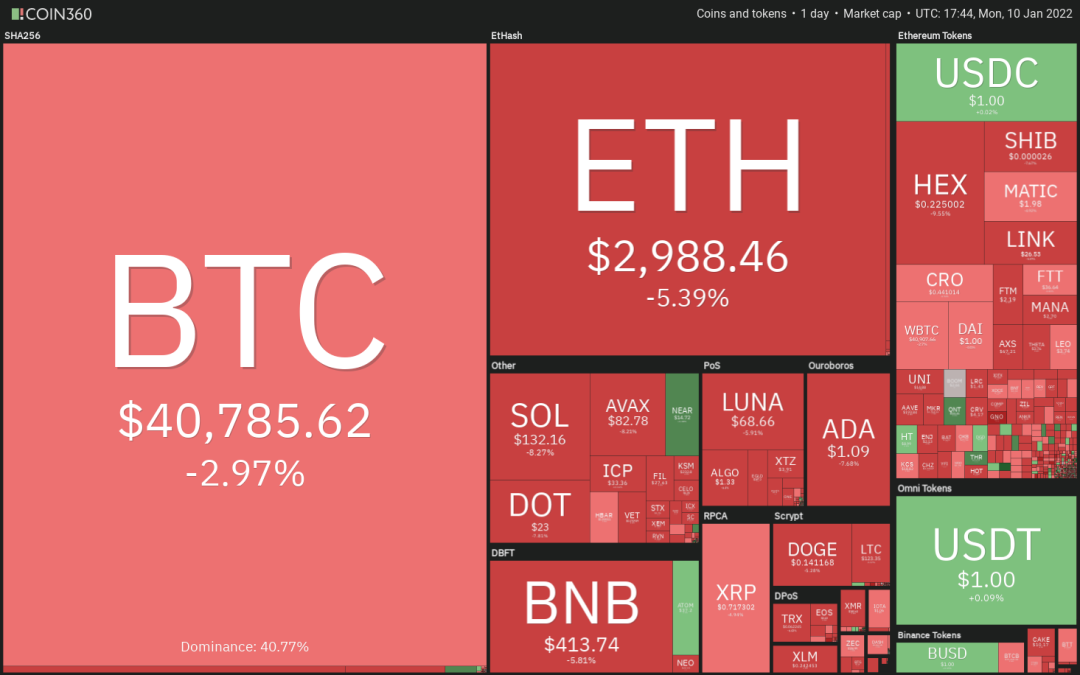

Bitcoin (BTC) dipped below the $40,000 level on Jan. 10 for the first time since September 2021. The crypto markets were not alone as the U.S. equity markets also witnessed strong selling when traders chose to reduce risk and piled into the 10-year Treasury yield, which surged to 1.8% from 1.51% at the end of 2021.

On Jan. 9, Goldman Sachs chief economist, Jan Hatzius, said that the U.S. Federal Reserve may increase rates by four quarter-percentage points in 2022.

Analyst Alex Krüeger also warned that crypto markets may not be able to ignore the Fed if it “decides to go all out wielding a deflationary machete.” He was not alone as ex-BitMEX CEO Arthur Hayes and Pentoshi also projected a bearish picture.

Quant analyst Benjamin Cowen gave some hopes to the bulls when he said that levels of “extreme fear” on the Crypto Fear & Greed Index occurred only four times since 2018 and those were followed by bullish reversals resulting in strong returns between 17% to 1,585% in Bitcoin.

Could Bitcoin and major altcoins start a sustained recovery or will the support levels give way? Let’s study the charts of the top 10 cryptocurrencies to find out.

BTC/USDT

Bitcoin plunged to $39,650 on Jan. 10 when buyers stepped in and bought aggressively as seen from the long tail on the candlestick. If buyers sustain the rebound, the price could attempt to move toward the 20-day exponential moving average (EMA) ($45,369).

Both moving averages are sloping down and the relative strength index (RSI) is in the oversold zone suggesting that bears are in command. If the price turns down from the 20-day EMA, the BTC/USDT pair could again drop to the strong support at $39,600 and remain range-bound between these two levels for a few days.

If the support at $39,600 gives way, the selling could intensify further and the pair could start its march toward $30,000.

Conversely, if bulls drive the price above the 20-day EMA, the pair could rally to the stiff overhead resistance at $52,088. A break and close above this resistance could signal a possible change in trend.

ETH/USDT

The bulls have been defending the support line of the descending channel for the past few days but they have not been able to achieve a strong rebound off it. This suggests that demand dries up at higher levels. Ether (ETH) attempted a recovery on Jan. 9, but it could not rise above the breakdown level at $3,250.

The price turned down again on Jan. 10 and the bears are attempting to pull the ETH/USDT pair below the descending channel. If they manage to do that, the selling could intensify and the pair could drop to the next strong support at $2,652.

This is an important support for the bulls to defend because if it cracks, the pair could plummet toward the psychological support at $2,000.

Conversely, if the price rebounds off the current level, the bulls will make one more attempt to clear the overhead hurdle at $3,250 and push the pair to the resistance line of the channel.

