Cryptocurrencies were mostly lower on Monday, although market conditions have stabilized following the weekend sell-off. Bitcoin was trading above its 200-day moving average (currently at $46,386), which suggests selling pressure could wane over the short term.

Analysts pointed out that excess leverage in the bitcoin futures market contributed to the broad sell-off. And despite room for a short-term price bounce, some analysts remain cautious about bitcoin’s price direction over the next few weeks.

“The previous two times that BTC challenged the 200-day moving average served as good buying opportunities, as the market remained structurally bullish but was simply over-leveraged.” Sean Farrell, a digital strategist at Fundstrat Global Advisors, wrote in a newsletter.

Latest Prices

- Bitcoin (BTC): $48,954, +0.5%

- Ether (ETH): $4,226, +2.7%

- S&P 500: +1.2%

- Gold: $1,779, -0.2%

- 10-year Treasury yield closed at 1.443%

“It must be noted, though, that one of the key bitcoin bull market indicators – the 20-week simple moving average – has now been decisively breached so the outlook is currently bearish in the short to medium term,” Anto Paroian, chief operating officer at crypto hedge fund ARK36, wrote in an email to CoinDesk.

“The violent price move in the digital asset market may also suggest that some investors are preparing to go into a risk-off mode for the time being,” Paroian wrote.

Still, it appears that some investors are comfortable with rotating back into speculative assets. For example, traditional equities stabilized on Monday as volatility declined. And in crypto markets, alternative coins such as ether, Polygon’s MATIC token and Solana’s SOL token have outperformed bitcoin over the past week, suggesting investors’ greater appetite for risk.

Extreme liquidation

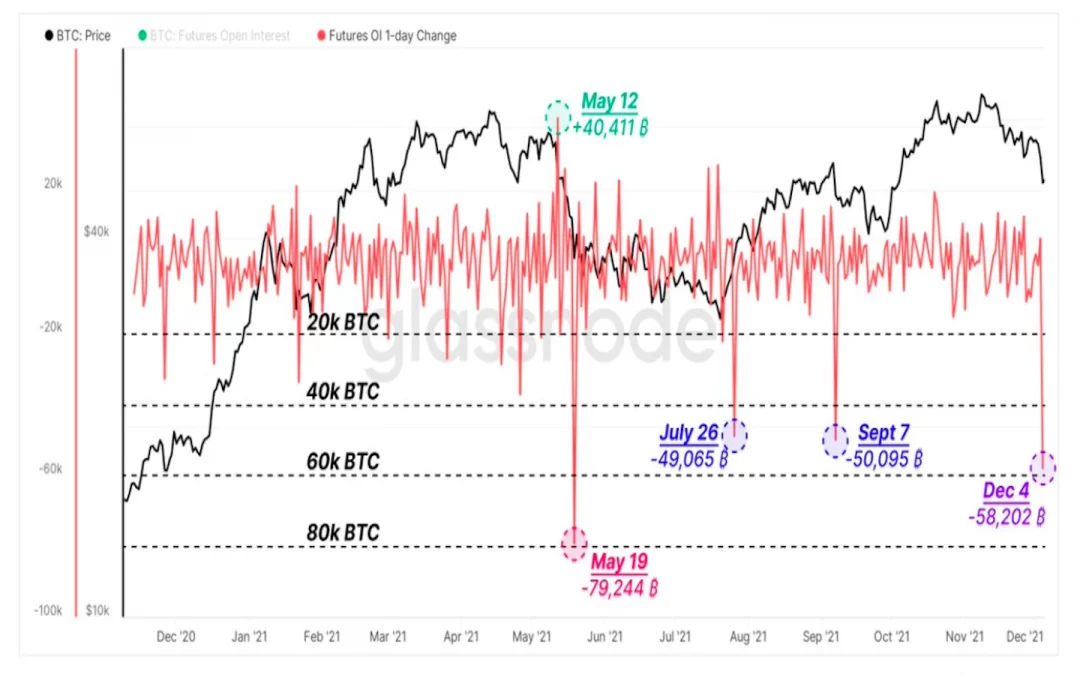

The chart below shows the largest one-day decline in BTC futures open interest since Sept. 7. And blockchain data suggests the sell-off accelerated as the BTC price dipped below break-even levels (cost basis) for many traders holding long positions.

“Bitcoin short term holders’ cost basis was sitting at $53K, and once we broke through that level, there was another big leg down,” Martha Reyes, head of research at digital asset prime brokerage and exchange BEQUANT.io, said.

