Bitcoin’s rally faded on Tuesday, suggesting that buyers took some profits around the $68,500 all-time price high.

The cryptocurrency is up about 5% over the past week, compared to a 3% rise in ether over the same period.

Despite a short-term pullback, some analysts are maintaining upward price targets for both BTC and ETH over the next month.

“There is a positive sentiment that often engulfs the crypto markets toward year’s end,” Galina Likhitskaya, vice president at smart contract audit company HashEx, wrote in an email to CoinDesk. Likhitskaya has a price target around $80,000 for BTC by the end of the year, and a $5,500 target for ETH during the same period. ETH is currently at $4,777.

“Analysts are suggesting $75,000 as a target on the upside, but if the price takes a turn downwards the price could fall to the 50-day moving average at around $56,000,” Jonas Luethy, a trader at the U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk.

Latest prices

- Bitcoin (BTC): $67,375, +1.93%

- Ether (ETH): $4,777, +0.32%

- S&P 500: $4,685, -0.35%

- Gold: $1,832, +0.42%

- 10-year Treasury yield closed at 1.43%

Trading BTC relative to ETH

“Bitcoin is oversold versus ether, and likely to see short-term outperformance as cryptocurrencies digest their gains in a consolidation phase,” Katie Stockton, managing partner at Fairlead Strategies, wrote in a research report.

“The uptick to multi-day highs in BTC/ETH likely signals a switch to better relative outperformance in bitcoin to ethereum, but more is needed to confirm this move,” Mark Newton, head of technical strategy at FundStrat wrote in a research report.

Overall, analysts agree that BTC’s breakout to an all-time high could signal the start of a final leg higher this quarter. However, cryptocurrencies could see a “more pronounced consolidation into next year,” Newton wrote.

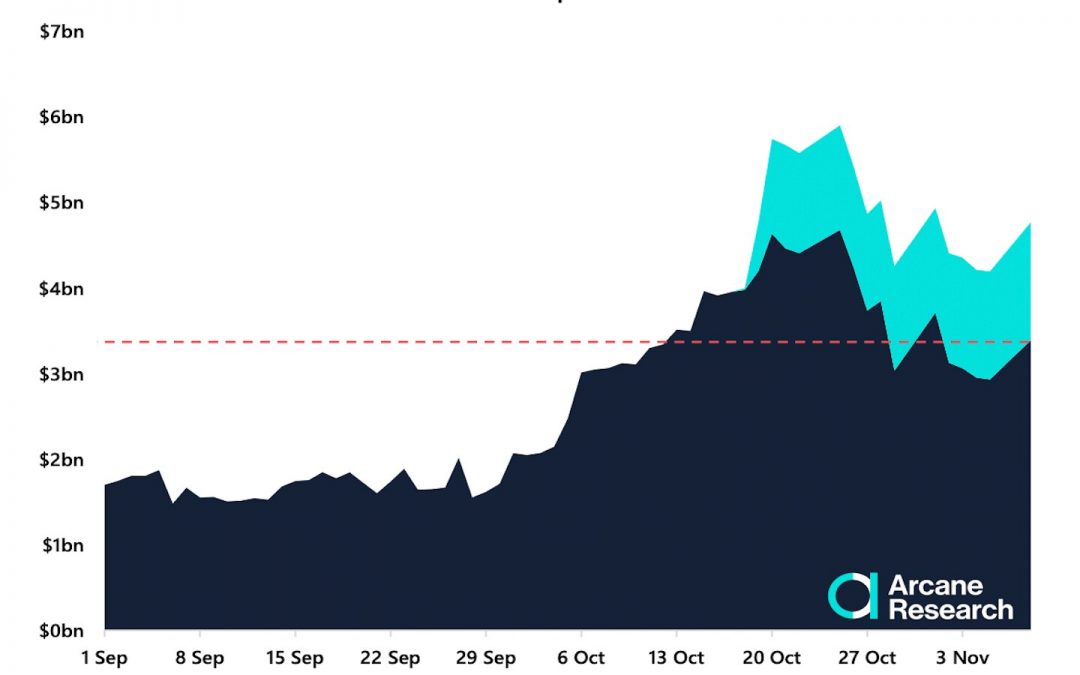

Decline in CME bitcoin futures open interest

The number of open contracts on the Chicago Mercantile Exchange (CME) is down 32% from its Oct. 25 peak, which could indicate reduced institutional presence in the bitcoin futures market at the moment, according to Arcane Research.

