Good morning. Here’s what’s happening:

Market moves: Bitcoin extends drop before rising slightly; Crypto Twitter was dominated by the DeFi Wonderland drama.

Technician’s take: BTC’s upside remains limited given the intermediate-term downtrend.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $36,948 +0.2%

Ether (ETH): $2,407 -2.6%

Top Gainers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Polygon | MATIC | +0.9% | Smart Contract Platform |

| Algorand | ALGO | +0.6% | Smart Contract Platform |

| Ethereum Classic | ETC | +0.1% | Smart Contract Platform |

Top Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Cosmos | ATOM | −7.0% | Smart Contract Platform |

| Internet Computer | ICP | −4.1% | Computing |

| Solana | SOL | −3.8% | Smart Contract Platform |

Markets

S&P 500: 4,236 -0.5%

DJIA: 34,160 -.02%

Nasdaq: 13,352 -1.4%

Gold: $1,796 -1.3%

Market moves

Bitcoin extended its losses for much of Thursday, a day after hawkish comments from U.S. Federal Reserve Chairman Jerome Powell, as the stock market also fell with some traders betting that the central bank will raise interest rates more than four times this year.

At the time of publication, the largest cryptocurrency by market capitalization was changing hands near $37,000, up slightly over the past 24 hours but still well off its high of a week ago, according to CoinDesk data. Ether, the second biggest cryptocurrency by market capitalization, was down over the same time period and was trading at about $2,400. Most other major altcoins were also in the red.

Amid the bearish crypto movement, the U.S. dollar was a strengthening. At the time of publication, the U.S. dollar currency index (DXY) was up by 0.79% over the past 24 hours to 97.2, according to TradingView.

A strengthening dollar is usually bearish for bitcoin, as CoinDesk has reported before. Bitcoin and the dollar index in the past have moved in opposite directions. Such inverse correlation became more noticeable last July.

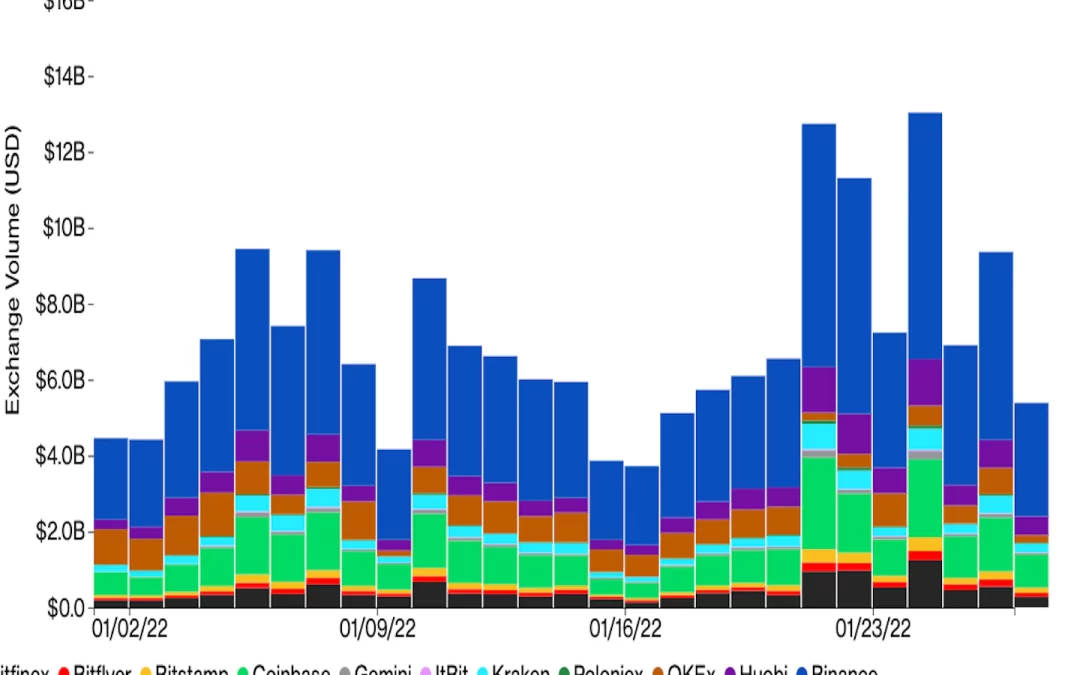

Data compiled by CoinDesk shows that bitcoin’s trading volume across major crypto exchanges was down from a day ago to its lowest level this week so far.

