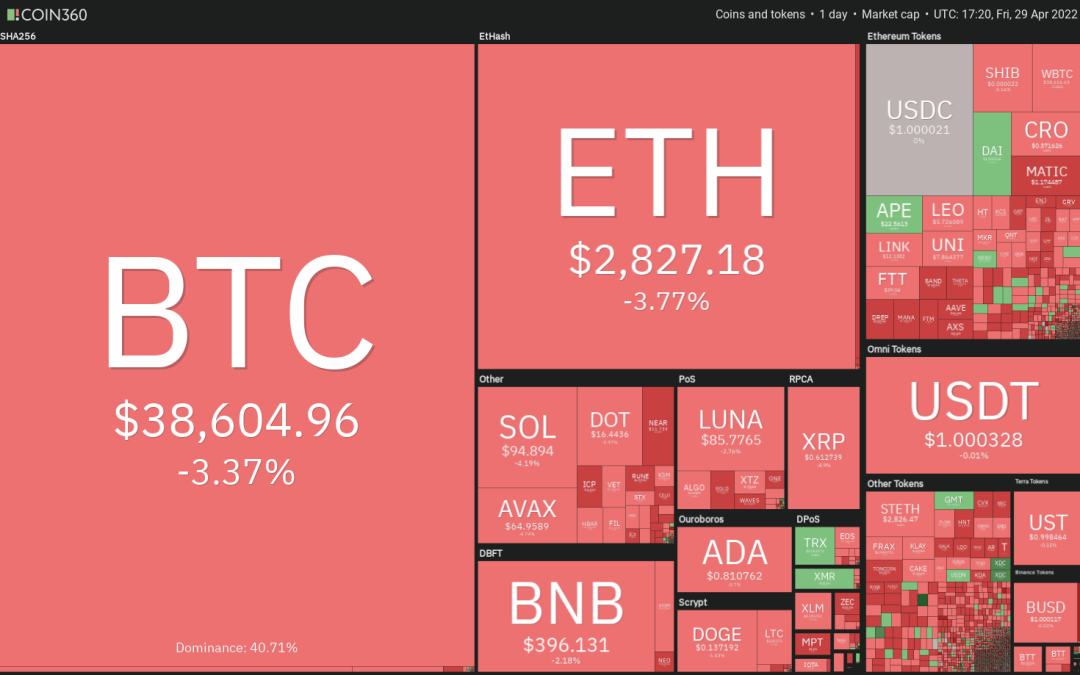

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters.

If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin.

Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2018.

The HODL mentality is not limited to Bitcoin investors alone. A nonfungible token (NFT) survey report by CoinGecko showed that more than 50% of respondents said they have a HODL mentality because they believe NFTs could be important items in games. The report added that the Metaverse could become an $800 billion market in the next two years.

Could Bitcoin and altcoins decline further or is a reversal on the cards? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin pulled back to the 20-day exponential moving average (EMA) ($40,363) on April 28 but the long wick on the day’s candlestick suggests that bears are selling on rallies to this level.

The downsloping 20-day EMA and the relative strength index (RSI) below 41 indicate that the path of least resistance is to the downside. If bears sink and sustain the price below the support line of the channel, the BTC/USDT pair could extend its decline to $34,300 and later to $32,917.

To invalidate this negative view, the buyers will have to push and sustain the price above the 50-day simple moving average (SMA) ($41,981). If they succeed, the pair could start its northward journey to the 200-day SMA ($47,433) where the bears may again pose a stiff challenge.

ETH/USDT

Ether (ETH) pulled back to the 20-day EMA ($2,991) in the past two days but the bulls could not push the price above it. This suggests that the sentiment remains negative and traders are selling on rallies.

The bears will now attempt to sink the price to the uptrend line. This is an important level for the bulls to defend because a break and close below it could invalidate the developing ascending triangle pattern. The ETH/USDT pair could then decline to $2,450.

This negative view could invalidate in the short term if the price turns up and breaks above the 50-day SMA ($3,045). That could attract buyers who may then push the pair to the 200-day SMA ($3,464). A break and close above this level could signal the start of a new up-move.

BNB/USDT

BNB dropped below $391 on April 26 but the bears could not sustain the lower levels. The price rose back above the breakdown level on April 27. This suggests demand at lower levels.

The bulls pushed the price to the 50-day SMA ($410) on April 28 but could not clear this hurdle. This suggests that bears are selling on rallies. The bears will now attempt to pull the price below the $391 to $380 support zone.

