The world’s first Bitcoin (BTC) spot price exchange-traded fund (ETF) is buying BTC again after a month of selling.

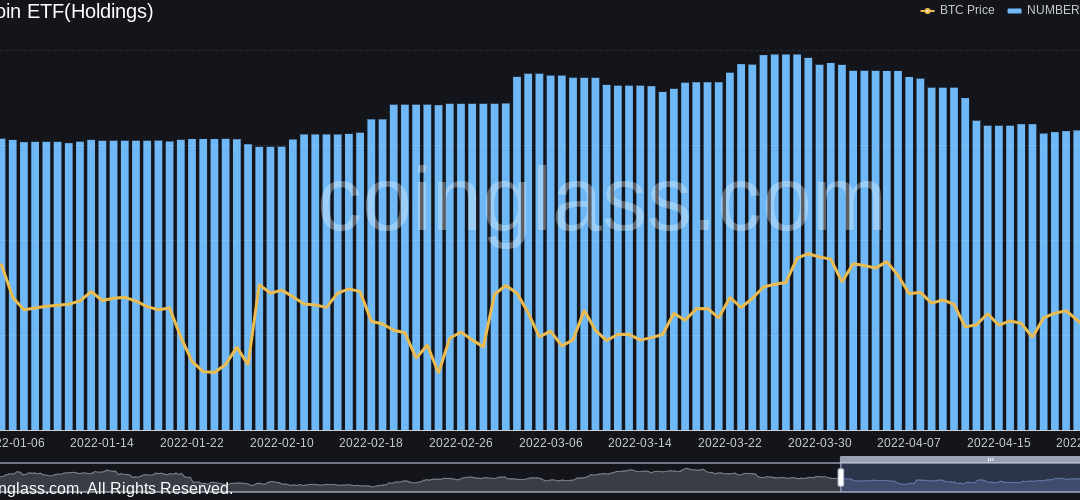

Data from on-chain monitoring resource Coinglass confirms that on April 27, Canada’s Purpose Bitcoin ETF added 1,132 BTC to its holdings.

Data: Buy the dip interest “skyrocketing”

Despite fears that Bitcoin is not yet done with its sell-off, an about turn at Purpose hints at increasing institutional demand.

Beginning March 28, when BTC/USD traded above $48,000, Purpose began reducing its exposure, which at the time totaled 36,321 BTC. Wednesday’s increase is thus the first since March 25.

At the time of writing, Purpose held 31,162.7 BTC, while BTC/USD traded at $39,000.

The move coincides with figures from statistics firm Santiment showing that interest in “buying the dip” on both Bitcoin and altcoins is also increasing.

Measuring what it calls “crowd interest,” Santiment recorded the biggest uptick in trends for “buy dip” and “buy dips” in six weeks.

“Social interest in buying the dip has skyrocketed after crypto’s latest pullback,” accompanying Twitter comments summarized.

“The SP500 correlation is not working in the favor of the cryptocurrency sector, and crowd fear will play a large part in the two markets breaking apart from one another.”

Search interest flatlines

Other sources recording social interactions with the crypto sphere are less enthusiastic.

Related: GBTC premium nears 2022 high as SEC faces call to approve Bitcoin ETF

Google search data shows that worldwide search interest in “Bitcoin,” for example, is at its lowest since October 2020.

In what could nonetheless signal a bottoming phase for crypto markets, a rebound now could set the stage for the bullish launch that characterized the second half of Q4 that year.

As Cointelegraph reported, short-term sentiment fears the worst this week, with “extreme fear” combining with calls for a return to $30,000.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.