It’s very odd that citizens never get to vote or have any say in regard to society’s money, even though it’s one of the most important aspects of everyday life. In fact, in developed countries, most central banks are institutions that are privatized from political interference and history explains why.

Also Read: IRS Agents Propose Draconian Tactics to Investigate Bitcoin Users

Money: The World’s Most Powerful Weapon

Most people think they understand how governments work. People assume this because a bunch of people pay their taxes in the belief that ‘representatives’ are doing their bidding when it comes to law and order. What the majority of folks don’t understand is that there’s one very important aspect of society that taxpayers have literally no say in — the creation of legal tender and the country’s monetary system. Many people believe the black swan of Bitcoin was born because modern society is now dictated by private, central banks that have irresponsibly printed vast quantities of fiat and manipulated the world’s economy in the worst way. Bureaucrats have given central banks the world’s most powerful weapons. Even worse, the banking cartels are never held liable for the inflation and the rampant busts and booms that have plagued the world’s economy for many decades.

From Simple Stock Traders to the Money Trust and the House of Morgan

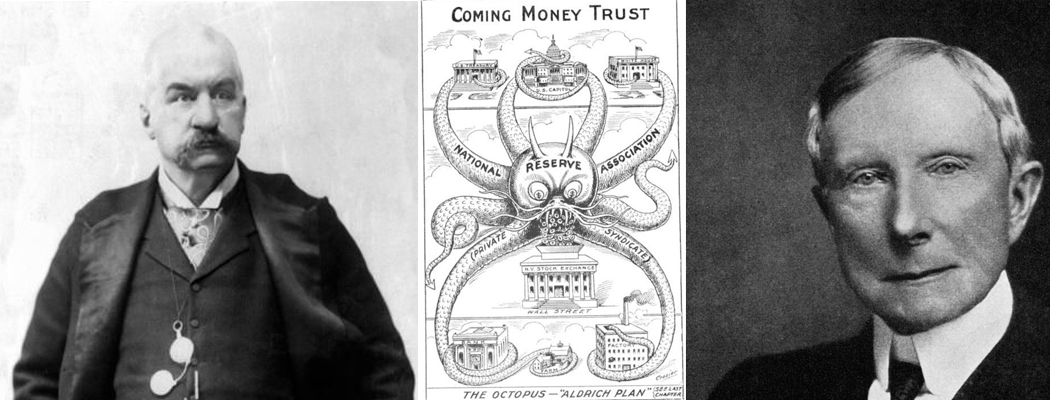

People who question the ethics of the state understand that central banks arrogated to themselves a compulsory monopoly over society’s monetary system. The consortium of modern central banking started in the 17th century and one of the first known central banks was the Swedish Riksbank spawned in 1668. Following the Riksbank was the creation of the Bank of England in 1694 and 100 years later the Banque de France in 1800. In the U.S., President Woodrow Wilson created the Federal Reserve System the day before Christmas Eve in 1913 in response to the economy and the banking panic of 1907. That year the ‘Banker’s Panic’ or ‘Knickerbocker Crisis’ saw a nationwide run on banks and trusts throughout the U.S. Even though the Federal Reserve was initiated in an act of Congress, it is considered politically independent and not legally owned by the U.S. government. The Federal Reserve is the quintessential example of a 21-century central bank created by a group of bankers called the Money Trust more than 100 years ago.

You see, when Bitcoin was launched after the bank bailouts of 2008, the creation of the Federal Reserve was a very similar situation. The Federal Reserve Act stemmed from the likes of stock market traders and bankers in distress. Even Sweden’s Riksbank and the Bank of England have initial ties to stock market traders. The St. Louis Federal Reserve office even attributes the creation of the Fed to “a series of bad banking decisions and a frenzy of withdrawals caused by public distrust of the banking system.” So much like the bank bailouts of 2008, JP Morgan, along with other Wall Street bankers, attempted to save the country from financial crisis. The citizens of America at the time had no say in the creation of the Federal Reserve nor have they ever had a say or vote toward the central bank’s monetary policies. What’s even more interesting is the fact that the same banking families who controlled the world’s monetary policy in 1907 are still in control today. If one was to study the newspapers during the time when the Federal Reserve was created they would read about how a group of bankers called the Money Trust helped push the concept of the Fed.

Reading the Pujo hearings gives great detail to this secret society of bankers who conducted mysterious meetings in order to ‘save the country.’ U.S. citizens back in the early 1900s got a nice glimpse of what happens when a small group of men have the power to control the finances of a country. The Fed and many central banks worldwide don’t care about laws because they operate outside of them in a private manner. The very same bankers bailed out in 2008 come from the same families the Fed bailed out 101 years earlier in 1907. The Morgan, Rothschild, Heinze, Rockefeller, and Warburg families influenced markets greatly at the time. The now-deceased Austrian economist and historian Murray Rothbard explained in his book “The Case Against the Fed” how special banking interests formed a coalition to bolster the Federal Reserve system.