BNB/USDT

Binance Coin (BNB) slipped below the support line of the descending channel on Jan. 8 but the long tail on the day’s candlestick showed buying at lower levels. The bulls pushed the price back into the channel on Jan. 9 but failed to sustain the price above the breakdown level at $435.30.

The price turned down once again on Jan. 10 and the bears are attempting to sustain the BNB/USDT pair below the channel. If they succeed, the pair could decline to $392.20. This is an important support for the bulls to defend because if it cracks, the next stop could be $330.

The RSI has dropped into the oversold territory, indicating that the selling may be overdone in the short term. This could result in a minor recovery or a range-bound action in the next few days. A break and close above the 20-day EMA ($492) will be the first sign that the sellers may be losing their grip.

SOL/USDT

Solana (SOL) attempted a recovery on Jan. 8 but the bulls could not push the price back above $150. This suggests that bears are selling on relief rallies.

If bears sustain the price below $133, the SOL/USDT pair could drop to the strong support at $116. Both moving averages are sloping down and the RSI is close to the oversold zone, indicating that bears are in control.

If the $116 level cracks, the pair could decline to the support line of the channel. If this support also breaks down, the selling may intensify and the pair could plummet to $82. The first sign of strength will be a break and close above the 20-day EMA ($162).

ADA/USDT

Cardano (ADA) broke and closed below the $1.18 support on Jan. 9 indicating the resumption of the downtrend. The next support on the downside is the critical level at $1.

The bulls are likely to defend this level aggressively as it has not been breached for the past several months. If the price rebounds off $1, the pair could rise to the 50-day SMA ($1.39) where the bears are expected to mount a strong resistance.

If the price turns down from the moving averages, the bears will make one more attempt to pull the ADA/USDT pair below $1. If they succeed, the selling could pick up momentum and the pair could drop to the support line of the channel.

XRP/USDT

Ripple (XRP) closed below the $0.75 support on Jan. 8 but rose back above the level on Jan. 9. This suggests that bulls were attempting to trap the aggressive bears, but the recovery attempt was short-lived.

The price turned back below $0.75 on Jan. 10, indicating that bears are selling on every minor rally. The downsloping moving averages and the RSI near the oversold zone indicate that bears are in command.

If the price sustains below $0.75, the XRP/USDT pair could drop to the Dec. 4 intraday low at $0.60. The bulls will have to push and sustain the price above the 50-day SMA ($0.87) to signal the start of a stronger recovery.

LUNA/USDT

Terra’s LUNA token broke below the descending channel pattern on Dec. 8 but the long tail on the day’s candlestick suggests buying at lower levels. The bulls pushed the price back into the channel and above the 50-day SMA ($70) on Dec. 9.

The relief rally hit a barrier at $75.67 and the price has turned down below the 50-day SMA on Jan. 10. This suggests that bears continue to sell on rallies. The 20-day EMA ($78) is sloping down and the RSI is near 43, indicating that bears are in control.

If bears pull the price below $62.46, the selling could intensify and the LUNA/USDT pair could drop to $51.84. This bearish view will be negated if the price turns up from the support line of the channel and breaks above the resistance line.

Related: Billionaire investor Bill Miller puts 50% of net worth in Bitcoin

DOT/USDT

Polkadot (DOT) attempted a rebound off the strong support at $22.66 but the bulls have not been able to push the price to the 20-day EMA ($26.95). This suggests that demand dries up at higher levels.

The downsloping moving averages and the RSI in the negative zone suggest that bears have the upper hand. If bears sink and sustain the price below $22.66, the DOT/USDT pair could start its downward journey to $16.81.

Alternatively, if the price rebounds off the current level, the bulls will again try to push the pair above the 20-day EMA. If they manage to do that, the pair could rise to the 50-day SMA ($29.66) and then to the overhead resistance at $32.78.

AVAX/USDT

Avalanche (AVAX) slipped below the uptrend line of the symmetrical triangle on Jan. 8 but the bears could not build upon this advantage. The bulls pushed the price back into the triangle on Jan. 9.

However, the recovery was short-lived as the bears have pulled the price back below the triangle. This indicates that the sentiment remains negative and traders are selling on every minor rally.

There is a strong support at $75.50 but if it collapses, the AVAX/USDT pair could tumble to $57.02 and then to $50.

On the other hand, if the price rebounds off the current level or the $75.50 support and sustains inside the triangle, it will suggest accumulation at lower levels. The pair could then rise to $98 where bears may mount a strong resistance.

A break and close above the moving averages could open the doors for a rally to the downtrend line.

DOGE/USDT

Dogecoin (DOGE) has broken below the critical support at $0.15, signaling the start of the next leg of the downtrend.

The downsloping moving averages and the RSI in the oversold territory suggest that the path of least resistance is to the downside. If bears sustain the price below $0.15, the DOGE/USDT pair could drop to the Dec. 4 intraday low at $0.13.

Contrary to this assumption, if the price rebounds off the current level, the bulls will try to push the pair above the moving averages. If they do that, it will bring the $0.19 to $0.15 range into play and the pair could rise to $0.19.

The bulls will have to push and sustain the price above this resistance to indicate the start of a new up-move.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.