As the possibility of an August 1 user-activated hard fork (UAHF) approaches, a few well-known bitcoin exchanges have issued statements to customers that they will not support the ‘Bitcoin Cash’ (BCC) protocol and its associated token.

Also read: How Exchanges Plan to Deal With a Possible August 1 Fork

The First Exchange to Announce the Platform Will Not Support Bitcoin Cash

Over the past few weeks, Bitcoin.com has kept our readers informed of the possibility of an upcoming hard fork at the end of the month. It seems that the user-activated hard fork that was initially supposed to just be a contingency plan against the user-activated soft fork (UASF) still might happen. This means Bitcoin Cash supporters will try to veer off from the main chain and operate on their own terms of consensus. Over the past few weeks, many bitcoin trading platforms have revealed their plans to deal with this particular hard fork as some of them will list the BCC token. However, there are a bunch of other well-known exchanges that will not support the BCC branch.

Over the past few weeks, Bitcoin.com has kept our readers informed of the possibility of an upcoming hard fork at the end of the month. It seems that the user-activated hard fork that was initially supposed to just be a contingency plan against the user-activated soft fork (UASF) still might happen. This means Bitcoin Cash supporters will try to veer off from the main chain and operate on their own terms of consensus. Over the past few weeks, many bitcoin trading platforms have revealed their plans to deal with this particular hard fork as some of them will list the BCC token. However, there are a bunch of other well-known exchanges that will not support the BCC branch.

The first bitcoin trading platforms to announce they will not support the BCC hard fork were GDAX and Coinbase. The GDAX exchange is a subset of the Coinbase company, and the August 1 UAHF plans are the same.

“The current User Activated Hard Fork (UAHF), including Bitcoin ABC, is a proposal to alter the Bitcoin protocol by creating a new version of the Bitcoin software, which will operate on its own, separate blockchain,” explains Coinbase and GDAX. “We do not plan to offer support for the UAHF chain at this time — You will not be able to withdraw the UAHF version of any Bitcoin from Coinbase.”

The UAHF is incompatible with the current Bitcoin protocol and will create a separate blockchain — Should the UAHF activate on August 1, Coinbase will not support the new blockchain or its associated coin. Any BTC within customers’ accounts will remain accessible over the main blockchain only, and will not be converted into BTC on the UAHF chain.

Poloniex Leaves the Decision Up in the Air

On July 24 the large cryptocurrency exchange Poloniex revealed its plans to handle the “potential bitcoin network disruption.” The exchange will be halting withdrawals and deposits but will allow trading to continue on August 1. As far as the hard fork is concerned and listing the BCC token on Poloniex, the firm says at this time they “cannot commit to supporting any specific blockchain that may emerge if there is a blockchain split.” From Poloniex’s announcement, it seems the trading platform is leaving it up in the air for now.

“Even if two viable blockchains emerge, we may or may not support both and will make such a decision only after we are satisfied that we can safely support either blockchain in an enterprise environment,” explains the U.S. based exchange Poloniex.

Itbit Will Not Support the UAHF Outcome

The institutional bitcoin trading platform Itbit has also detailed that it will not support Bitcoin Cash or a UAHF derivative token. From August 1 at 00:01 UTC to August 2 00:01 the exchange will not process fiat and bitcoin withdrawals alongside suspending BTC deposits. According to Itbit the UAHF proposal could effectively create a new coin on August 1, 2017, and the company will not support the outcome.

“Itbit will not support the trading of Bitcoin Cash — If customers want to access Bitcoin Cash immediately following the fork, they should withdraw their Bitcoin to an external wallet address on or before July 31, according to standard cutoffs,” Itbit details.

If customers leave Bitcoin on Itbit, their Bitcoin Cash will not be immediately available for withdrawal. However, customers will continue to be able to withdraw and trade Bitcoin.

Bitmex and Exodus Choose to Decline BCC Listing

The cryptocurrency exchange Bitmex is also joining the exchanges that will not support the BCC blockchain. Bitmex says the change is “incompatible” with the current Bitcoin ruleset and the trading platform may be unable to protect the new BCC tokens on behalf of clients.

“As such, Bitmex will not support the split or distribution of Bitcoin Cash, nor will Bitmex be liable for any Bitcoin Cash sent to Bitmex,” the company’s blog explains. “Therefore, it is up to our users to withdraw from Bitmex prior to August 1st if they wish to access Bitcoin Cash tokens or any other hardfork.”

