Bitcoin rose toward $62,000 as the first U.S. futures-based bitcoin exchange-traded product (ETF) was set to go live this week. The world’s largest cryptocurrency by market capitalization was up about 2% over the past 24 hours as the total crypto market cap reached an all-time high near $2.5 trillion on Monday.

Most of the price rally was attributed to the U.S. Securities and Exchange Commission’s (SEC) approval of the ProShares Bitcoin Strategy ETF on Friday, which will start trading on the New York Stock Exchange tomorrow. Bitcoin rallied about 30% over the month as bullish sentiment improved ahead of the bitcoin futures ETF announcement.

“An Ethereum ETF will likely follow soon after as CME [Chicago Mercantile Exchange] already offers Ethereum futures contracts,” crypto trading firm QCP Capital wrote in a Telegram announcement.

“A lot of good news has already been priced in, although with bitcoin’s all-time high just $3K away, a fresh attempt to break this is very likely to happen in the short term,” Nicholas Cawley, analyst at DailyFX, wrote in an email to CoinDesk.

Technical charts show strong price resistance around the $63,000 BTC all-time high reached in April, which could cap upside moves over the short term. Indicators also show price is the most overbought since July, which preceded a near 10% pullback.

Latest prices

- Bitcoin (BTC): $61,450, +1.6%

- Ether (ETH): $3,747, +0.3%

- S&P 500: +0.3%

- Gold: -0.2%

- 10-year U.S. Treasury yield closed at 1.585%, +0.011 percentage point

Crypto market cap near $2.5 trillion

The total cryptocurrency market capitalization reached an all-time high on Monday, just shy of $2.5 trillion. The previous attempt at an all-time high was in May, which preceded a sell-off in cryptocurrencies. However, the total crypto market cap remained above $1 trillion as the sell-off stabilized in July.

Overheated futures market

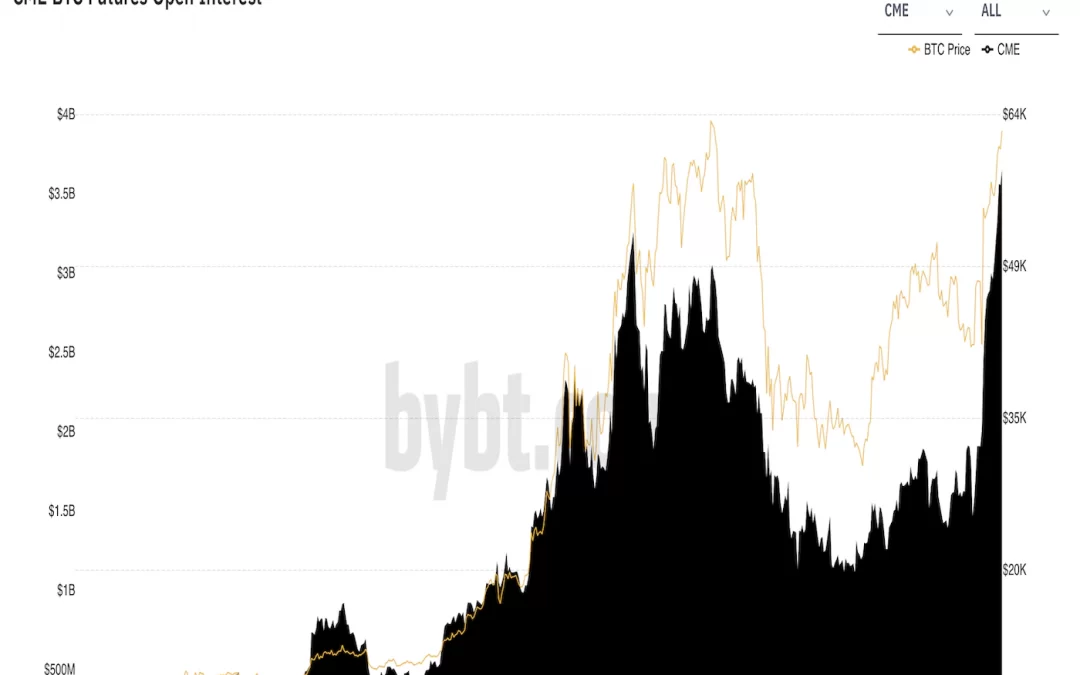

The amount of money locked in the bitcoin futures contracts on the global derivatives giant CME surged to record highs on Friday as the SEC gave the green light to futures-based ETFs tied to the cryptocurrency, reported CoinDesk’s Omkar Godbole.

