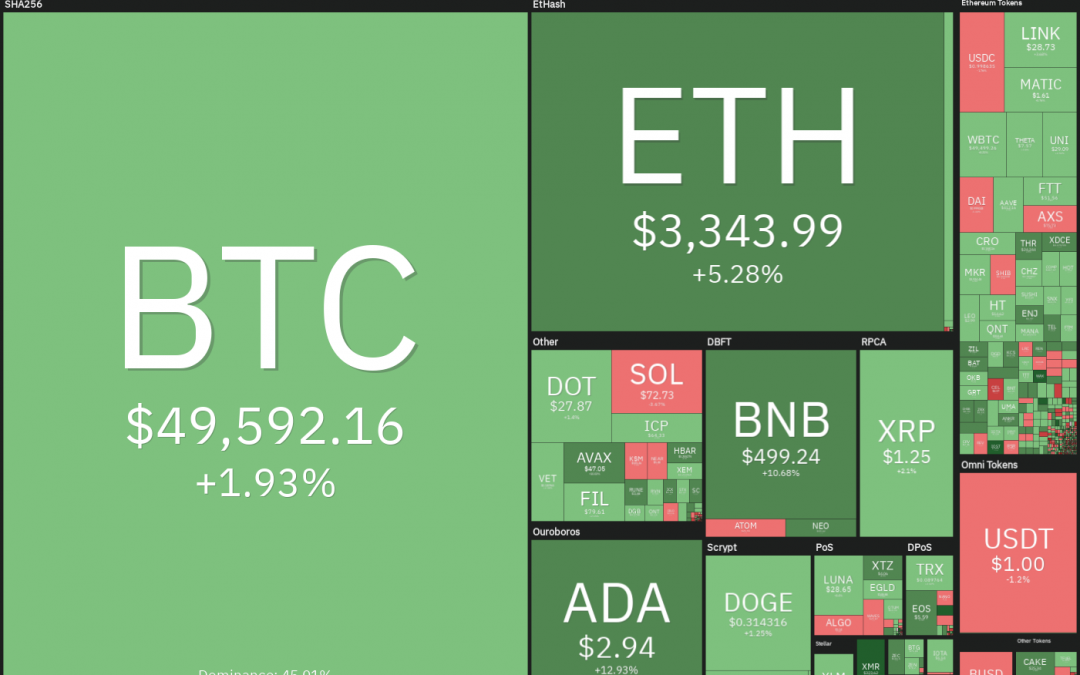

Bitcoin (BTC) rallied above the psychological hurdle at $50,000 today for the first time since May 15. The sharp rally of the past few days has turned the sentiment bullish with many expecting the resumption of the bull run.

Morgan Creek Digital co-founder Anthony Pompliano told CNBC on Monday that Bitcoin could make a blow-off top, similar to the one seen in 2017 when the price had surged from “$10,000 to $20,000 in 18 days.”

The Crypto Fear & Greed Index has risen to 79, indicating extreme greed. Just a month back, the indicator was showing a reading of extreme fear at 22. This shows how the sentiment has changed completely within a few days.

In other news, on August 22, PayPal announced that it will provide cryptocurrency services to the residents of the United Kingdom. This step increases the penetration of digital assets because PayPal has over 2 million active users in the U.K.

Will Bitcoin and altcoins continue their up-move or will profit-booking set in? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin has been trading inside a rising wedge pattern for the past few days. The bulls flipped the $48,000 level to support on Aug. 22 and pushed the price above the psychological level at $50,000 today.

The BTC/USDT pair could now rise to the resistance line of the wedge where the bears may mount a stiff resistance. If the price turns down from this resistance, the pair could drop to the support line of the wedge.

This is an important level for the bulls because if it cracks, the pair could start a deeper correction to $42,451.67.

On the contrary, if buyers drive the price above the wedge, the bullish momentum could pick up and the pair may rally to the $58,000 to $60,000 resistance zone. The upsloping moving averages and the relative strength index (RSI) in the overbought zone indicate that bulls are in control.

ETH/USDT

The bears tried to stall Ether’s (ETH) advance at the overhead resistance at $3,335 on Aug. 21 but the bulls did not allow the price to sustain below $3,200. This suggests that sentiment remains bullish and traders are buying on minor dips.

The bulls are currently attempting to sustain the price above the overhead resistance at $3,335. If they succeed, the ETH/USDT pair could resume its uptrend and rally to $3,670 and then to the psychological level at $4,000.

Alternatively, if the price turns down from the current level, the pair may drop to $3,000. If this level holds, the pair may consolidate between $3,000 and $3,335 for a few more days.

A breakdown and close below $3,000 will be the first sign that bulls are losing their grip. That may result in long liquidation, dragging the price down to the 50-day simple moving average ($2,547).

ADA/USDT

Cardano (ADA) has been in a strong uptrend for the past few days. After hesitating near the previous all-time high at $2.47 on Aug. 20 and 21, the bulls resumed the rally on Aug. 22.

The next target objective on the upside is the psychological barrier at $3. Vertical rallies are rarely sustainable, hence the ADA/USDT pair may enter a minor consolidation or correction near $3.

