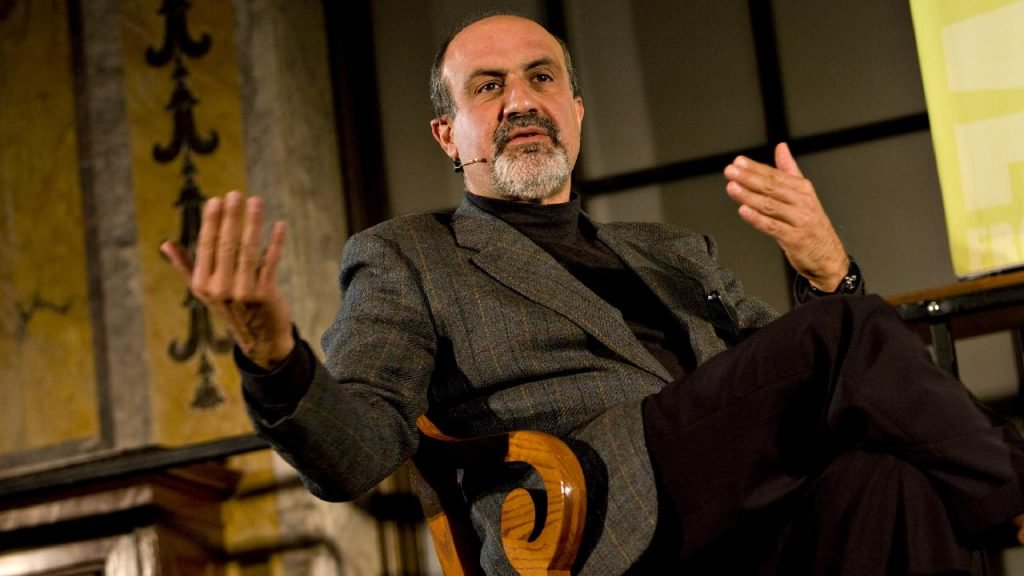

The Bitcoin Standard: The Decentralized Alternative to Central Banking, by bitcoin maximalist Saifedean Ammous, is set for a spring release, having managed to make news ahead by snagging philosopher Nassim Nicholas Taleb to write its foreword. Mr. Taleb is his usual profound self, offering a full-throated defense of its essential idea, in contrast to many contemporary intellectuals who often dismiss bitcoin out of hand.

Also read: Tezos Swiss Foundation Concept is “Old, Inflexible and Stupid”

Nassim Nicholas Taleb Forwards Bitcoin

“Which is why Bitcoin is an excellent idea,” continues a crypto community favorite philosopher, Nassim Nicholas Taleb, 57, in a recent post to his Opacity blog, It May Fail but We Now Know How to Do It. “It fulfills the needs of the complex system, not because it is a cryptocurrency, but precisely because it has no owner, no authority that can decide on its fate. It is owned by the crowd, its users. And it has now a track record of several years, enough for it to be an animal in its own right.”