The wallet and built-in exchange platform Exodus says they will not embrace the BCC token either. However, Exodus users will be able to import their keys into a BCC compatible client and retrieve their hard fork holdings after the split. The company highly recommends not using bitcoin during the fork and tells customers they should patiently wait for the protocol change to end. Similarly, the bitcoin wallet provider BTC.com will also provide a tool for those who wish to extract their Bitcoin Cash from the BTC.com wallet.

Bitstamp Says BCC is an ‘Altcoin’ and Will Not Support the Protocol

The European Union-based bitcoin exchange Bitstamp has taken the opportunity on July 27 to inform customers what it plans to do during a potential hard fork. As of now Bitstamp will not honor the BCC side of the fork and considers the token an “altcoin.”

“In the event of a User Activated Hard Fork (UAHF) on 1 August or thereafter, it is important to clarify that Bitstamp would not be in a position to support Bitcoin Cash (BCC), the coin associated with the Bitcoin Cash proposal,” explains the company’s blog post.

In Bitstamp’s view, BCC is an altcoin and the decision to list BCC tokens remains at our sole discretion at all times.

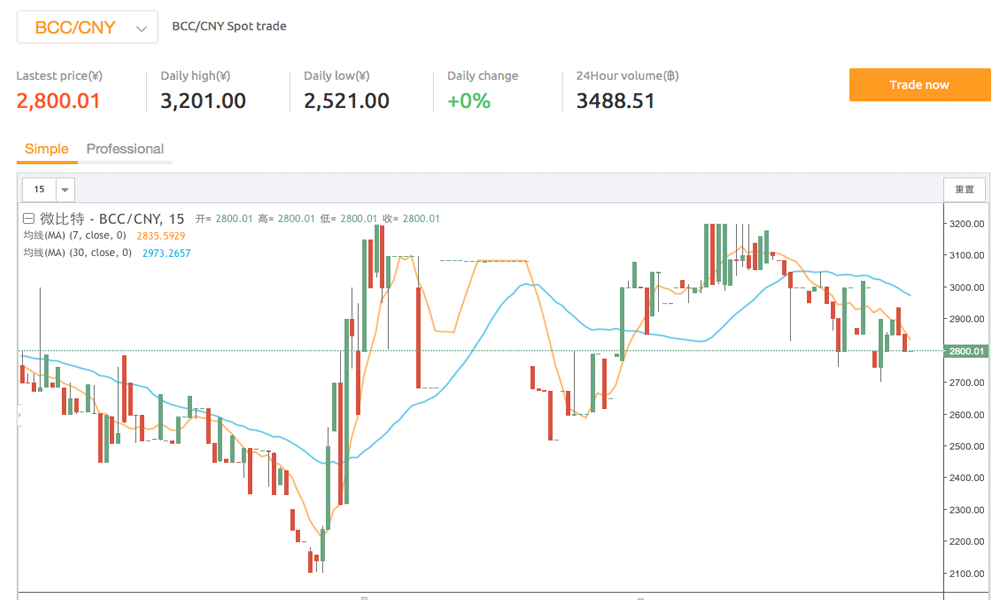

There are also a bunch of exchanges like Okcoin, Huobi, Livecoin, BTCC, Bithumb, Viabtc, and others that have announced they will support the Bitcoin Cash blockchain and list the BCC token. It’s also worth noting the Bitcoin Cash token may have a problem with its abbreviated ‘BCC’ ticker as it is already used by a cryptocurrency called Bitconnectcoin.

Meanwhile, many BCC advocates are disappointed with these other trading platforms choosing not to list the UAHF token. Some skeptics have even asked what these exchanges plan to do with the bitcoin left on platforms and whether or not the company will reap the benefit of this potential split. Whatever the case may be these trading platforms will not support the BCC protocol, and those who wish to obtain the token should remove their funds from these specific exchanges.

What do you think about the exchanges that are choosing not to list BCC? Do you think they have given customers enough notice? Let us know what you think in the comments below.

Images via Shutterstock, Bitcoin Cash, Coinmarketcap.com, and the Viabtc exchange.

Need to calculate your bitcoin holdings? Check our tools section.