Bitcoin (BTC) and other bulls will not benefit from a major change in United States inflation policy in 2023, one analyst says.

In a Twitter thread on Dec. 20, Jim Bianco, head of institutional research firm Bianco Research, said that the United State Federal Reserve would not “pivot” on rate hikes next year.

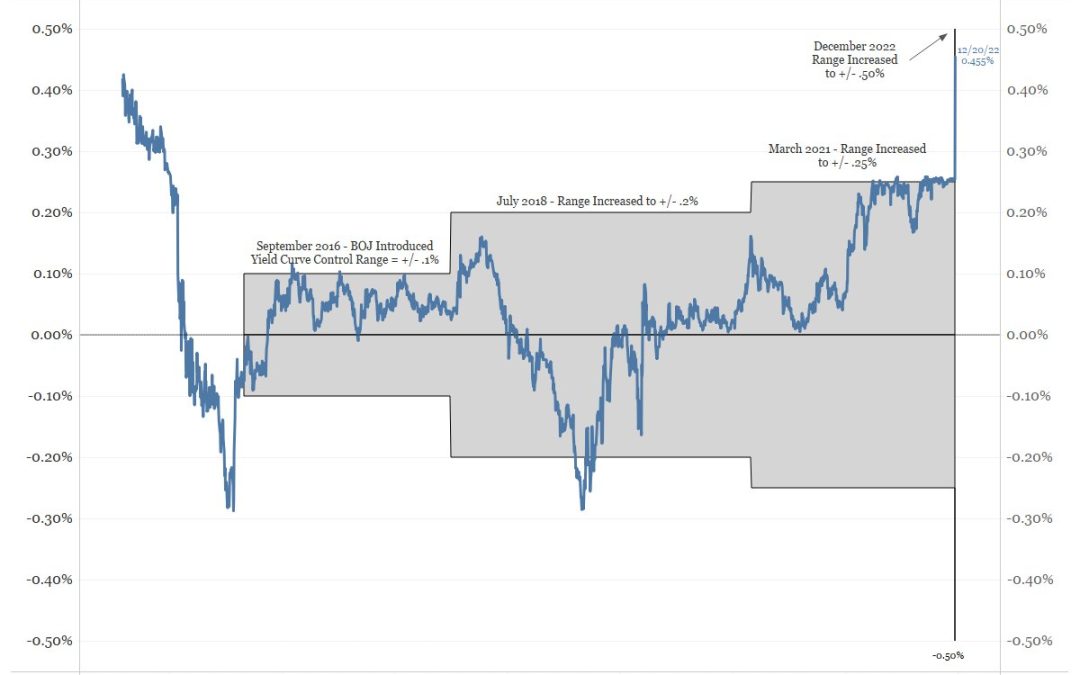

Bianco: Japan YCC move “matters for all markets”

In light of the surprise yield curve control (YCC) tweak by the Bank of Japan (BoJ), analysts have become all the more bearish on the prospects for risk assets this week.

As Cointelegraph reported, the move spelled immediate pain for the U.S. dollar, and with the Wall Street open in sight, equities futures were trending down in step at the time of writing.

For Bianco, the fact that the BoJ was now seeking to follow the Fed in tightening policy to ward off inflation meant that the latter was unlikely to loosen its own policy.

“Again, if JAPAN! is NOW hiking to changing policy NOW because of inflation, remind me why the Fed would be pivoting anytime in 2023?” part of one post read.

“The answer is they will not. You can forget a pivot.”

The real tangible consequences of Japan’s decision may only be felt later, Bianco continued. With bond yields rising, Japan should attract capital back home and away from the United States.

“The dollar is getting crushed against the Yen (or the Yen is soaring versus the dollar). Japan is getting a yield again. That should drive funds back into Japan,” he wrote.

A return to lowering interest rates is a key eventuality being priced in by markets beyond crypto, and this is something that simply no longer pays, Bianco said. Despite BTC/USD already down nearly 80% in just over a year in tandem with the Fed’s quantitative tightening (QT), the pain may thus still be far from over.

“Powell is hawkish,” he concluded, referring to last week’s speech by Fed Chair Jerome Powell, in which he sought to steer markets away from anticipating any policy loosening.

“ECB head Legarde (Madam Laggard) is now talking hawkish. Kuroda and the BoJ are (now) making moves that show concern about inflation. Markets may need to rethink their view about central banks pivoting.”

Fidelity exec warns of “choppy” year

Other perspectives sought to offer a more hopeful view of the coming year while avoiding implicitly bullish language.

Related: ‘Wave lower’ for all markets? 5 things to know in Bitcoin this week

Jurrien Timmer, director of global macro at asset management giant Fidelity Investments, forecast 2023 as a “sideways” trading environment for equities.

“My sense is that 2023 will be a sideways choppy market, with one or more retests of the 2022 low, but not necessarily much worse than that,” he tweeted on Dec. 19.

“Either way, I don’t think we are close to a new cyclical bull market yet.”

In subsequent comments, Timmer added that while he believed a secular bull market had been in place ever since 2009, the “question is whether the secular bull market is still alive.”

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.