The United States equities markets rallied sharply on June 2 even though nonfarm payrolls in May rose by 339,000, blowing past economists’ expectations of a 190,000 increase. A few analysts pointed out that the market was possibly encouraged by the slower growth rate of hourly earnings, which was slightly below estimates, and an uptick in the unemployment rate.

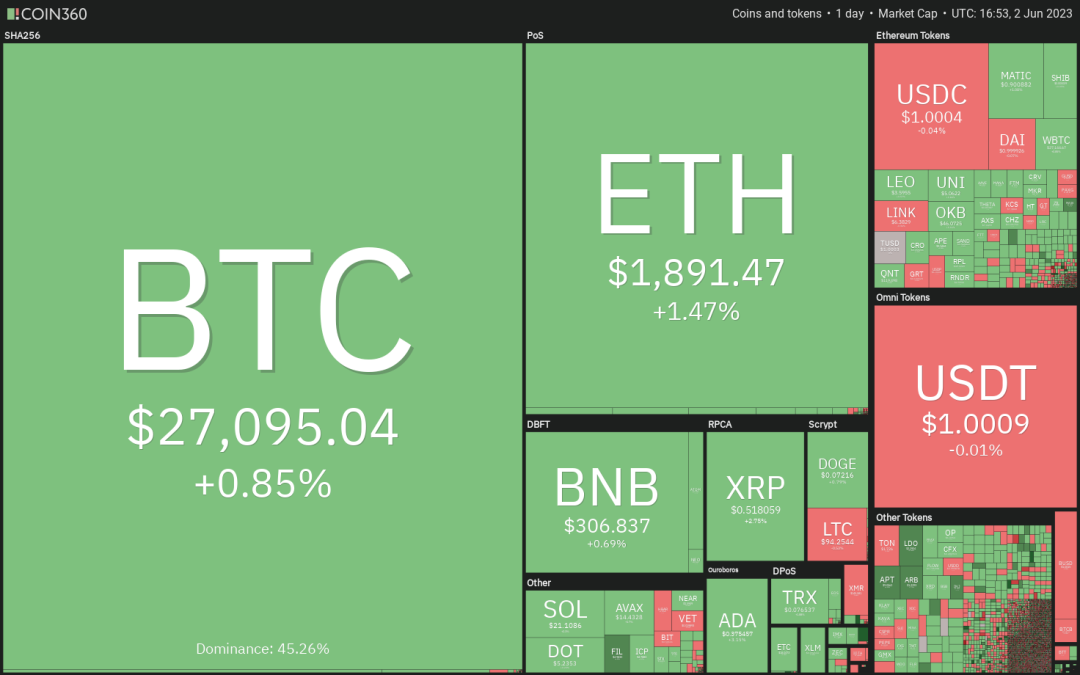

The rally in the equities markets failed to act as a tailwind to the cryptocurrency markets, which remain stuck in a range. Galaxy Digital CEO Mike Novogratz said in an interview with CNBC that the lack of enthusiasm in the crypto markets was due to an absence of institutional buying.

Bitcoin’s (BTC) historical performance in June does not give a clear advantage either to the bulls or the bears. According to CoinGlass data, between 2013 and 2022, there have been an equal number of positive and negative monthly closes in June.

Will buyers defend the respective support levels and start a strong recovery in Bitcoin and select altcoins? Let’s study the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin has been trading inside a descending channel pattern for the past few days. The price closed below the 20-day exponential moving average (EMA) of $27,239 on May 31, but the bears are struggling to maintain the lower levels.

The bulls will try to push the price back above the 20-day EMA. If they do that, the BTC/USDT pair could reach the resistance line where the bears are expected to mount a strong defense.

If the price turns down from the resistance line, it will signal that the pair may extend its stay inside the channel for some more time. The crucial support to watch on the downside is $25,250 because a break below it will indicate that bears are in control.

The first sign of strength on the upside will be a break and close above the channel. The pair could then start its journey toward $31,000.

Ether price analysis

The bulls have successfully thwarted attempts by the bears to pull Ether (ETH) back into the falling wedge pattern. This suggests that the bulls are trying to flip the resistance line into support.

The ETH/USDT pair has rebounded off the 20-day EMA ($1,855), indicating a change in sentiment from selling on rallies to buying on dips. The bulls will next try to propel the price above $1,927 and retest the stiff overhead resistance at $2,000.

This positive view will invalidate in the near term if the price turns down and re-enters the wedge. That could trap the aggressive bulls, resulting in a long liquidation. The pair may then slump toward the support line of the wedge.

BNB price analysis

BNB (BNB) has been consolidating in a tight range between $300 and $317 for the past few days. This shows indecision among the bulls and the bears about the next directional move.

