Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin moved little, while the “tether premium” dropped as Huobi’s deadline approaches.

Technician’s take: Long-term momentum is starting to fade, which could limit price gains this month. For now, BTC is holding support above $53K.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $56,604 -1%

Ether (ETH): $4,536 -1.1%

Markets

S&P 500: $4,577 +1.4%

Dow Jones Industrial Average: $34,639 +1.8%

Nasdaq: $15,381 +0.8%

Gold: $1,768 +0.7%

Market moves

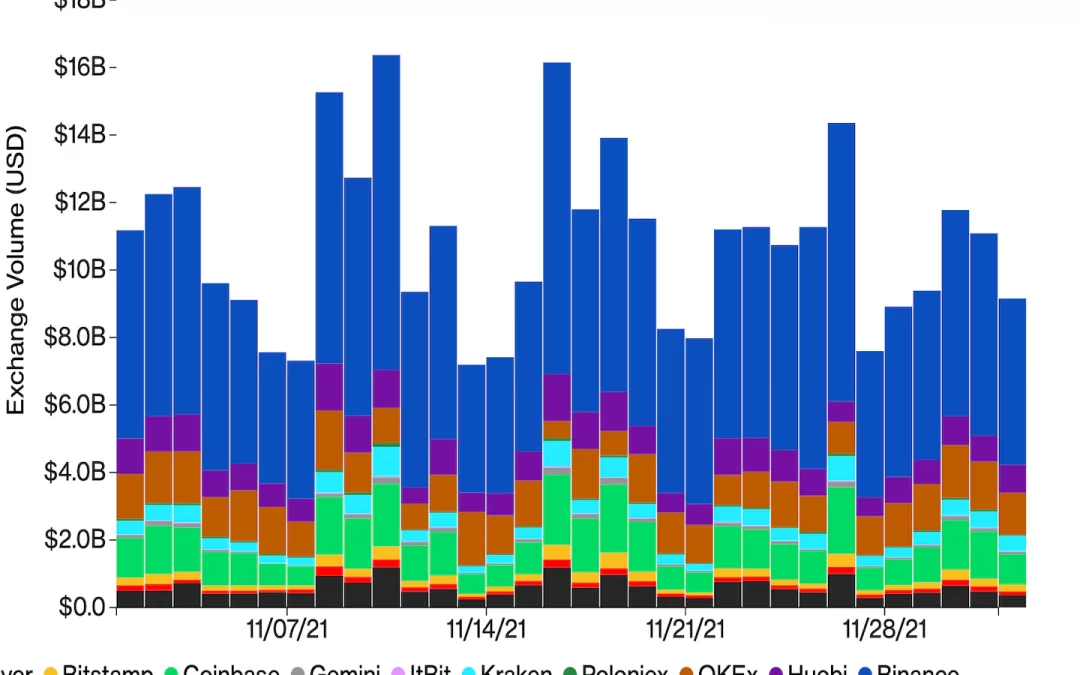

Bitcoin remained around $57,000 on Thursday as the market remained in a wait-and-see mode. The oldest cryptocurrency’s daily trading volume on centralized exchanges also declined.

Data compiled by CoinDesk shows that bitcoin’s trading volume across 11 major centralized exchanges sank from a day ago and was much lower than a week ago. Ether, the second-largest cryptocurrency by market capitalization, fell slightly but remained in the $4,500-$4,600 range.

Meanwhile, the price for the USDT/CNY (tether/Chinese yuan) pair tumbled entering December,as the deadline approaches for Huobi, a popular crypto exchange among Chinese investors, to close the accounts of its existing users in mainland China. Amid China’s latest ban on crypto trading and mining, Huobi announced that it would remove all mainland Chinese accounts by the end of this year.

As a previous Asia First Mover mentioned, the market in China has been slowly rebounding from the country’s September crypto trading ban with tether’s quoted prices in the yuan on the over-the-counter (OTC) market recovering from a deep discount.

Under normal market conditions, the price of tether expressed in yuan should match that of the U.S. dollar’s exchange rate with the Asian currency, but tether had traded at a significant discount since China’s ban and turned into negative (as much as negative 5.31% yesterday) again after a brief recovery, according to data from feixiaohao.

Technician’s take

Bitcoin Struggles Near Resistance; Support at $53K

Bitcoin (BTC) continues to stabilize above the $53,000 support level after last month’s decline.

There appears to be a stalemate, however, between buyers and sellers because the cryptocurrency is roughly flat over the past 24 hours. Resistance is seen around $60,000, which has capped upside moves over the past week.

BTC was trading around $56,000 at the time of publication and is down about 4% over the past week.

The short-term downtrend in BTC is defined by a series of lower price highs since Nov. 10, as seen in the chart above. Recently, oversold signals appeared on the charts, which could encourage short-term buying from the $53,00 support level. A decisive break above $60,000 would reverse the short-term downtrend.

Still, there is strong overhead resistance between $60,000 and $65,000, which could limit price gains this month.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Jibun bank services purchasing managers index (Nov.)

9:45 a.m. HKT/SGT (1:45 p.m. UTC): Caixin services purchasing managers index (Nov.)

3:45 p.m. HKT/SGT (7:45 a.m. UTC): France industrial output (Oct. MoM)

All Day: Art Basel Miami Beach

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Square Changes Name to ‘Block,’ Crypto Bosses to Testify on Capitol Hill Next Week

“First Mover” hosts spoke with I/O Fund founder and CEO Beth Kindig about Square’s rebranding and her pick for the next big tech stock. Bitwise Asset Management Chief Investment Officer Matt Hougan shares insights into crypto markets as analysts maintain that bitcoin’s bullish trajectory will remain intact. The U.S. House Financial Services Committee plans to hold a hearing with the CEOs of several major crypto exchanges and startups. CoinDesk’s Managing Editor for Global Policy & Regulation, Nikhilesh De, had the scoop. Plus, for CoinDesk’s “Future of Money” Week, Cato Institute VP for Monetary Studies Jim Dorn spoke about the relationship between the free market and money tech.

Latest headlines

SEC Rejects WisdomTree’s Spot Bitcoin ETF Application: The decision comes seven months after the agency said it would start evaluating the asset manager’s application.

Goldman Sachs, Other Wall Street Banks Exploring Bitcoin-Backed Loans: Sources: U.S. banks want to use bitcoin as loan collateral without touching the bitcoin.

Filecoin Might Have a Way for Bitcoin to Fight Its Energy Critics (if Miners Use It): Did Filecoin just launch a tool to end the never-ending debate over bitcoin’s carbon footprint?

How a Collection of 1M Music NFTs Could Mint the Next Platinum Record: Deadmau5 and Portugal. The Man: They are debuting NFTs of their new single at Miami’s Art Basel festival.

Can Stablecoin Supply Measure Ethereum Adoption?: As innovation on top of Ethereum continues to connect decentralized finance with the outside world, stablecoin growth appears to be a strong measure of adoption.

Longer reads

Shiba Inu: Memes Are the Future of Money: LOL u mad bro?

Note to Brands: Crypto Isn’t Funny Money. It’s Community: How marketers can engage with crypto folk (and how not to).

Today’s crypto explainer: Why Use Bitcoin?

Other voices: Cutting a Banksy Into 10,000 (Digital) Pieces