Bitcoin experienced sharp price swings on Wednesday along with most traditional assets. The spotlight was on the U.S. Federal Reserve, which stated at the conclusion of its two-day meeting that it will “soon be appropriate to raise the target range for the federal funds rate.”

The latest Fed decision comes as the central bank has been winding down its asset-purchasing program. Monetary stimulus has been an important source of market support, which underpinned the rise in both equities and cryptocurrencies over the past year.

BTC reversed earlier gains shortly after the Fed announcement on Wednesday. Analysts remain skeptical, noting the recent bounce occurred on low conviction among buyers.

“Short-positioned traders are dominating the derivative market. This indicates that bitcoin’s bounce was driven by [the spot market] rather than derivatives, which is confluent with the significant bidding seen on Coinbase,” Marcus Sotiriou, analyst at the UK-based digital asset broker GlobalBlock, wrote in an email to CoinDesk.

Latest prices

●Bitcoin (BTC): $37154, +0.90%

●Ether (ETH): $2530, +3.76%

●S&P 500 daily close: $4350, −0.15%

●Gold: $1818 per troy ounce, −1.88%

●Ten-year Treasury yield daily close: 1.85%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Bitcoin options activity

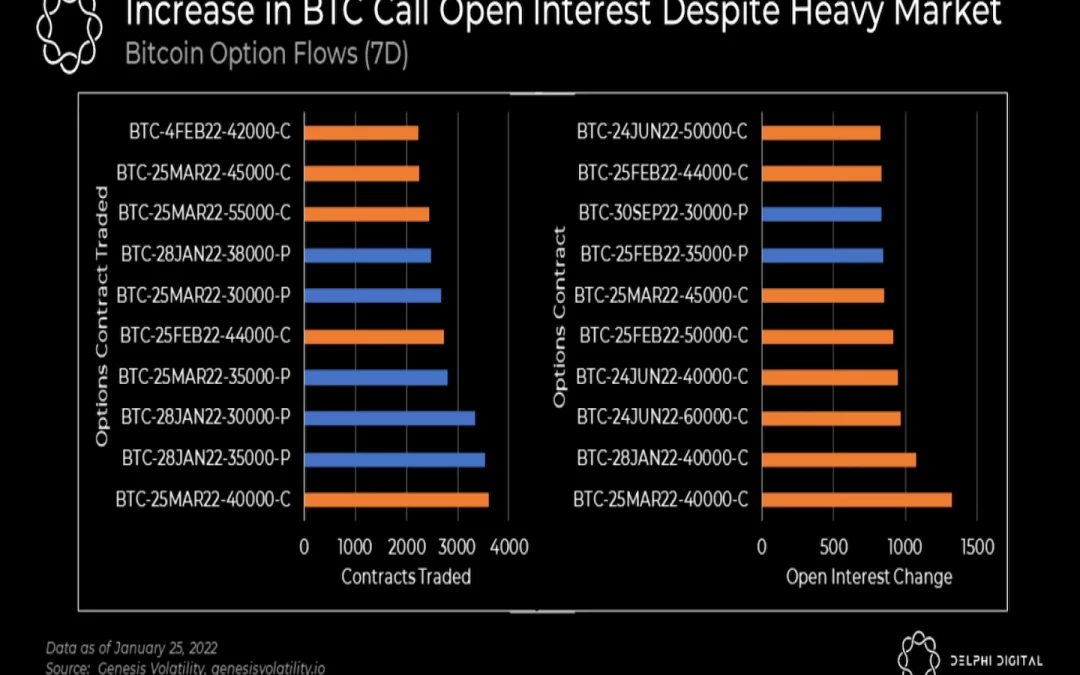

Analysts have noticed bearish positioning among bitcoin option traders, which indicates a high level of uncertainty around current price levels. For example, data from Genesis Volatility shows that retail option traders have been net-short March $40,000 BTC calls and net-long March $35K puts – a bearish trade.

On a more positive note, BTC also saw a large increase in call open interest and volume led by the March $40,000 strike price, which is bullish. Further, large institutional traders have been taking the opposite side of bearish option trades, according to a blog post by Delphi Digital.

Overall, mixed views among option traders could point to higher volatility, especially over the next two months.

Altcoin roundup

- Dogecoin leads gains among major cryptos: Prices of BTC, ETH and other major cryptocurrencies rose as much as 7% shortly before New York trading hours, with meme coin dogecoin (DOGE) leading gains among the biggest assets by market capitalization. DOGE eventually pulled back toward $0.14 and is down 9% over the past week.

- Fake Grimacecoin jumped 285,000% after McDonald’s’ Tesla joke: “Only if Tesla accepts grimacecoin,” McDonald’s said on Wednesday morning, referencing its purple mascot fashioned after a taste bud. That tweet was in response to Tesla CEO Elon Musk’s tweet on Tuesday, “I will eat a happy meal on TV if McDonald’s accepts Dogecoin.” The tweet triggered the creation of nearly 10 grimacecoins on the Binance Smart Chain (BSC) network alone. Read more here.

- Wonderland’s TIME sets low of $420 after liquidation cascade: TIME has lost 95% of its value from its November peak of $10,000, becoming one of the worst-performing cryptocurrencies in the past few months. Theories in crypto circles behind the sell-off included Wonderland developers selling part of their holdings, and the unwinding of positions of overleveraged traders, according to CoinDesk’s Shaurya Malwa. Read more here.

Relevant news

- Fed Keeps Interest Rates at Zero, Says Hike Appropriate ‘Soon’

- How Bitcoin Contributions Funded a $1.4M Solar Installation in Zimbabwe

- Money Laundering Picks Up Steam on DeFi Protocols: Chainalysis

- Coinbase Shares Are Very Unattractive Heading Into First Half, Mizuho Securities Says

- Valkyrie Applies to List Bitcoin Miners ETF on Nasdaq

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Largest gainers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Filecoin | FIL | +9.7% | Computing |

| Polygon | MATIC | +6.2% | Smart Contract Platform |

| Cardano | ADA | +5.7% | Smart Contract Platform |

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Cosmos | ATOM | −7.2% | Smart Contract Platform |

| Internet Computer | ICP | −0.7% | Computing |

| Polkadot | DOT | −0.4% | Smart Contract Platform |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.