Bitcoin drawdown

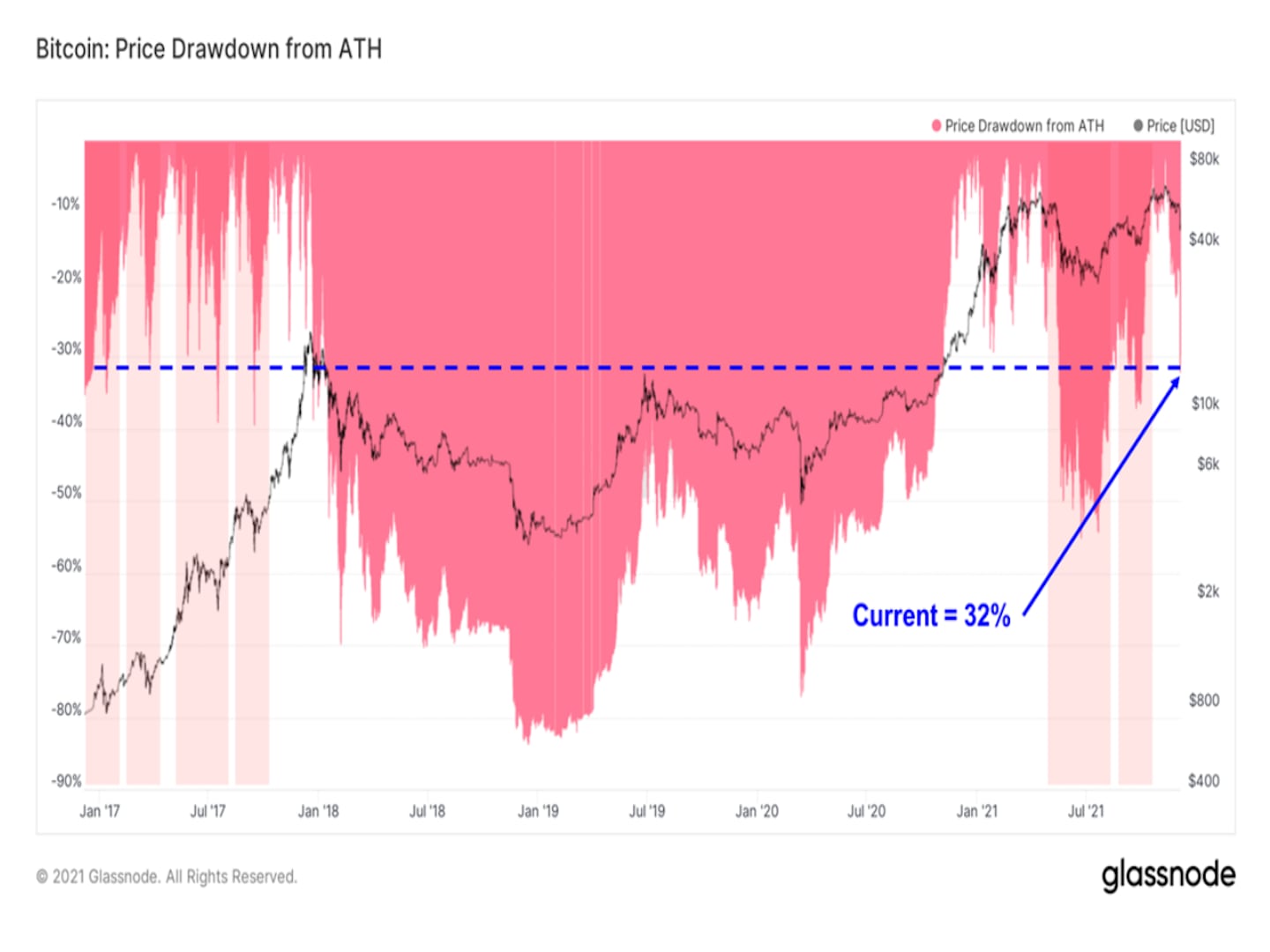

Bitcoin has dropped nearly 30% from its all-time price of around $69,000, which is the largest drawdown (percent decline from peak to trough) since September. Typically, bitcoin experiences sharp drawdowns between 10%-20% even in a bull market. In a bear market, however, drawdowns can extend well beyond 30%, and the price can take several months to recover.

Altcoin roundup

- Polygon attracts fundraising attention from Sequoia, Steadview: A group of venture capital investors including Sequoia Capital India and Steadview Capital are in talks to back Ethereum-scaling network Polygon with an investment of between $50 million and $150 million, CoinDesk’s Jamie Crawley reported. The investment would reportedly take the form of a purchase of MATIC tokens, the cryptocurrency that powers the Polygon network. Polygon is a “sidechain” that aims to solve the scalability problems associated with the Ethereum network, which has suffered from congestion and high fees.

- Metaverse tokens plummet amid broader crypto market sell-off: Decentraland (MANA), the top-ranking metaverse asset according to the cryptocurrency analysis firm Messari, is down 25% in the last seven days, CoinDesk’s Lyllah Ledesma reported . MANA’s drop is followed closely by Axie Infinity’s AXS token, which is down 23% in the last seven days. The AXS market cap stands at $6.21 billion. It had reached a high of $9.77 billion on Nov. 7, according to CoinMarketCap. Matthew Dibb, Stack Funds’ chief operating officer and co-founder, said that while the future of the metaverse and gaming tokens looks bright, there is very little real adoption in the present.

- CoinDesk 20 gains $ATOM, $SOL and $ICP, replacing $UNI, $AAVE and $GRT: Cosmos’ Atom, Solana’s native currency and Internet Computer (formerly Dfinity) all entered the CoinDesk 20 in this quarter’s reconstitution, in a shift where Web 3 software platforms, tools and infrastructure replaced decentralized finance (DeFi) and DeFi-related applications as among the most-traded currencies in crypto. The CoinDesk 20 is a list of the top 20 cryptocurrencies by trading volume, as measured on a select list of trusted exchanges.

Relevant News

- CME Group Introduces Micro Ether Futures

- BitMart CEO Says Stolen Private Key Behind $196M Hack

- Crypto Mining Stocks Extend Declines as Bitcoin, Ether Prices Fall

- Craig Wright Found Not Liable for Breach of Kleiman Business Partnership

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polygon (MATIC), +10.3%

- EOS (EOS), +8.1%

Notable losers:

- Algorand (ALGO), -3.1%

- Chainlink(LINK), -1.4%