Over the past nine days, Bitcoin’s (BTC) daily closing price fluctuated in a tight range between $28,700 and $31,300. The May 12 collapse of TerraUSD (UST), previously the third-largest stablecoin by market cap, negatively impacted investor confidence and the path for Bitcoin’ price recovery seems clouded after the Nasdaq Composite Stock Market Index plunged 4.7% on May 18.

Disappointing quarterly results from top United States retailers are amping up recession fears and on May 18, Target (TG) shares dropped 25%, while Walmart (WMT) stock plunged 17% in two days. The prospect of an economic slowdown brought the S&P 500 Index to the edge of bear market territory, a 20% contraction from its all-time high.

Moreover, the recent crypto price drop was costly to leverage buyers (longs). According to Coinglass, the aggregate liquidations reached $457 million at derivatives exchanges between May 15 and 18.

Bulls placed bets at $32,000 and higher

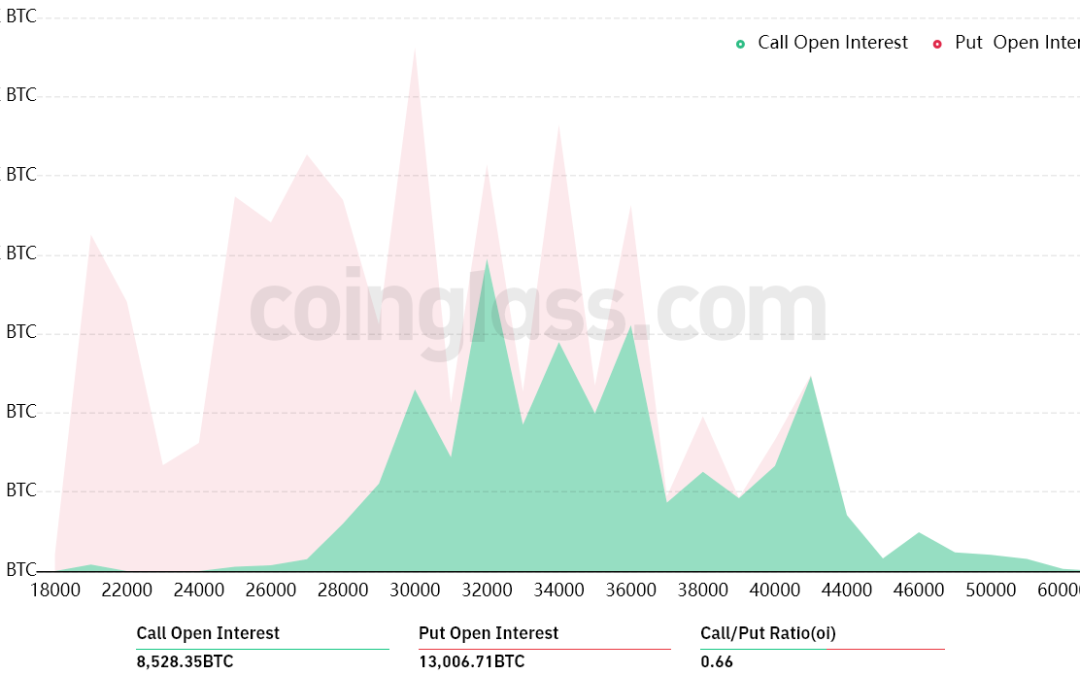

The open interest for the May 20 options expiry is $640 million, but the actual figure will be much lower since bulls were overly-optimistic. Bitcoin’s recent downturn below $32,000 took buyers by surprise and only 20% of the call (buy) options for May 20 have been placed below that price level.

The 0.66 call-to-put ratio reflects the dominance of the $385 million put (sell) open interest against the $255 million call (buy) options. However, as Bitcoin stands near $30,000, most put (sell) bets are likely to become worthless, reducing bears’ advantage.

If Bitcoin’s price remains above $29,000 at 8:00 am UTC on May 20, only $160 million worth of these put (sell) options will be available. This difference happens because a right to sell Bitcoin at $30,000 is worthless if BTC trades above that level on expiry.

Sub-$29K BTC would benefit bears

Below are the three most likely scenarios based on the current price action. The number of options contracts available on May 20 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $28,000 and $29,000: 300 calls vs. 7,100 puts. The net result favors the put (bear) instruments by $190 million.

- Between $29,000 and $30,000: 600 calls vs. 5,550 puts. The net result favors bears by $140 million.

- Between $30,000 and $32,000: 1,750 calls vs. 3,700 puts. The net result favors the put (bear) instruments by $60 million.

This crude estimate considers the put options used in bearish bets and the call options exclusively in neutral-to-bullish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price, but unfortunately, there’s no easy way to estimate this effect.

Bulls have little to gain in the short-term

Bitcoin bears need to pressure the price below $29,000 on May 20 to secure a $190 million profit. On the other hand, the bulls’ best case scenario requires a push above $30,000 to minimize the damage.

Considering Bitcoin bulls had $457 million in leveraged long positions liquidated between May 15 and 18, they should have less margin required to drive the price higher. Thus, bears will try to suppress BTC below $29,000 ahead of the May 20 options expiry and this decreases the odds of a short-term price recovery.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.