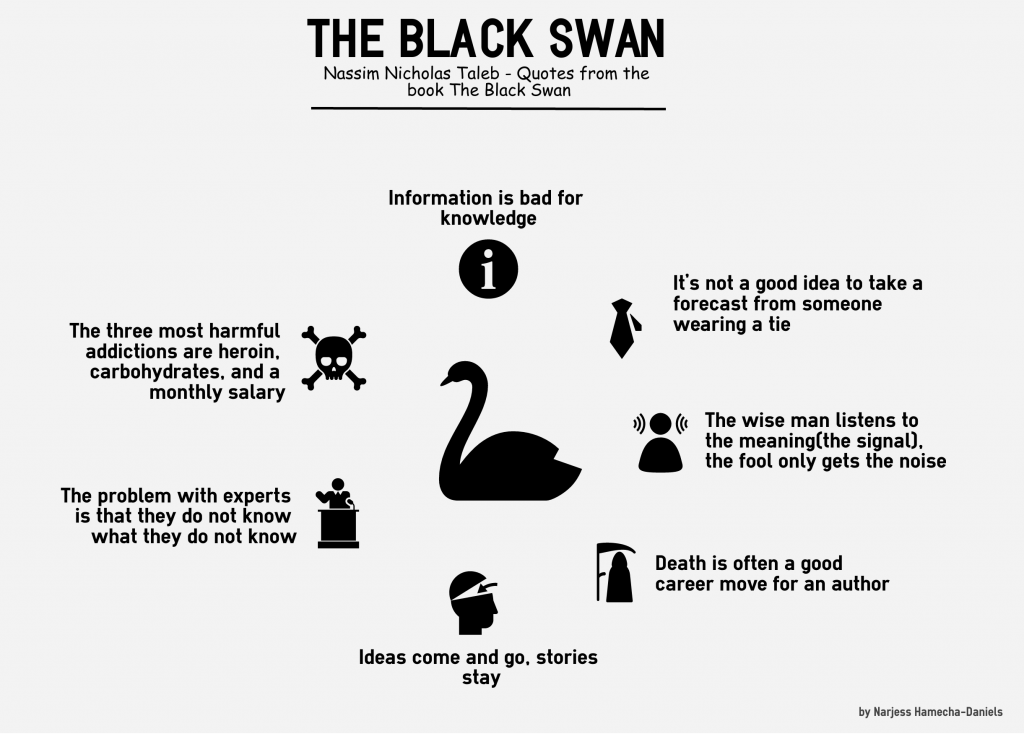

Mr. Taleb is best known for his work in probability, risk, decision theory, and his books include 2010’s The Black Swan: The Impact of the Highly Improbable, and 2012’s Antifragile: Things That Gain from Disorder, both highly cited by ecosystem enthusiasts. His present meditation on bitcoin came by way of a foreword to an upcoming release.

In his defense of bitcoin, he rifles through “experts” on the economy, familiar names who’ve either outright failed or who merely kept the dying patient alive for a little while longer, arriving at the cautionary value of how “we need to be careful on who to endow with centralized macro decisions.” The echo chamber of central banking has sought only its own ends rather than improving upon currency, half of all transactions. It’s probably safe to write the industrialized world hasn’t experienced innovation for at least a century. Imagine if any other technology, tool, commodity was allowed such stillbirth.

Mr. Taleb notes Hayek as inspiration for the innovation of bitcoin, at least in spirit. The distribution of knowledge means, almost paradoxically, “it looks like we do not even need that thing called knowledge for things to work well. Nor do we need individual rationality. All we need is structure,” and that structure is decentralization. Even stalwart stores of value throughout history, such as gold, have lost their heroic reason for existence: they’re now wholly play things of governments, from Hong Kong to New Jersey, while “Bitcoin is a currency without a government,” Mr. Taleb reminds readers.

As such, he explains, it “has a huge advantage over gold in transactions: clearance does not require a specific custodian. No government can control what code you have in your head,” Mr. Taleb insists. He does acknowledge bitcoin’s present drawbacks in terms of network congestion and transaction fees, however, but brings us back to Hayekian ground, as bitcoin “is the first organic currency.”

David GW Birch Might’ve Very Well Missed the Point of Bitcoin

While Mr. Taleb is refreshingly pithy and grounded in bitcoin’s ultimate ends, other intellectuals of note in the financial world aren’t so convinced. Before Babylon, Beyond Bitcoin: From Money that We Understand to Money that Understands Us (London Publishing Partnership, 2017), is a breezy enough read by a familiar English financial columnist and pundit, David GW Birch. Mr. Birch, The Telegraph notes, is “one of the world’s leading experts on digital money,” and a director of Consult Hyperion, an IT management consultancy.

Despite its title, the book has precious little to say about bitcoin, devoting almost as much space to ether, zcash, and ripple as possible alternatives to what Mr. Birch declares a near sure thing: bitcoin won’t survive. Indeed, cryptographic currencies won’t either, at least not in the manner Mr. Taleb has praised, according to Mr. Birch.

Of its 18 chapters, it takes until the 13th before a discussion of cryptocurrency is hashed out. And really the segment is to probably justify the title, as scattered paragraphs tangent to practical concerns and comparisons to M-Pesa. Lost wallets and lack of recovery. Low relative adoption rates. Finally, he even doubts bitcoin is a currency. He writes almost rhetorically, “might it be the future of money? I think not,” Mr. Birch answers.

“Bitcoin is not the future of money, and the future of money is not Bitcoin,” he emphasizes. He does walk a tightrope of coming close to Mr. Taleb’s understanding, suggesting many people are fed up with status quo currency arrangements. But then Mr. Birch cheers much more centralized cryptocurrency alternatives such as ripple before advocating a kind of digital fiat hybrid where central bankers somehow stabilize and tame crypto in preference to his favored centralized structure. And then he’s off to the drug of professional financial journalists, “blockchain” this and “blockchain” that.

Mr. Birch has it exactly backward: bitcoin is practical in a liberation sense. It’ll find its way toward use cases, and is nearly every day. While Mr. Birch’s predictions might just come to pass, the allure of bitcoin as an idea is now out there: people are free to transact without minders. Ending on Mr. Taleb for contrast suffices to push home the point:

“But its mere existence is an insurance policy that will remind governments that the last object establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.”

What do you think bitcoin’s future is? Let us know in the comments section below.

Images courtesy of Pixabay, Nassim Nicholas Taleb, David GW Birch.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post Nassim Nicholas Taleb vs David Birch on The Bitcoin Standard appeared first on Bitcoin News.