“Since World War II, indeed, the various financial interests have entered into a permanent realignment: the Morgans and the other financial groups have taken their place as compliant junior partners in a powerful “Eastern Establishment,” led unchallenged by the Rockefellers,” Rothbard book details. “Since then, these groups, working in tandem, have contributed rulers to the Federal Reserve System.” Rothbard even ties the Money Trust members to the current Federal Reserve chairperson at the time and states:

Thus, the present Fed Chairman, Alan Greenspan, was, before his accession to the throne a member of the executive committee of the Morgans’ flagship commercial bank, Morgan Guaranty Trust Company. His widely revered predecessor as Fed Chairman, the charismatic Paul Volcker, was a long-time prominent servitor of the Rockefeller Empire.

The House of Morgan, another name for JP Morgan and his association of bankers, had met at Morgan’s private library several times in order to convince banks to join the lending pool. The American citizens had no voice in these meetings and had absolutely no say when President Wilson enacted the Federal Reserve Act with his group of cronies from the House of Morgan. We must remember these are the same bankers who were never prosecuted for their crimes in 2008 and have never been held liable for manipulating the global economy. More than a century later, JP Morgan Chase & Co. is the largest bank in America and the sixth largest in the world. The House of Morgan was also involved during the crash in 1987 called Black Monday, which began in Hong Kong and spread to Europe and then the United States. It’s no wonder that one of Morgan’s banker buddies Mayer Amschel Rothschild told the public long ago:

Permit me to issue and control the money of a nation, and I care not who makes its laws.

The Song Remains the Same When it Comes to the Central Planning of the World’s Monetary Policy

After the decades of mistrust over the central banking system, people have tried to protest acts like massive fiat printing, quantitative easing, fractional reserve banking, and the manipulation of interest rates. Just like in 1907, the bankers got a fresh round of stimulus from the Emergency Economic Stabilization Act of 2008, otherwise known as the ‘bank bailouts.’ That September, just before the Bitcoin whitepaper was published, protests against the bank bailouts occurred in 100 cities across 41 states in the U.S. Even after the protests in the U.S. and Europe as well, the 2008 financial crisis allowed bankers to gain vast amounts of money, creating significant wealth disparity. The disparity was so large that global citizens protested the 1% again four years later during the Occupy Wall Street movement. Still, no banker was jailed and the Federal Reserve was allowed to print billions of dollars that only trickled down to their banker compadres.

It is crazy that Americans have no say in how the privatized Federal Reserve operates and the entity is allowed to toy with the economy on a whim. The Federal Reserve is not much different to the rest of the world’s central banks as most of them are interconnected in some fashion. Even with the blatant manipulation of society’s monetary system, the world still has a choice to escape the wrath of centralized planners. After the crisis in 2008, Bitcoin’s inventor Satoshi Nakamoto unleashed a technological breakthrough when it comes to money, an invention that cut out the cartel of central bankers. The message in Bitcoin’s genesis block suggests that Nakamoto created a coin with scarcity for a reason, highlighting the bank bailouts of 2008. Many libertarians and students of Austrian economics have questioned the Federal Reserve and have called for the bank to be audited and even terminated. Former Senator Ron Paul is well known for trying to push an audit of the Federal Reserve and often shouts the slogan “End the Fed” at his rallies.

“It is no coincidence that the century of total war coincided with the century of central banking,” Paul emphasized in his book which is also called End the Fed.

Free Market Instruments Will Prove More Fruitful When Fighting Against the Fiat Regime

Ron Paul explained in his paper called The Dollar Dilemma, published in July 2018, that free market instruments like bitcoin and precious metals can help destroy the fiat regime. Paul highlights that it is “conceivable that cryptocurrencies, using blockchain technology, and a gold standard could exist together, rather than posing an either-or choice — Different currencies may be used for certain transactions for efficiency reasons.” The former U.S. Senator continues:

Ultimately, the market proves more powerful than government manipulation of economic events.

Central banks and the Fed are afraid of digital currencies like bitcoin because it’s the first time in history global participants have had access to a decentralized peer-to-peer payment network that’s powered by users with no central authority or middlemen. Banking cartels hate this because the Fed and other central banks control fiat currencies. Free market tools like cryptocurrencies remove central banks from their power to exert economic influence over an individual’s monetary choices. We may never understand why central bank operations can’t be voted on by global citizens and why we cannot choose our own tender.

However, understanding the history of the world’s banking cartel will allow people to understand the game has been rigged for decades by the same banking families. If we play with fiat, then like a casino, the House of Morgan will likely always win. But the fact is that a widely adopted cryptocurrency could bring the power of money back into the hands of the people, rendering the current banking system irrelevant.

What do you think about the history of modern central banking through the creation of the Federal Reserve? Do you think it is odd that global citizens have no say in monetary policy? Let us know what you think about this subject in the comments section below.

OP-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

Image credits: Shutterstock, Getty Images, Ron Paul, Wiki Commons, and Pixabay.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH, and other coins, on our market charts at Markets.Bitcoin.com, another original and free service from Bitcoin.com.

The post Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society appeared first on Bitcoin News.