Bitcoin traded lower on Monday after buyers failed to sustain a weekend rally toward $60,000. The cryptocurrency was trading at around $56,000 at press time and is down about 5% over the past 24 hours.

Equities and cryptocurrencies initially ticked higher earlier during New York trading hours after U.S. President Joe Biden said he will renominate Federal Reserve Chairman Jerome Powell, following some speculation that Fed Governor Lael Brainard could replace Powell to lead the central bank for the next four years.

For now, some analysts view the current pullback in cryptocurrencies as a normal occurrence after a strong rally over the past month.

“With bitcoin and other crypto assets having reached fresh all-time highs, there was always likely to be a measure of profit-taking from investors, which then translates into price weakness,” Simon Peters, an analyst at eToro, wrote in an email to CoinDesk.

Latest Prices

- Bitcoin (BTC): $55,898, -6.17%

- Ether (ETH): $4,065, -7.19%

- S&P 500: $4,682, -0.32%

- Gold: $1,804, -2.14%

- 10-year Treasury yield closed at 1.62%

As bitcoin buyers take some profits, equities appear to be holding up. The S&P 500 is up about 4% over the past month, compared with a 7% decline in BTC over the same period.

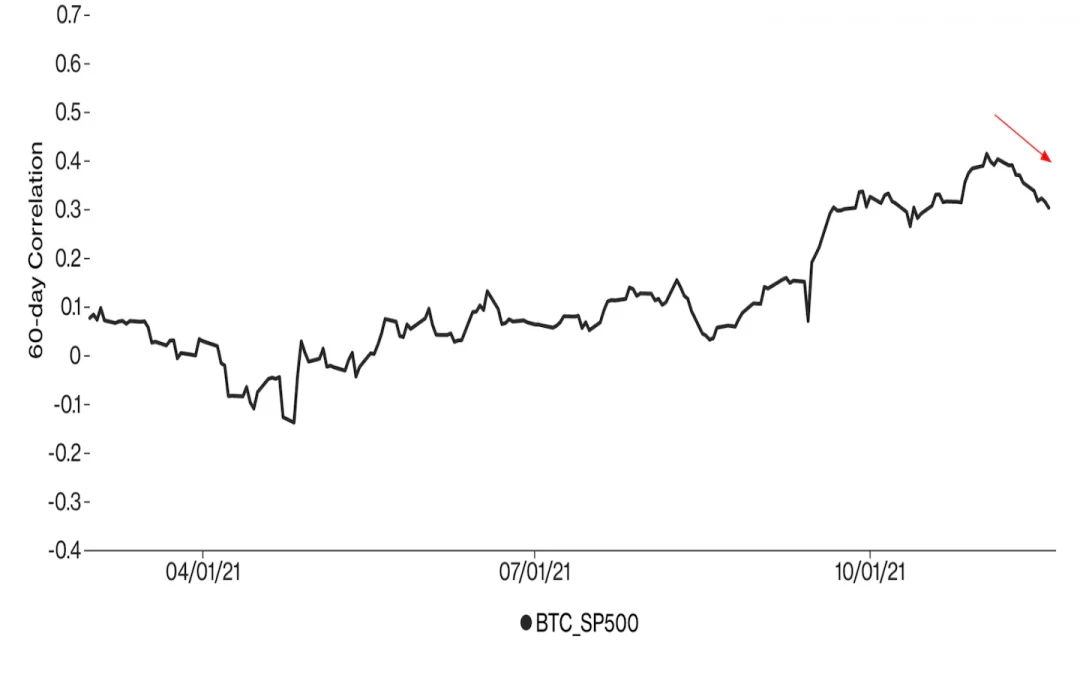

The chart below shows the recent decline in the 60-day correlation between bitcoin and the S&P 500. The short-term disconnect between the cryptocurrency and the stock index suggests that investors still have an appetite for risk even as some have reduced exposure to crypto.

Bitcoin funds attract fresh capital

Digital asset investment products saw inflows of $154 million last week despite the recent sell-off across cryptocurrencies. The rise in fund inflows reflects strong investor appetite for crypto exposure.

The recent futures-based bitcoin exchange-traded fund launches in the U.S. accounted for 90% of inflows into bitcoin products last week, according to a report by CoinShares.

Ethereum investment products saw inflows of $14 million last week, marking their fourth consecutive week of inflows. Other alternative cryptocurrency products, such as cardano, saw minor outflows last week.

Altcoin roundup

- Shiba Inu slips in Coinbase volume rankings: SHIB accounted for 6.72% of the total volume on the crypto exchange, slipping to the third position behind bitcoin and ether, Coinbase Institutional’s weekly email dated Friday shows.

- Metaverse gaming, NFTs could account for 10% of luxury market by 2030: Morgan Stanley notes that luxury brands are already exploring collaborations with gaming and metaverse platforms, with an increasing number of revenue sharing deals, and that could add $10 billion-$20 billion to the luxury sector’s total addressable market, CoinDesk’s Will Canny reported.

- Algorand project raises $3.6M: C3 Protocol, a cryptocurrency trading project linked to the Algorand blockchain, raised $3.6 million in a funding round that was led by Arrington Capital and Jump Capital, CoinDesk’s Ian Allison reported. Algorand’s ALGO token is down about 6% over the past month, compared with a 7% decline in BTC and a 1% rise in ETH over the same period.

Relevant News

- Biden Renominates Powell as Fed Chair, Appoints Brainard Vice Chair

- El Salvador to Create ‘Bitcoin City,’ Use $500M of Planned $1B Bond Offering to Buy More Crypto

- ProShares Bitcoin Futures ETF Wins ‘First Mover Advantage’ as VanEck Launch Falls Flat

- Morgan Stanley Sees Facebook as Best Stock to Gain Exposure to the Metaverse

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable losers as of 21:00 UTC (4:00 p.m. ET):

- The Graph (GRT), -8.61%

- Litecoin (LTC), -8.35%

- Chainlink (LINK), -8.35%