If they manage to do that, the BNB/USDT pair could drop to the strong support at $350. The buyers are expected to mount a strong defense at this level. The short-term trend could turn positive if bulls push and sustain the price above the 50-day SMA.

SOL/USDT

Solana (SOL) bounced off the support line of the ascending channel on April 27 but the bulls could not sustain the positive momentum and clear the overhead hurdle at the 20-day EMA ($101).

The bears now sense an opportunity and will try to sink the price below the support line of the channel. If they manage to do that, the selling could accelerate and the SOL/USDT pair could slide to the strong support at $75. This is an important level for the bulls to defend because a break and close below it could signal the resumption of the downtrend.

This negative view could invalidate in the short term if the price turns up and breaks above the 20-day EMA. The pair could then rise to $110 and later attempt a rally to $122.

LUNA/USDT

The failure of the bulls to push Terra’s LUNA token above the psychological resistance at $100 could have tempted short-term traders to book profits. That pulled the price below the minor support at $86 on April 29.

The RSI has dipped into the negative zone, indicating that the bullish momentum has weakened. If bears sustain the price below $86, the LUNA/USDT pair could drop to the strong support at $75. The bulls are expected to defend the zone between $75 and the 200-day EMA ($69) aggressively.

On the upside, the buyers will have to overcome the stiff barrier at $100 to set up a potential retest of the all-time high at $119. A break and close above this level could signal the resumption of the uptrend.

XRP/USDT

Ripple (XRP) rebounded off the support at $0.62 on April 26 but the weak rebound suggested a lack of aggressive buying. The selling resumed on April 29 and the bears have pulled the price below the critical support.

The 20-day EMA ($0.71) is sloping down and the RSI is in the oversold zone, suggesting that the path of least resistance is to the downside. If the price sustains below $0.62, the XRP/USDT pair could plummet to $0.55 and later challenge the psychological support at $0.50.

Contrary to this assumption, if the price rebounds off the current level, the buyers will make one more attempt to push the pair above the 20-day EMA. If they succeed, it will suggest that the pair may consolidate between $0.62 and $0.91 for some time.

ADA/USDT

Cardano (ADA) tried to start a relief rally from $0.81 on April 27 but failed to reach the 20-day EMA ($0.91). The selling resumed on April 29 and the bears will now attempt to pull the price to the strong support at $0.74.

The 20-day EMA is sloping down and the RSI is near the oversold territory, suggesting that bears have the edge. If bears sink the price below $0.74, the selling could intensify and the ADA/USDT pair could plummet to $0.68.

Contrary to this assumption, if the price rebounds off $0.74, the bulls will try to push the pair above the 20-day EMA. If they succeed, the pair could rally to the psychological level at $1, which is likely to act as a stiff resistance.

Related: 3 reasons why Dogecoin price can now gain 50% by September

DOGE/USDT

Dogecoin (DOGE) has managed to stay above the 50-day SMA ($0.13) for the past three days but the bulls have not been able to sustain the price above the 20-day EMA ($0.14). This suggests that the bears are selling at higher levels.

The failure to bounce may attract further selling, which could pull the price below the 50-day SMA. If that happens, the DOGE/USDT pair could drop to $0.12 and later to the psychological support at $0.10.

Contrary to this assumption, if the price rises and sustains above the 20-day EMA, the buyers will try to push the pair to the overhead resistance at $0.17. The bulls will have to clear this hurdle to signal a possible change in trend.

AVAX/USDT

Avalanche (AVAX) has declined to the strong support at $65. The bulls had defended this support on two previous occasions; hence, they will again try to arrest the decline at this level.

However, the bears are likely to have other plans. The downsloping 20-day EMA ($74) and the RSI near the oversold territory favor the bears. If the price breaks below $65, the AVAX/USDT pair could drop to the critical support at $51.

Alternatively, if the price rebounds off $65, the pair is likely to hit a wall at the 20-day EMA. If the price turns down from this resistance, the prospects of a break below $65 increase.

The bulls will have to push and sustain the price above the 20-day EMA to indicate that the bears may be losing control. The pair could then rise to the 200-day SMA ($85).

DOT/USDT

The bulls are defending the support of the large range between $16 and $23 but haven’t been able to achieve a strong rebound off it. This suggests that demand dries up for Polkadot (DOT) at higher levels.

The downsloping 20-day EMA ($18) and the RSI in the negative territory indicate advantage to sellers. The bears will now attempt to pull the price below the $16 support and if they manage to do that, the DOT/USDT pair may drop to $14.

The buyers will have to push and sustain the price above the 50-day SMA ($19) to signal that the corrective phase may be over. The pair could then start its journey toward the overhead resistance at $23.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.