The surge in bitcoin futures open interest, or total number of outstanding derivative contracts, over the past month coincided with the launch of the first bitcoin futures-based exchange-traded fund (ETF) introduced by ProShares, trading under the ticker BITO. “Now, the open interest has declined substantially, particularly when subtracting the BITO contribution,” Arcane wrote in a research report.

Some analysts expect recent market hype surrounding ETFs to fade, at least until a spot bitcoin ETF is approved sometime next year.

So far, BITO has lagged behind BTC’s price rally since inception. The ETF launch contributed to bitcoin’s previous all-time price high around $66,900 on Oct. 20.

Crypto fund flows rise

Digital asset products saw inflows totaling $174 million last week, bringing year-to-date (YTD) inflows to $8.9 billion. This is a significant increase from the $6.7 billion pumped into digital assets in 2020.

Total assets under management (AUM) have also reached an all-time high of $80 billion, with bitcoin and ether leading the chart with roughly $53 billion and $20 billion, respectively.

Inflows in bitcoin-focused funds totaled $95 million last week, with a year-to-date record of $6.4 billion invested in the largest cryptocurrency by market capitalization. Meanwhile, funds focused on ether saw inflows of $31 million last week.

Altcoin roundup

- Neon Labs raises $40 million to bring EVM functionality to Solana: Neon Labs announced a $40 million fundraising round led by Jump Capital with participation from IDEO CoLab Ventures, Solana Capital, Three Arrows Capital and others, CoinDesk’s Andrew Thurman reported. Neon Labs is the developer of Neon, a software environment on Solana that lets developers build applications using Ethereum Virtual Machine (EVM) and allows them to write smart contracts in familiar coding languages and use tools like wallet interface MetaMask. The project aims to bring Ethereum’s computation engine to Solana.

- Ripple to launch liquidity service for six cryptocurrencies: Fintech firm Ripple will launch a product called the “Ripple Liquidity Hub” to give business customers access to the BTC, ETH, LTC, ETC and BCH cryptocurrencies and Ripple’s native coin XRP, CoinDesk’s Ian Allison reported. The Ripple Liquidity Hub will use smart order routing to find digital assets at the best prices, with Coinme joining as the first partner. Down the road, Ripple plans to add features such as support for staking and yield-generating functions as well as getting liquidity from decentralized exchanges, RippleNet General Manager Asheesh Birla said.

- Solana’s growth strategy is going mobile: Top brass at Solana Labs, which builds on the proof-of-stake ecosystem, waxed bullish on mobile wallet integrations in the past week, with Head of Growth Matty Tay saying Phantom’s yet-to-launch mobile wallet could “open the floodgates” to millions of new users, CoinDesk’s Danny Nelson reported. Mobile wallets wouldn’t be completely new for Solana. A number of crypto exchanges already let users send, stake and store SOL from their phones. Solana will also become wallet analysis company Nansen’s first non-Ethereum Virtual Machine chain, it was announced Tuesday. The software company will add coverage for Solana in Q1 2022, project leads said at the Solana conference in Lisbon.

Relevant news

- Apple CEO Tim Cook Reveals He Owns Crypto but Has No Plans to Buy It for the Company

- Bank of England and UK Treasury to Assess Case for a CBDC Next Year

- Riot Blockchain, Hive Outperform Crypto Miners as Bitcoin, Ether Rally

- CityCoin’s Plan for NYCCoin Is Welcomed by Mayor-Elect Adams

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Litecoin (LTC): +20%

- Ethereum Classic (ETC): +12%

- The Graph (GRT): +12%

Notable losers:

- Polkadot (DOT): -4%

- Polygon (MATIC): -4%

- Algorand (ALGO): -2%