Stellar (and owns one billion XLM) is unable to do so.

Reasons to Be Cautious

There are evident risks inherent to investing in a project whose market price is hostage to a handful of whales. But there are also other reasons why ripple is a controversial cryptocurrency that should be approached with caution. News.Bitcoin.com recently reported on how ripple has the power to “freeze” funds at its discretion, and the 55 billion XRP currently on lockdown at ripple XRP are effectively the biggest pre-mine of any digital currency.

As one dissenter pithily put it: “Ripple can f– off. They’re the Intel of crypto – backdoored from the start”. Cryptocurrency maximalists, who are passionate about matters such as financial freedom and the decentralized economy, are especially skeptical of ripple. One thing ripple’s rise arguably does show is that there is an appetite for a centralized currency that isn’t beholden to community concerns. Obtaining consensus for improvements to bitcoin core is notoriously tricky; ripple on the other hand, can be modified by the company without consultation or advance warning.

Ripple’s rise means little to the average bitcoiner, whose preference for decentralized financial systems will remain unwavering. The success of XRP could mean a lot to central banks, however, who are watching the token’s ascent with keen interest. How fitting if Ripple, a centralized cryptocurrency, were to prove the gateway drug to a centralized banking coin.

What are your thoughts on ripple and where do you see its price going? Let us know in the comments section below.

Images courtesy of Shutterstock, Coincodex, and Coinmarketcap.

Bitcoin Games is a provably fair gaming site with 99% or better expected returns. Try it out here.

The post Rising Ripple Threatens to Usurp Bitcoin and Usher In “The Rippening” appeared first on Bitcoin News.