Bitcoin has traded in a tight range over the past few days. It appears that extreme bullish sentiment is starting to cool after BTC reached its all-time high of around $66,900 two weeks ago. For now, traders are gearing up for a strong November and expect positive crypto returns heading into the end of the year.

Still, some analysts see room for a slight pullback as open interest rises in the bitcoin futures market. “[Rising open interest] is typically a bearish signal as it means there is more leverage in the system – this increases the chance of a liquidation event where traders are forced to sell and the price cascades lower,” Marcus Sotiriou, a sales trader at U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk.

“Aside from open interest, the euphoria seen from the rise in meme coins last week, notably SHIB, could contribute to a leverage flush in the short term, due to the increase in retail traders,” Sotiriou wrote.

In observance of the U.S. Election Day, a CoinDesk company holiday, Market Wrap will not be published on Tuesday.

Latest Prices

- Bitcoin (BTC): $61,135.37, +0.55%

- Ether (ETH): 4,355.40, +2.38%

- S&P 500: 4,613.67, +0.18%

- Gold: 1,793.47, +0.74%

- 10-year Treasury yield closed at 1.56%

Seasonal strength for bitcoin

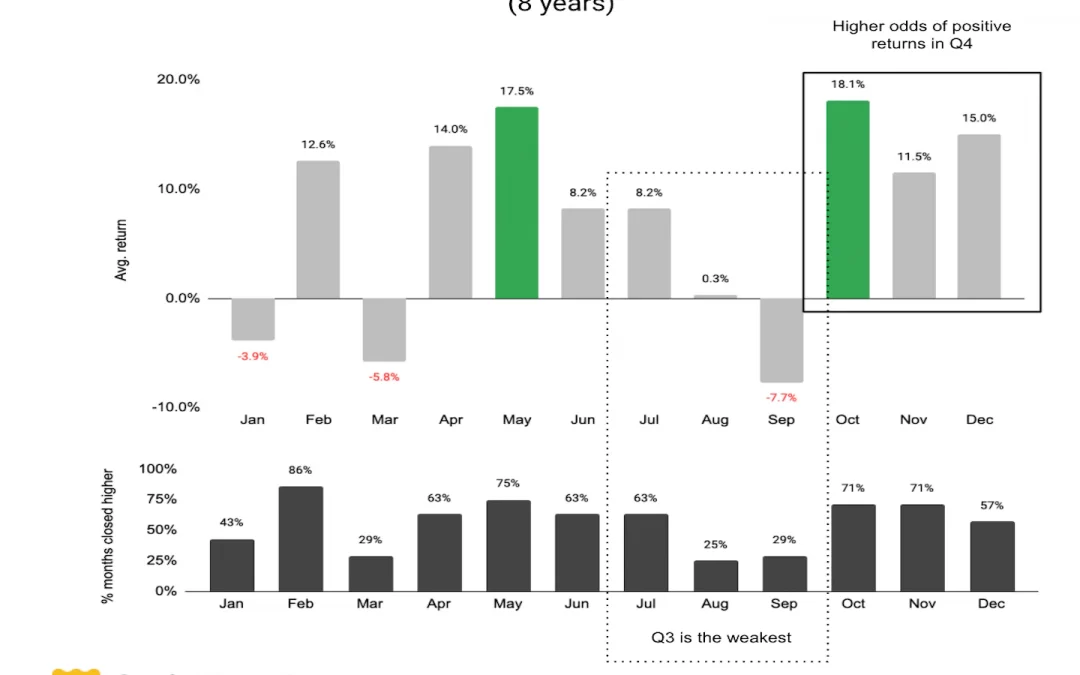

Bitcoin tends to gain 11%-18% in the fourth quarter, which is one reason why some analysts have maintained their bullish outlook on crypto prices for the remainder of the year. It appears that BTC has followed a seasonal pattern with a sell-off earlier this year and a volatile September, although the downside was limited as traders entered to buy on dips.

Despite wild price swings, bitcoin’s long-term uptrend remains intact. And generally, analysts view cryptocurrencies as an early-stage investment. “Crypto is still under-owned and there is still a large knowledge gap,” but the industry is rapidly gaining traction among professional investors, crypto trading firm QCP Capital wrote in a Telegram chat.

Bullish Tuesdays

Here is another interesting stat for traders. CoinDesk Research analyzed bitcoin’s average daily returns since 2010 and found that Tuesday is the most bullish day of the week, followed by Wednesday.

Crypto fund inflows slow

Digital asset investment products saw a total of $288 million in inflows during the week ended last Friday, a report Monday by CoinShares showed. That’s down from a record $1.47 billion during the prior week, but it helped to push inflows to $8.7 billion year to date.

As in the previous week, the majority of new investments went into bitcoin-related funds, at about $269 million.

The decrease in flows coincided with a market pause as bitcoin (BTC) hit its all-time high of $66,974 on Oct. 20 but retreated last week.

Meme tokens rallied in October

Popular meme tokens saw large gains in October as cryptocurrency market sentiment improved, CoinDesk’s Lyllah Ledesma reported. The dog-themed coin SHIB’s 765% gain in October made it the month’s top-performing cryptocurrency among those with a reported market capitalization of at least $10 billion.

And last Thursday, dogecoin reached its highest level since Aug. 20, trading near $0.30. It finished the month with a market cap of $36 billion.

Within the CoinDesk 20, a group of 20 curated digital assets, the top performing coins in October were Polygyon’s MATIC, which climbed 56%; Polkadot’s DOT, up 36%; and Ethereum’s ether (ETH), which rose by 30%.

Altcoin roundup

- Avalanche developers and investors form $200 million investment fund: A group of former Ava Labs and Avalanche Foundation staff has launched “Blizzard,” an AVAX-focused venture capital and incubation fund, CoinDesk’s Andrew Thurman reported. The fund raised $200 million in an initial seed investment that included participation from the Avalanche Foundation, Ava Labs and Polychain Capital, among others. The fund will invest in early-stage projects across the Avalanche ecosystem, including decentralized finance, non-fungible tokens, social tokens and more.

- DeFi startup Notional launches V2 upgrade: Fixed-rate cryptocurrency lending startup Notional has launched its V2 upgrade in an effort to boost its decentralized finance (DeFi) presence, CoinDesk’s Eli Tan reported. The company said the new iteration of its platform has improved security and liquidity. Notional, which closed a $10 million Series A funding round in April, offers fixed-rate debt using an on-chain automated market maker (AMM) to let users borrow USD coin (USDC) and DAI for up to one year and bitcoin (wBTC) and ether (ETH) for up to six months.

- SQUID token developers leave the project after token crashes: The developers behind a play-to-earn token SQUID inspired by Netflix’s show “Squid Game” have left the project after the price crashed to nearly zero, CoinDesk’s Muyao Shen reported. The project gained instant popularity after its release and rose by more than 35,000% in just three days despite several red flags. At press time, the project’s official website and its account on Medium were down and the account was temporarily restricted by Twitter for “unusual activity.”

Relevant News

- Binance Temporarily Disables All Crypto Withdrawals, Cites Backlog

- NFT Platform OneOf Signs 3-Year Deal With Grammys

- Genesis Digital Expands in US With 300MW Bitcoin Mining Facility in Texas

- November Is Crypto Literacy Month

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polkadot (DOT): +16%

- Chainlink (LINK): +5.25%

- Aave (AAVE): +4.36%

- Uniswap (UNI): +4.2%

Notable losers:

- The Graph (GRT): -1.57%

- Bitcoin Cash (BCH): -1.53%

- Stellar (XLM): -1.05%