The gradually downsloping 20-day EMA ($310) and the relative strength index (RSI) below the midpoint give a slight advantage to the bears. If the price turns down from the 20-day EMA, it will enhance the prospects of a break below $300. If that happens, the BNB/USDT pair could collapse to the next support at $280.

If bulls push the price above the 20-day EMA, the pair may reach the overhead resistance at $317. A break and close above this level will indicate the start of an up move to $334 and then $350.

XRP price analysis

Buyers are trying to arrest XRP’s (XRP) pullback above the 38.2% Fibonacci retracement level of $0.49. A shallow correction is a positive sign, as it shows that traders are keen to buy on minor dips.

The bulls will try to drive the price above the immediate resistance at $0.53. If they manage to do that, the XRP/USDT pair could attempt a rally to $0.56. This level is expected to act as a major hurdle, but if bulls overcome it, the pair may start a new uptrend toward $0.80.

Alternatively, if the price turns down from the current level and slips below $0.49, it will suggest that the bulls are booking profits. The pair could drop to the 20-day EMA ($0.48) and then to the 50-day simple moving average (SMA) of $0.47.

Cardano price analysis

Sellers tried to sink Cardano (ADA) below the uptrend line of the ascending triangle pattern on June 1, but the bulls held their ground.

The ADA/USDT pair has risen above the 20-day EMA ($0.37), and the bulls will try to thrust the price above the 50-day SMA ($0.38). If they succeed, the pair could gradually climb to $0.42 and thereafter to the overhead resistance at $0.44.

Contrarily, if the price turns down from the current level or the 50-day SMA, it will indicate that bears are selling on rallies. That will increase the likelihood of a break below the uptrend line. The pair may then start its descent to the next support at $0.30.

Dogecoin price analysis

The bulls again managed to sustain Dogecoin (DOGE) above the horizontal support at $0.07, but they are finding it difficult to push the price above the 20-day EMA ($0.07).

This tight-range trading is ripe for a breakout. If buyers kick and sustain the price above the 20-day EMA, the DOGE/USDT pair could rally to $0.08. This level may again act as a strong barrier. If the price turns down from it, the pair may trade inside the range between $0.07 and $0.08 for some time.

If the price turns down from the 20-day EMA, it will suggest that bears are selling on every minor rally. The bears will then try to yank the price below $0.07 and extend the correction to $0.06.

Polygon price analysis

Polygon (MATIC) fell below the 20-day EMA ($0.90) on May 30, but the bears could not sustain the lower levels. This suggests buying on dips.

The flattish 20-day EMA and the RSI near the midpoint signal a balance between supply and demand. If bulls push the price above the 20-day EMA, the MATIC/USDT pair will once again try to surmount the resistance at $0.94. If that happens, the pair could start its northward march toward the downtrend line.

On the contrary, if the price turns down from $0.94 and dips back below the 20-day EMA, it will suggest that bears are trying to flip the level into resistance. That could keep the pair stuck inside the $0.82 to $0.94 range for a few more days.

Related: Bitcoin wicks down to $26.5K, but trader eyes chance for ‘bullish surprise’

Solana price analysis

Solana (SOL) has been trading between the moving averages for the past few days. The bears tried to tug the price below the 20-day EMA ($20.58) on May 31 and June 1, but the bulls did not budge.

The tight-range trading is unlikely to continue for long. Buyers will try to thrust the price above the 50-day SMA ($21.50). If they can pull it off, the SOL/USDT pair may rally to $24 and subsequently to $27.12.

Instead, if the price turns down from the 50-day SMA and plummets below the 20-day EMA, it will suggest that supply exceeds demand. The pair could then drop to the vital support at $18.70. The bulls are likely to defend this level fiercely.

Polkadot price analysis

Polkadot (DOT) has been consolidating in a tight range between $5.15 and $5.56 for the past several days.

The price rebounded off the $5.15 support on June 2, but the bulls are facing selling at the 20-day EMA ($5.37). This suggests that every relief rally is being sold into. If the price continues lower and plunges below $5.15, the DOT/USDT pair could start the next leg of the downtrend toward $4.22.

Buyers have a difficult task ahead of them. If they want to prevent a decline, they will have to shove the price above the 50-day SMA ($5.69). The pair could then attempt a recovery to $6 and eventually to the downtrend line.

Litecoin price analysis

Litecoin (LTC) dipped below the moving averages on May 31, but the bulls purchased at lower levels as seen from the long tail on the day’s candlestick.

Buyers propelled the price above the overhead obstacle at $95 on June 1, but they haven’t achieved a close above it yet. If they do that, the LTC/USDT pair could rise to the resistance line of the symmetrical triangle pattern.

If the price turns down sharply from the resistance line, it will suggest that the pair may continue to oscillate inside the triangle for some more time.

On the other hand, a break and close above the triangle will indicate the start of a new uptrend. The pair could first reach $115 and then start its march toward the pattern target of $142.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.