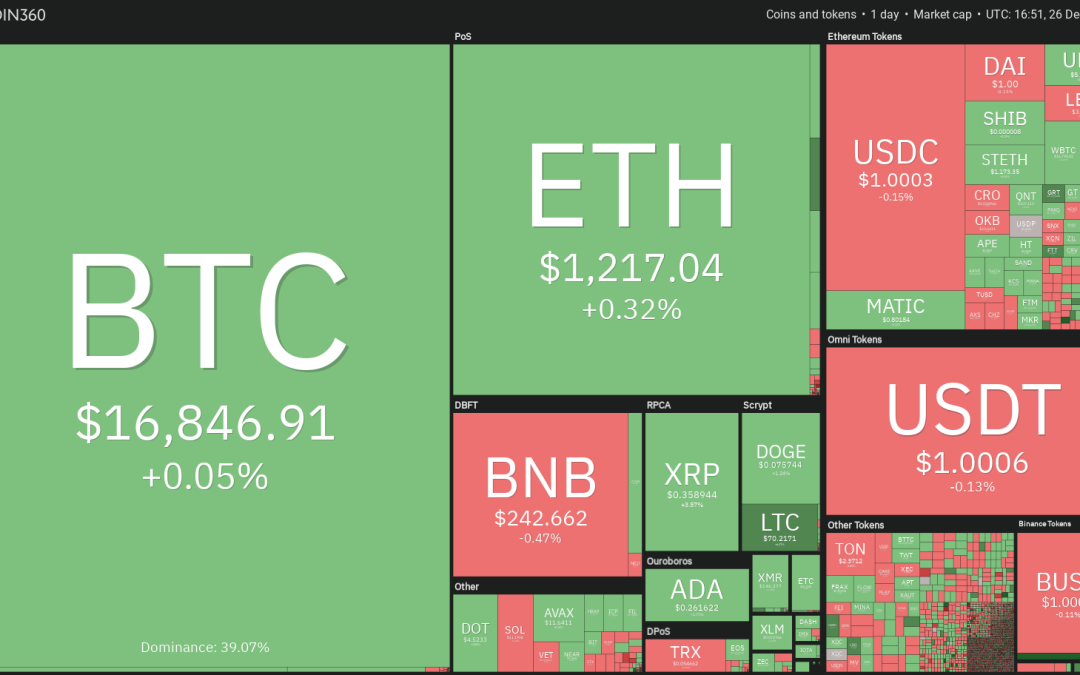

The cryptocurrency markets are trading at record low volatility as investors have largely stayed away during the holiday season. That could be because investors are unsure about the cryptocurrencies that could lead the next bull run.

Cumberland senior research analyst Steven Goulden said in a “Year in Review” report that he expects four “emerging narratives” to lead the crypto space over the next six to 24 months. Goulden anticipates growth in nonfungible tokens, Web3 apps and games. He expects export-oriented nations to add Bitcoin (BTC) and Ether (ETH) as reserve assets and if that happens, it could be a huge positive.

Jared Gross, head of institutional portfolio strategy at JPMorgan Asset Management, holds a different view. While speaking to Bloomberg, Gross said that the bear market had broken the notion that Bitcoin could act as a form of digital gold or an inflation hedge. He added that large institutional investors have stayed away from the crypto sector and that approach was unlikely to change anytime soon.

Could the S&P 500 index (SPX) and the cryptocurrency sector witness a recovery in the next few days? Let’s study the charts to find out.

SPX

The S&P 500 index (SPX) turned down sharply from the downtrend line and tumbled below the 50-day simple moving average (3,885) on Dec. 16. Buyers tried to push the price back above the 50-day SMA on Dec. 21 but the bears held their ground.

The sellers pulled the price below the immediate support of 3,795 on Dec. 22 but the long tail on the candlestick shows strong buying at lower levels. The bulls will again try to thrust the price above the moving averages and challenge the downtrend line. A break and close above the downtrend line could indicate a potential trend change.

Contrarily, if the price turns down from the 20-day exponential moving average (3,907), it will suggest that the bears continue to sell on rallies. The index could then drop below 3,764 and reach the next support at 3,650.

DXY

The U.S. dollar index (DXY) has been trading below 105 for the past few days. This suggests that the bears are trying to flip the 105 level into resistance.

Both moving averages are sloping down and the RSI is in the negative territory, indicating advantage to bears. If the price turns down and breaks below 103.44, the selling could pick up momentum and the index could plunge to 102 and later to the psychological level of 100. The bulls may vigorously defend this level.

On the upside, the bulls will have to kick the price above the 20-day EMA (105) to suggest that the selling pressure may be reducing. The index could then attempt a rally to 107 and subsequently to 108. The bears are likely to mount a strong defense at this level.

BTC/USDT

Bitcoin has been trading in a tiny range for the past few days. This indicates that traders are not clear about the next directional move, hence they may be sitting on the sidelines.

