Crypto exchange Gemini is introducing a prime brokerage following the acquisition of trading technology platform Omniex less than a week after it bought digital-asset management company Bitria as it looks to attract more institutional investors.

- Terms for the Omniex acquisition announced Wednesday were not disclosed. Omniex provides order, execution and portfolio management services for institutional crypto traders.

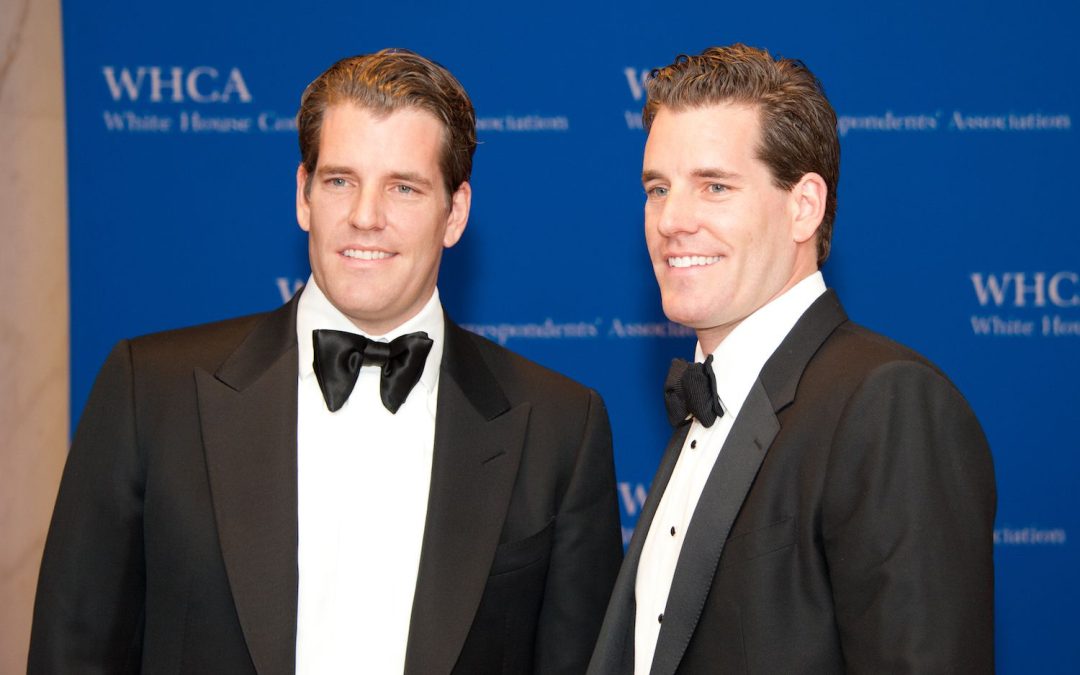

- The acquisition comes less than a week after the crypto exchange founded by Cameron and Tyler Winklevoss acquired digital asset management startup Bitria to expand its ability to manage clients’ portfolios from a single interface.

- Gemini announced the launch of Gemini Prime, which aims to simplify trading for institutional investors by providing access to multiple exchanges and over-the-counter liquidity sources. Gemini Prime, which is already being used by a select group of clients, will be fully rolled out in the second quarter.

- A growing number of institutions have expressed a desire to provide crypto services, not least due to demand from their wealthy clients. Last May, Swiss financial giant UBS Group said it was looking for ways to offer exposure to crypto, and a survey in July found that 82% of institutional investors expect to increase their exposure to digital assets by 2023, with four out of 10 expecting to do so dramatically.

- While Gemini had a trading volume of around $150 million in the last 24 hours, it lags some way behind rivals such as Crypto.com, FTX and Coinbase whose volumes number in the billions.

Read more: Gemini to Allow Crypto Trading in Colombia Under Government-Sponsored Pilot Program