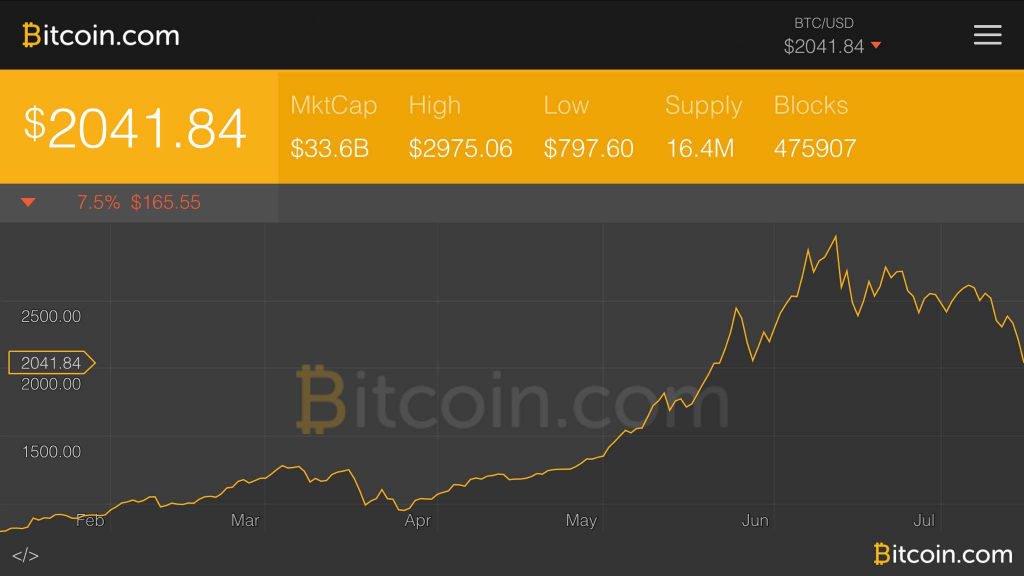

This week the price of bitcoin has been descending downwards following a bearish trendline and is currently hovering just around the US$2000 range. The price started its downtrend on July 10 after staying around the $2550 territory for a few days, but subsequently started dropping to a low of $2225 on July 14. At press time the price of BTC is struggling to stay above $2K, and current technical indicators are showing the bear run may not be over.

Also read: August 1 and the Potential Disruption of the Bitcoin Network

Fear Uncertainty and Doubt Plagues Cryptocurrency Markets

It’s been a pretty grueling week if you’ve been watching cryptocurrency markets, as bitcoin and various altcoins have drastically corrected in value. On July 14 bitcoin’s price formed some new lows dipping to the $2225 range forming a downwards triangular pattern. Over the course of the day and into the overnight the price per BTC continued to slide until finally subsiding to just above the $2K mark. The decentralized currency’s total market capitalization is now only $33 billion, but due to the significant drop in altcoin markets, BTC dominance is up to 46 percent. Bitcoin trade volume is seeing mediocre activity compared to weeks prior at roughly $1 billion USD worth of trading per day.

BTC/USD Technical Indicators

Technical indicators show that traders have allowed bears to reign over the market and the ball is in their court now. At press time the long term 200 Simple Moving Average (SMA) is well above the 100 SMA, pointing to continued market losses. The Relative Strength Index (RSI) has dropped pretty low since July 12 indicating the beginning of the seller’s market takeover. Further stochastic indicators are also signaling bearish conditions and those shorting the market may be able to set some downside targets. However, at the time of writing, there is a significant foundation at the $1950-2K range and the price may hover in this vicinity for a few more hours.

Market Sentiment: Upcoming Protocol Changes Has Likely Created Weak Hands

The bearish market sentiment is likely due to the protocol changes planned for the end of the month. There have been many discussions on the various scenarios where the bitcoin blockchain could split on August 1. Many bitcoiners are patiently waiting to see if the storm passes, but no one knows exactly how things will play out between UASF, UAHF, and Segwit2x. Some bitcoin proponents are fairly positive that Segwit will be implemented soon and the August 1 scenarios may not happen. Other bitcoin enthusiasts are waiting for the next Segwit2x release that is expected to come out this weekend, according to Jeff Garzik. When this happens, the vast majority of miners signaling support for Segwit2x will actually start running the code.

The uncertainty tied to the bitcoin ecosystem is likely affecting altcoins markets as well. Just like Crypto Compare’s Charles Hayter told us last week, “a rising tide lifts all boats, but the opposite is also true.”

Waiting on the Sidelines for the Perfect Entry Point

Overall bitcoiners are either not happy about the price drop or enthusiastically detailing they are buying the dip. It’s safe to assume as the next two weeks get closer, there will be some volatile action for intra-range players to profit off scalps and breaks. Some traders are speculating that Segwit will be activated soon and the price will reverse back up the ladder. Other traders are envisioning a continued drop to the $1800 territory and a possible following rise after that low price point. One thing is for sure is that traders are uncertain right now and the bulls have stepped off to the sidelines for a lower price entry.

Bear Scenario: If bitcoin breaks the key resistance range below $2K we will see lower trajectories towards the $1800-1900s. At press time according to order books and depth readings, there is a solid foundation within the $1800-2000 territory that should certainly last for the next few days. These critical zones, however, can cause quite a bit of fear and uncertainty which can always spark the possibility of more intensified panic selling.

Bull Scenario: If buy pressure picks up after consolidating above the $2K range we could see some nice recovery over the next 24-hours. Sell walls are pretty flat at the moment, and the price could break higher with ease if bullish traders decide to jump back in the game. However, it seems most buyers are waiting for a lower price trajectory and are assuming this will happen with the current looming possibility of a chain split. Another bullish theory that could take place is; Segwit gets activated within the next two weeks, and the price climbs upwards following this event.

Where do you see the price of bitcoin going from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitcoin.com, and Bitstamp.

Need to calculate your bitcoin holdings? Check our tools section.