Bitcoin Cash (BCH) markets started climbing this past Thursday and soared on August 18 reaching a high of $760 per BCH around 6 pm EDT. Now on August 19, the cryptocurrency has captured a $18B market cap as the BCH value has spiked higher hovering around $900 at press time.

Also read: Search Volumes for Bitcoin and Ethereum Enter Inverse Correlation

Bitcoin Cash Markets Soar

Just recently news.Bitcoin.com reported on the Bitcoin Cash network and how BCH markets were performing. At the time BCH was averaging around $550 per token and mining profitability compared to BTC flipped. Currently, according to Coin Dance statistics, BCH is 66 percent more profitable to mine than BTC making the stakes a bit more tempting for miners. Blocks are moving faster on the BCH chain, and so far 1109 have been found at a 13 percent difficulty compared to BTC. This week BCH miners found an 8MB block and the price has rallied significantly since this milestone took place.

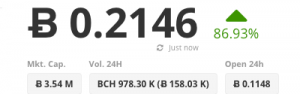

While BCH markets have been holding around the $890-930 price territory, BTC markets have slumped a bit. At press time the price per bitcoin is $3960 as it dropped 7 percent during the August 18 overnight. Interestingly enough if holders of both tokens added the values together, it would be roughly $4600-4800 for people still holding 1:1, and this hasn’t changed much, even when BCH was hovering at $300. Currently using Crypto Compare’s price index the Relative Strength Index (RSI) is heading south and this shows the coin seems to be overbought. In time this may lead to some more price lag and buyer exhaustion. However, The short-term Simple Moving Average (SMA) is well above the long-term SMA showing BCH bulls may still have some steam left in their engines.

Korean Won Volume Eclipses Most BCH Trading Pairs

Market sentiment may be partly due to the recent Segwit2x fiasco between the Core development team. As soon as the public got wind that Core developers would ultimately oppose a 2MB hard fork, and after the drama between Bitpay, BCH markets began to soar. A few speculators believe some Segwit2x supporters are holding BCH as a sort of “lifeboat” plan, just in case the second half of the New York Agreement falls apart.

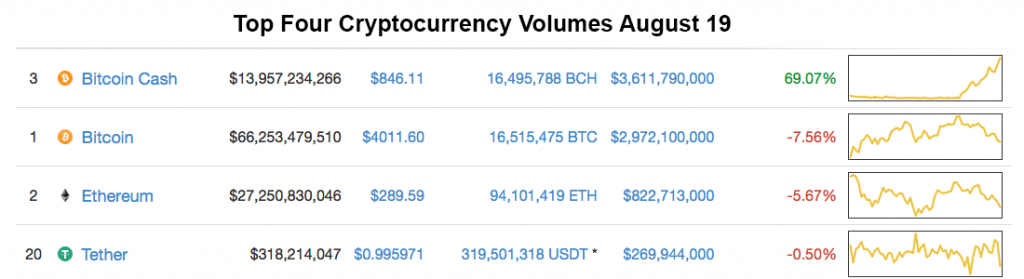

Lastly, much of the BCH market action has been stemming from South Korean exchanges like Bithumb, Coinone, and Korbit. Over $1.5B in BCH trading came from won pairs, and the digital currency swapped over $3B worth of currencies on Friday. On Saturday South Korean BCH prices are trading at a premium of $1100 at press time. During certain periods of the past two days, BCH trade volumes met parity and then surpassed BTC trade volume. BCH markets on August 19 are now commanding a $3.6B trade volume and has eclipsed bitcoin’s $2.9B. Alongside the Korean market push, large BCH volumes are also coming from exchanges like Bitfinex, Poloniex, Kraken, and Bittrex as well.

Images courtesy of Shutterstock, Coinmarketcap, and Crypto Compare.

Need to calculate your bitcoin holdings? Check our tools section.