Bitcoin traded in a choppy price range on Wednesday as traders reacted to the U.S. Federal Reserve’s plans to taper its $120-billion-a-month in bond purchases.

The unprecedented amount of buying by the Fed as part of its monetary stimulus plan known as quantitative easing (QE) provided a tailwind for financial assets, such as cryptocurrencies, deemed by the market to be risky. But lower liquidity as a result of the tapering could encourage investors to reduce their exposure to crypto and other risks.

Bitcoin’s price fell by about 5% during the announcement by the Fed’s policymaking Federal Open Market Committee in its post-meeting statement, but buyers were quick to step in around the $60,000 support level.

Analysts remain bullish on cryptocurrencies, but some have pointed to declining trading volume as a sign of slowing upside momentum in prices.

“We haven’t even seen an episode of FOMO (fear of missing out) yet, so the sharpest bull-run part of the rally is yet to come,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk. “Despite BTC’s very sluggish performance in recent days, what still draws attention is the apparent support on dips,” Kuptsikevich wrote.

Latest Prices

- Bitcoin (BTC): $62,997.19, -0.64%

- Ether (ETH): 4,630.40, +2.78%

- S&P 500: 4,660.57, +0.65%

- Gold: 1,772.56, -0.83%

- 10-year Treasury yield closed at 1.596%

Bitcoin rally on low trading volume

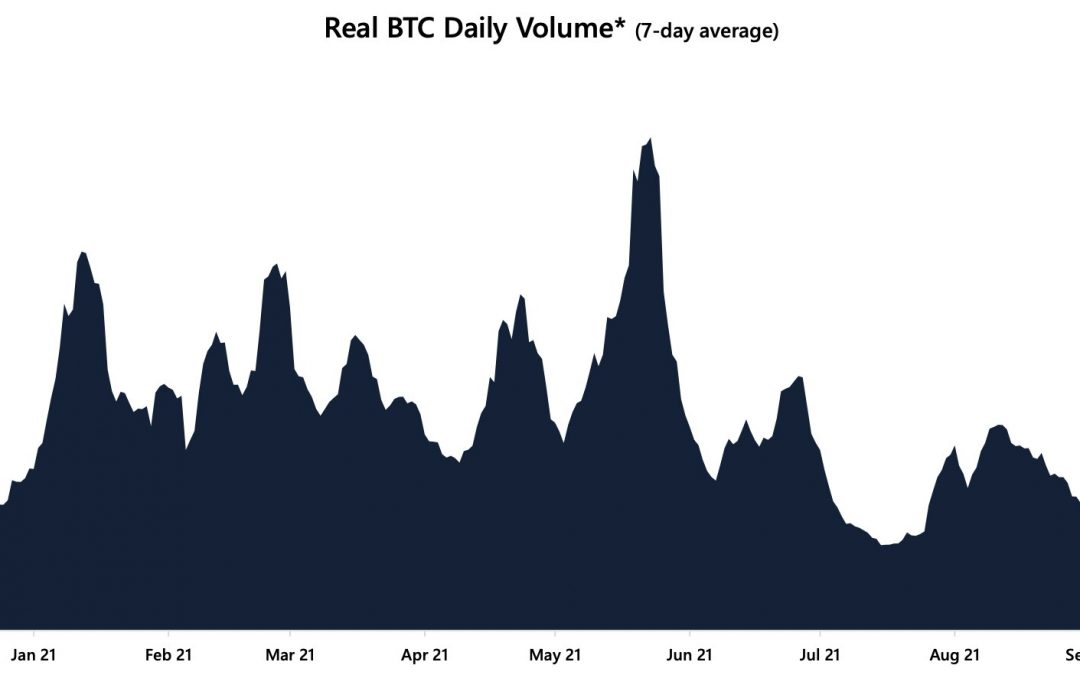

Trading volume in the bitcoin spot market continued to decline despite bitcoin’s price rally over the past month. The chart below shows the seven-day average BTC trading volume, which is down almost $1 billion from the previous week, according to data compiled by Arcane Research.

But some analysts expect higher trading activity if BTC rallies through the end of the year.

“The trading volume has decreased substantially since bitcoin hit an all-time high on October 20, and it should increase considerably if bitcoin is to challenge its all-time high again soon,” Arcane wrote in a Wednesday report.

Trading has also been relatively quiet on the Coinbase crypto exchange over the past week, with BTC accounting for 21% of total volume. However, the company noted that trading activity is starting to increase in alternative cryptocurrencies (altcoins) as bitcoin’s price stalls.

“Ether (ETH) volumes have also seen an increase to 18.51%, relegating SHIB to the third spot,” Coinbase wrote in a newsletter to institutional clients, referring to the shiba inu coin. “It is possible to envisage a scenario where ETH will again overtake BTC in terms of volumes as we head into year-end if this narrative gains steam.”

Altcoin roundup

- Layer 2 coins are thriving as Ethereum costs are rising: The average fee on Ethereum has given rise by 2,300% since late June and is now at $56. This appears to be driving investors to coins associated with layer 2 products that facilitate faster and cheaper transactions, and those of rival programmable blockchains, CoinDesk’s Omkar Godbole reported. This allowed Solana’s SOL token, which surged in price by 13% in the past 24 hours to $234, to pass Cardano’s ADA as the fifth-largest cryptocurrency, according to CoinGeckio. At the same time, smart-contract blockchain Polkadot’s DOT token also rallied to an all-time high of $53.37 early Wednesday.

- EOS Foundation CEO says, “EOS, as it stands, is a failure:” At a virtual event on Wednesday, Yves La Rose, CEO of the EOS Foundation, claimed the EOS blockchain protocol’s native currency, EOS, has been “a terrible investment,” CoinDesk’s Andrew Thurman reported. La Rose’s speech places much of the blame on backer and former developer Block.one, which the project will no longer be relying on for guidance. He also said that EOS was “a victim of its own success,” and that it was put in a position of “having to meet extreme expectations as it raised extreme sums.”

- Kraken fails to list SHIB: Cryptocurrency exchange Kraken has failed to list popular meme token SHIB on its exchange after it promised to do so on Twitter, CoinDesk’s Muyao Shen reported. In a tweet on Monday, the exchange said that if they got 2,000 “likes,” it would list shiba inu on Tuesday. However, at press time on Wednesday, SHIB is still not available to buy and sell on Kraken despite the tweet having over 77,000 likes. The lack of action by Kraken has triggered anger on social media, with one user tweeting, “[Y]ou have lost me as lifetime customer now.”

Relevant news

- JPMorgan Report Says CBDCs Can Save Firms $100B a Year in Cross-Border Costs

- Riot Blockchain Raises Hashrate Guidance by 11.7% for 2022

- Direxion Withdraws Application for Short Bitcoin Futures ETF

- China’s CBDC Has Been Used for $9.7B of Transactions

- Digital Currency Group Achieves $10B Valuation in $700M Secondary Sale

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polygon (MATIC): +5.51%

- XRP (XRP): +5.19%

- Polkadot (DOT): +4.84%

Notable losers:

- Dogecoin (DOGE): -2.34%

- The Graph (GRT): -1.64%

- EOS (EOS: -1.42%

- Chainlink (LINK): -1.4%