Bitcoin dipped below $43,000 on Thursday, suggesting a slowdown in buying activity.

The cryptocurrency’s price is roughly flat over the past week, compared to a 3% decline in ether. Price movements among some alternative cryptocurrencies (altcoins) have been choppy over the past week, especially relative to BTC, which could reflect some uncertainty among traders.

“It seems that many have been hedging and decreasing exposure to crypto in recent weeks in anticipation of [the U.S. consumer price index] releasing on Wednesday, who are now having to buy back,” Marcus Sotiriou, an analyst at the U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk. Still, some buyers have been missing in action, at least over the past 24 hours.

Regulatory developments could have soured the mood among crypto traders. On Thursday, local media reported the government of Pakistan and its central bank want to ban the use of cryptocurrencies. The submission is the first time a clear position has been taken by the country’s central bank.

For now, bitcoin is stuck between $40,000 support and $44,000 resistance, according to technical analysis.

Latest prices

●Bitcoin (BTC): $42712, −2.69%

●Ether (ETH): $3270, −3.33%

●S&P 500 daily close: $4659, −1.42%

●Gold: $1821 per troy ounce, −0.32%

●Ten-year Treasury yield daily close: 1.71%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Mixed sentiment among option traders

The bitcoin options market assigns a roughly 70% probability that BTC will trade above $35,000 in March, according to crypto data provider Skew. That expectation aligns with the current range of technical support around the $40,000 price level, so long as buyers are able to sustain short-term momentum.

Sentiment among options traders appears to be mixed, judging by recent order placements.

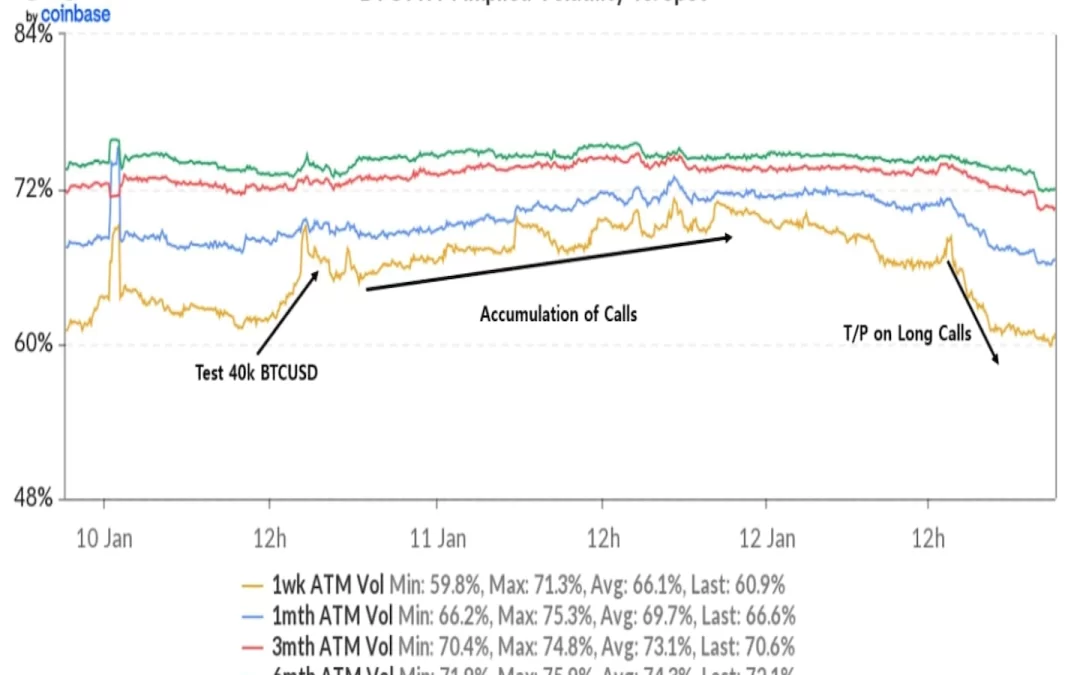

“A sharp options player who had bought 42,000 January BTC calls started taking profit on those around the $44,000 spot BTC level, naturally creating some resistance there,” crypto trading firm QCP Capital wrote in a Telegram announcement.

“We think option activity will increasingly dictate spot movements as the option market continues to grow,” QCP wrote.

The firm also noted the collapse in the front end of the BTC option volatility curve, which was not consistent with the recent price bounce. For now, the decline in volatility suggests choppy price action could persist, especially given macroeconomic uncertainty this year, according to QCP.