The chart below shows that the dollar value of open interest (OI) – or the number of futures contracts traded but not liquidated with an offsetting position – stood at $3.64 billion on Friday, more than doubling the total for the month, according to data provided by bybt. The previous lifetime high of $3.26 billion was recorded during the bull market frenzy in February.

Some analysts warned about overheating in the futures market given the recent rise in leveraged positions.

“Today’s volatility seems to be driven by a high-leveraged future market,” CryptoQuant wrote in a blog post published on Monday. “The strongest support levels (based on UTXO price distribution histogram) are [$]54K, [$]56K BTC,” the firm wrote.

Crypto-fund assets at all-time high

Total assets under management in cryptocurrency funds tracked by CoinShares have been climbing – and could swell further as one or more U.S. bitcoin futures exchange-traded funds launch this week.

The rise of fresh capital contributed to a boost in total assets under management, now $72.3 billion, the highest on record.

Bitcoin funds continue to dominate inflows, totaling $70 million last week. Polkadot and Cardano products also saw inflows totaling $3.6 million and $2.7 million, respectively. Read more here.

Altcoin roundup

- Stablecoin risk warning from Fitch: Credit-rating firm projects that stablecoin issuers’ holdings of short-term debt instruments such as commercial paper will grow to exceed that of money market funds over the next two to three years. Commercial paper is a type of short-term, unsecured debt issued by corporations, typically used for the financing of payroll, accounts payable and inventories. The scale of run risks and stablecoin-related turbulence posed to the $1.1 trillion commercial paper market will depend on the evolution of regulations affecting the crypto asset class, Fitch said in a press release.

- Terra to see ecosystem growth: More than 160 projects will launch early next year on the Terra blockchain project, CryptoSlate reported. Those include Inter-Blockchain Communication protocol and Wormhole support, according to the publication. As CoinDesk reported earlier this month, Terra’s Columbus-5 upgrade recently went live, letting users easily transfer the native LUNA token and stablecoin TerraUSD (UST) to other networks, and vice versa. The LUNA price has jumped 54-fold in digital-asset markets this year, for a market capitalization of $14 billion.

- FLOW now on Kraken in U.S., Canada: Crypto exchange Kraken said Monday the FLOW token will now be available for trading and staking for U.S. and Canadian clients, after making the token available to many clients elsewhere earlier in the year. Funding, staking and trading go live Tuesday at 15:30 UTC (11:30 a.m. ET), according to the announcement. The Flow blockchain, pioneered by Dapper Labs, has attracted attention this year as fans flocked to non-fungible tokens (NFT). The FLOW price has doubled this year, for a market cap of $4.4 billion.

Relevant news

- Guggenheim’s Minerd Predicted Bitcoin at $15K and $400K. Now He’s Bowing Out Entirely

- Brazilians Have Acquired $4B in Cryptocurrencies in 2021, Central Bank Says

- New York Attorney General Directs Two Crypto Lending Platforms to Cease Activities

- Cryptocurrency Exchange Bakkt Falls in First Day of Trading After SPAC Deal

- Grayscale Reiterates Plans to Convert Bitcoin Trust to Spot ETF

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Dogecoin (DOGE) +7.4%

- Polygon (MATIC) +5.7%

- Binance coin (BNB) +4.0%

Notable losers:

- Chainlink (LINK) -1.0%

- Aave (AAVE) -0.2%