Bitcoin was trading around the lower end of its weeklong range as bullish sentiment began to fade. BTC is down about 7% over the past 24 hours compared with a 10% drop in ether and a 12% decline in Solana’s SOL token over the same period.

Recent declines across cryptocurrencies has some analysts concerned about near-term price direction, especially ahead of the U.S. Federal Reserve Open Market Committee (FOMC) meeting Dec. 14-15. Market participants expect the central bank to accelerate the pace of asset purchases, which could cause some investors to reduce their exposure to speculative assets including equities and cryptocurrencies.

Tighter monetary policy remains a cyclical headwind that “may continue to dominate performance in the weeks ahead,” crypto exchange Coinbase wrote in a newsletter to institutional clients. The exchange also mentioned that “investors should be prudent about their level of risk exposure.”

Latest prices

- Bitcoin (BTC): $46,366, -7.79%

- Ether (ETH): $3,728, -10.09%

- S&P 500: $4,668, -0.91%

- Gold: $1,786, +0.21%

- 10-year Treasury yield closed at 1.41%

From a technical perspective, bitcoin’s price appears vulnerable to a breakdown if current support levels fail to hold up.

“A significant short-term indicator for the market promises to be the 200-day average for bitcoin,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk. “An ability to bounce back above that line would indicate bullish sentiment prevails and promises new attempts to climb above $50K or $60K this month. A sharp fall would formally clear the way for a deeper correction to $41K or even $30K,” Kuptsikevich wrote.

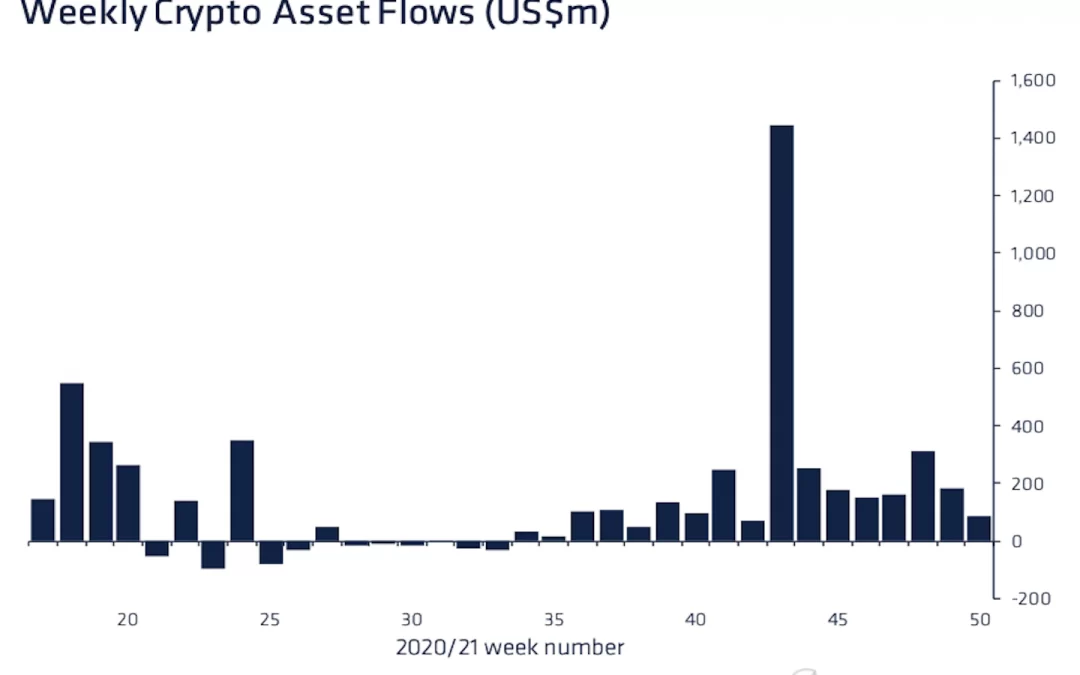

Crypto fund inflows slow

Digital asset investment products saw inflows drop 52% last week to $88 million as crypto markets saw a downturn.

The inflows into crypto funds during the week ended Dec. 10 compared with $184 million the prior week, according to a report Monday from CoinShares.

Funds focused on bitcoin, the largest cryptocurrency, accounted for the bulk of the week’s inflows at $52 million, CoinDesk’s Lyllah Ledesma reported. The prior week, bitcoin-focused funds saw $145 million of inflows. Meanwhile, SOL, the token of the blockchain-based smart contracts platform, saw inflows of $17 million. SOL is down 35% on the month after reaching an all-time high in November.

Altcoin roundup

- SUSHI jumps 10%: Sushi tokens jumped as much as 10% in early European hours to over $6.19 from a low of $5.30 on Sunday night, data from market tool CoinGecko shows. Prices retraced slightly afterwards as some traders took profits. The move came shortly after Daniele Sestagalli, a top application developer on base layer (layer 1) blockchain Avalanche, proposed joining the platform in a post on the project’s governance forum, CoinDesk’s Shaurya Malwa reported.

- Tezos ‘Exchange-Traded Cryptocurrency’ launches on German exchange: Digital asset manager ETC Group has launched an institutional-grade tezos exchange-traded exchange-traded product (ETP) on Europe’s Deutsche Börse XETRA under the ticker symbol EXTZ. The launch of EXTZ brings XTZ, the native token of the Tezos blockchain, to investors across 16 European Union countries as institutional appetite for accessible altcoin products rapidly grows, CoinDesk’s Tracy Wang reported.

- Twitch Co-Founder Justin Kan Launches gaming NFT marketplace on Solana: Web 3 gaming received another boost on Monday with the announcement of Fractal, a marketplace for gaming-related NFTs led by Twitch co-founder Justin Kan. The platform will serve as a primary marketplace for players to buy non-fungible tokens directly from game companies to use in-game, as well as a secondary marketplace for peer-to-peer trading, CoinDesk’s Eli Tan reported.

Relevant news

- SEC’s Gensler Says Crypto ‘Fits in Our Broad Remit’: Report

- Robinhood Turns to Chainalysis for Data, Compliance Tools

- Wells Fargo, HSBC to Settle Forex Transactions Using Blockchain

- Bank of Russia Bars Mutual Funds From Investing in Crypto

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable losers as of 21:00 UTC (4:00 p.m. ET):

- Chainlink (LINK): -14.16%

- Polygon (MATIC): -14.00%

- Algorand (ALGO): -13.82%