If bulls can flip the $2.47 into support during the next pullback, it will signal strength. That will increase the likelihood of the resumption of the uptrend. The next target on the upside is $3.50.

Conversely, if bears sink and sustain the price below $2.47, it will indicate that the bullish momentum has weakened.

BNB/USDT

Binance Coin (BNB) broke above the overhead resistance at $433 on Aug. 20, indicating the start of a new uptrend. The bears tried to pull the price back below the breakout level on Aug. 22 and trap the aggressive bulls but failed.

The bulls resumed their buying today and pushed the price above the minor resistance at $460. The BNB/USDT pair may face minor resistance at $520 but if bulls can overcome this hurdle, the next stop could be $600.

On the way down, the critical level to watch is $433. If this level holds, the trend will continue to favor the bulls. The first sign of weakness will be a break and close below $433. Such a move will suggest that supply exceeds demand.

XRP/USDT

The bears tried to stall XRP’s recovery at $1.28 on Aug. 21 but the shallow correction on Aug. 22 indicates that bulls are not closing their positions in a hurry. The bulls will now try to propel the price above the overhead resistance at $1.35.

If they succeed, the XRP/USDT pair could pick up momentum and rally to the next stiff resistance at $1.66. The bears had aggressively defended this resistance in May, hence the pair may again witness a minor correction or consolidation near it.

Contrary to this assumption, if the price turns down from $1.35, the pair could drop to $1.07. A bounce off this support could keep the pair range-bound between the two levels for a few more days. The trend may turn in favor of the bears if the price slips and sustains below $1.07.

DOGE/USDT

Dogecoin’s (DOGE) rebound off the breakout level at $0.29 hit a wall at $0.33 on Aug. 20. This suggests that bears have not given up and are attempting to stall the recovery. The price is currently stuck between the breakout level at $0.29 and the overhead resistance at $0.35.

The rising 20-day exponential moving average ($0.28) and the RSI in the positive zone indicate that bulls have the upper hand. If the price sustains above $0.29 for a few more days, the buyers will again try to resume the uptrend by thrusting the DOGE/USDT pair above $0.35.

If they succeed, the pair could start its journey toward the next target objective at $0.45. This level may again pose a stiff challenge for the bulls. The trend will indicate weakness if the price slips and sustains below $0.29.

DOT/USDT

Polkadot (DOT) has been facing stiff resistance at the $28.60 level for the past three days. Although bulls pushed the price above the resistance on Aug. 21, they could not sustain the higher levels.

The long tail on the Aug. 22 candlestick suggests that bulls are buying on dips. They will make one more attempt to clear the obstacle at $28.60. If they succeed, the DOT/USDT pair will complete a V-shaped bottom. The pattern target of this setup is $46.83.

If the price turns down from the current level, the pair may drop to the 20-day EMA ($23.40). A strong rebound off this level will suggest that sentiment remains positive. The bulls will then try to push the price above $28.60 and start a new uptrend.

On the other hand, a break below the 20-day EMA will indicate that the pair may remain range-bound for a few more days.

SOL/USDT

Solana (SOL) hit a new all-time high at $82 on Aug. 21 but the bulls could not sustain the higher levels. This suggests that traders are booking profits after the sharp rally of the past few days.

The first support on the downside is $68. If the price rebounds off this level, the bulls will again try to resume the uptrend. If they drive the price above $82, the SOL/USDT pair could rally to $100.

Alternatively, if the support at $68 cracks, the pair could retest the breakout level at $58.38. If bulls flip this level into support, the pair may consolidate the gains for a few days before trying to resume the up-move. However, if bears pull the price below $58.38 it will suggest a possible change in trend.

Related: Google bans 8 ‘deceptive’ crypto apps from Play Store

UNI/USDT

Uniswap (UNI) turned down from the overhead resistance at $30 on Aug. 21, suggesting that bears are defending this level aggressively. Although sellers tried to pull the price below the 20-day EMA ($27.11) on Aug. 22, the bulls had other plans.

The UNI/USDT pair again rebounded off the 20-day EMA, suggesting that the sentiment remains positive and bulls are viewing the dips as a buying opportunity. The bulls will now again try to push the price above the $30 to $31.25 overhead resistance zone.

If they succeed, the pair could start a new uptrend that could reach $37 and then $45. On the contrary, if the price turns down from the overhead zone and breaks below the 20-day EMA, the pair may drop to $23.45.

A bounce off this level could keep the pair range-bound between $23.45 and $30 for a few more days.

BCH/USDT

The bears are attempting to defend the zone between $700 and $714.76 but the positive sign is that the bulls are not buckling under pressure and are buying Bitcoin Cash (BCH) on dips to the 20-day EMA ($630).

If buyers thrust the price above $714.76, the BCH/USDT pair could rally to $806.87 and then to $864.28. This zone is likely to act as stiff resistance but if bulls do not give up much ground, the possibility of a break above $864.28 increases.

Contrary to this assumption, if the price turns down from the current level or $714.76, the bears will again try to sink the pair below the 20-day EMA. If they manage to do that, the pair could drop to the 50-day SMA ($541).

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.