This tight-range trading may not continue for long because traders thrive in a volatile market. Buyers will try to establish their supremacy by pushing the price above the moving averages and the resistance at $17,100.

If they succeed, the BTC/USDT pair could rally to $17,854 and then to the stiff resistance at $18,388. This level may act as a major obstacle and the bulls may find it difficult to surpass it.

If the price turns down sharply from the current level and dips below $16,550, the bears will try to extend the decline to the $15,500 to $16,000 support zone.

ETH/USDT

The bears tried to pull Ether toward the $1,150 support on Dec. 25 but the long tail on the candlestick shows that bulls are buying on minor dips. Buyers are currently attempting to catapult the price above the moving averages.

If they manage to do that, the ETH/USDT pair could pick up pace and rally to $1,352. This level could act as a major hurdle because the bears will try to defend it to the best of their ability. If the price turns down from $1,352, it will suggest that the pair could remain stuck inside a large range for some more time.

If the price turns down sharply from the current level, it will enhance the prospects of a break below $1,150. The pair could then slide to $1,075 where buying may emerge. The flattish 20-day EMA ($1,227) and the RSI near 47 indicate a possible range-bound action in the near term.

BNB/USDT

The bears are aggressively defending the breakdown level of $250 but a minor positive is that the bulls have not given up much ground. This suggests that the bulls will again try to propel BNB (BNB) above the overhead resistance zone between $250 and $255.

If they can pull it off, the BNB/USDT pair could quickly move up to the $290 to $300 resistance zone, which may act as a major barrier.

The downsloping moving averages and the RSI in the negative territory indicate advantage to bears. If the price turns down and breaks below $236, it will suggest that the bears have succeeded in flipping $250 into resistance. The pair could then drop to $220. If this level cracks, the pair could sink to the psychological level of $200.

XRP/USDT

XRP (XRP) is trading inside a symmetrical triangle pattern. The price rebounded off the support line on Dec. 19 and reached the 20-day EMA ($0.36) on Dec. 26.

If the price turns down from the 20-day EMA, the bears will again attempt to sink the XRP/USDT pair below the support line. If they succeed, the pair could plunge to the pivotal support at $0.30.

Contrary to this assumption, if bulls push the price above the 20-day EMA, the pair could rally to the resistance line. The bears may fiercely protect this level but if bulls overcome their resistance, the pair could start a strong recovery. The pair could first rally to $0.42 and then to the pattern target at $0.47.

DOGE/USDT

Dogecoin’s (DOGE) recovery from the strong support at $0.07 fizzled out at $0.08. This suggests that bears continue to sell on minor relief rallies.

The DOGE/USDT pair could trade between $0.07 and $0.08 for some time. The downsloping moving averages and the RSI in the negative territory indicate advantage to bears.

If the price slips below $0.07, the selling could intensify and the pair may plummet to the critical support at $0.05.

This negative view could invalidate in the short term if bulls push and sustain the price above the 20-day EMA ($0.08). The pair could then attempt a rally to the overhead resistance at $0.11.

Related: Bitcoin price volatility due within days, new take says as BTC flatlines at $16.8K

ADA/USDT

Cardano (ADA) rebounded off the support line of the falling wedge pattern on Dec. 22 and the bulls are trying to push the price to the 20-day EMA ($0.27).

The bears will try to halt the recovery at the 20-day EMA and assert their supremacy. If the price turns down from this level, it will suggest that the trend remains negative and bears remain in command. The ADA/USDT pair could then retest the support at $0.25. If this level cracks, the pair may again drop to the support line.

If bulls want to gain the upper hand, they will have to push the price above the 20-day EMA. The pair could then rally to the 50-day SMA ($0.31) and later to the downtrend line.

MATIC/USDT

Polygon (MATIC) has been oscillating inside a large range between $0.69 and $1.05 for the past several months. Many times, trading inside a range is random and volatile.

The MATIC/USDT pair rebounded off $0.76 on Dec. 19 and the bulls are trying to push the price to the 20-day EMA ($0.83). The bears are expected to sell the rally to the 20-day EMA. If the price turns down from this level and breaks below $0.76, the pair could plummet to the strong support at $0.69.

On the other hand, if bulls drive the price above the 20-day EMA, the pair could attempt a rally to the overhead resistance at $0.97.

DOT/USDT

Polkadot (DOT) remains in a strong downtrend. The bulls are trying to protect the support at $4.37 but the shallow bounce increases the likelihood of the continuation of the down move.

The bears will try to strengthen their position by pulling the price below $4.37. If they do that, the DOT/USDT pair could resume the downtrend. The pair could thereafter reach $4 where the buyers may again try to arrest the decline.

In a downtrend, the bears generally sell the relief rallies to the 20-day EMA ($4.80). The bulls will have to clear this hurdle to suggest that the downward momentum could be weakening. The pair could then rise to the 50-day SMA ($5.30) and later to $6.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Market data is provided by HitBTC exchange.