Watch bitcoin funding rates

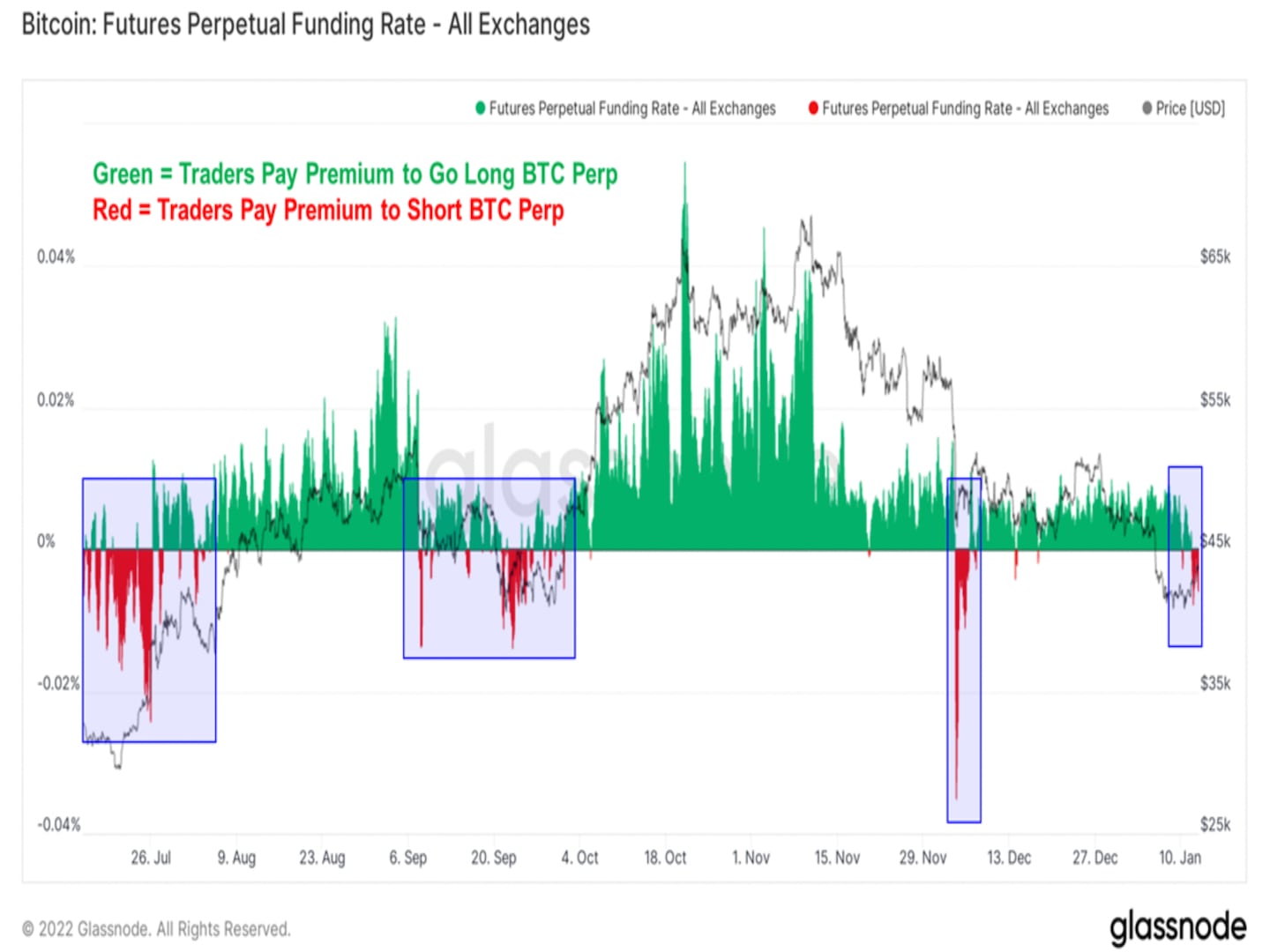

Analysts are also monitoring bitcoin’s average funding rate, or the cost of holding long positions in perpetual futures listed on major exchanges. Funding rates can signal the level of conviction among traders who are positioned for an upside or downside in price.

“When funding rates are positive (green), traders are paying a premium for a counterparty to take the short side of the trade. When funding rates are negative (red), traders are paying a counterparty a premium to take the long side of the trade,” Sean Farrell, head of digital asset strategy at FundStrat, wrote in a report.

If the current negative reading persists for a few more days, it could signal that BTC sellers will start to exit positions, according to Farrell.

Altcoin roundup

- Solana led gains after BofA endorsement but soon fell back: The move came after Bank of America said in a research note the Solana protocol’s low fees and high transaction speeds made it the “Visa of the digital asset ecosystem.” It could even usurp Ethereum’s current position as a leader among smart contract-enabled blockchains. Visa, on the other hand, wants to be a player in crypto, too. It sees itself as a building bridge between the fiat world and crypto, and even within the crypto world. Read more here.

- Near Raises $150M From Major Crypto Investment Firms: Near’s latest raise brings some of the space’s highest-profile investors into the fold as the network gears up for a major DeFi push. Su Zhu’s Three Arrows Capital led the $150 million funding run, with participation from major crypto-focused funds including Mechanism Capital, Dragonfly Capital, Andreessen Horowitz (a16z), Jump, Alameda, Zee Prime and Amber Group, among others. Read more here.

- DeFi Alliance Becomes ‘Alliance DAO’: DeFi Alliance, the incubator of platforms ranging from Sushi to Olympus DAO, rebranded itself as “Alliance DAO” Thursday. A who’s who of crypto investors, executives, non-fungible token (NFT) bulls – and even boxer Jake Paul – backed the self-styled “digital startup nation.” Some 300 contributors provided the funding, according to project founder Imran Khan, ranging from Libra co-creator Morgan Beller to OpenSea’s Devin Finzer, according to Danny Nelson. Read more here.

Relevant news

- Ex-CFTC Chair Chris Giancarlo Joins CoinFund as Policy Adviser

- Gemini Acquires Crypto Asset Management Platform Bitria; Terms Undisclosed

- Bitcoin Miner Rhodium’s Planned IPO Values It at Up to $796M

- Allbridge Raises $2M to Expand Cross-Chain Token Bridge

- Seashell Emerges From Stealth Mode With ‘Inflation-Resistant’ High-Yield Savings Accounts

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Largest winners:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Dogecoin | DOGE | +4.0% | Currency |

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Algorand | ALGO | −7.6% | Smart Contract Platform |

| Cosmos | ATOM | −7.1% | Smart Contract Platform |

| Chainlink | LINK | −6.8% | Computing |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.