Instead of bitcoin, at the center of the market and crypto Twitter was the surprising drama around Wonderland, a popular decentralized finance (DeFi) protocol.

As CoinDesk reported, the identity of the pseudonymous treasury manager for Wonderland was revealed on Twitter as Michael Patryn, co-founder of QuadrigaCX, a notorious Canadian crypto exchange that defrauded investors of more than $190 million. The shocking fact has shaken “Frog Nation,” a group of protocols including Wonderland led by well-known DeFi developer Daniele Sestagalli.

At the time of publication, the price of wonderland (TIME) was down by more than 25% to $396, according to data from CoinGecko. Prices of cryptocurrencies such as SPELL that are also part of “Frog Nation” were also down significantly.

Technician’s take

Bitcoin Stuck Below $40K Resistance; Support at $33K

Bitcoin has failed to sustain a brief price rise from $32,900 to $39,000 over the past few days. The cryptocurrency is trading in a tight range on intraday charts, and technical indicators are mostly neutral over the short term.

Price action has remained below a downward-sloping 100-day moving average on the four-hour chart over the past few weeks, which indicates strong selling pressure. So far, oversold signals have preceded brief price rises, suggesting limited upside ahead given the persistent downtrend since November.

For now, buyers will need to hold support at between $30,000 and $37,000 in order to stabilize the pullback.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia producer price index (Q4, QoQ/YoY)

2:30 p.m. HKT/SGT (6:30 a.m. UTC): France consumer spending (Dec. MoM)

3 p.m. HKT/SGT (7 a.m. UTC): Germany important price index (Dec. MoM/YoY)

6 p.m. HKT/SGT (10 a.m. UTC): European Commission business climate (Jan.)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. personal spending (Dec.)

CoinDesk TV

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Rio de Janeiro Planning to Allocate 1% of Treasury Reserves to Crypto, Voice from China: Digital Yuan to Face International Audience at Beijing Winter Olympic Games Next Week

“First Mover” hosts spoke with Rio de Janeiro Municipal Secretary for Economic Development Chicão Bulhões as the city reportedly plans to allocate 1% of treasury reserves to crypto. From Brazil to China, the hosts spoke with Michael Sung from China’s Fudan University. He shared details of China’s digital yuan rollout and the possible international reactions during the Beijing Winter Olympics next week. Toroso Investments Chief Investment Officer Michael Venuto provided insights into the crypto markets a day after the Fed pointed to a March rate hike. Plus, the latest regulatory news was provided by CoinDesk Managing Editor for Global Policy & Regulation Nikhilesh De.

Headlines

Robinhood Shares Slump as Crypto Trading Weakness Continues: The popular no-commission trading platform saw its crypto revenue decline for the second straight quarter.

Trezor Adopts Swiss Travel Rule Protocol for Private Crypto Wallets: The protocol automatically identifies an unhosted wallet when crypto is withdrawn from a Swiss exchange.

Fan Token Site Socios Sues Argentine Soccer Association for Signing Competing Deal With Binance: A judge issues a preliminary injunction ordering the league to honor its contacts with the site.

Libra’s Long Road From a Facebook Lab to the Global Stage: A Timeline: A detailed chronology of Libra’s journey from a skunkworks inside Facebook to a potential global monetary game-changer to a shadow of its former self.

The Sandbox Looks to Boost Metaverse Startups With $50M Incubator Program: The Animoca Brands subsidiary has committed to invest $250,000 in up to 40 metaverse projects each year over the next three years.

A Struggling South Korean Museum Is Auctioning National Treasures; Meet the 2 DAOs Trying to Buy Them: The Gansong Art Museum will be auctioning the sculptures, which the DAOs hope to keep on public display.

Longer reads

Don’t Let Web 3 Repeat Web 2’s Mistakes: Web 3 must be private by default, Tor Bair of the Secret Foundation writes for CoinDesk’s Privacy Week.

Today’s crypto explainer: Someone Gave You Crypto as a Gift … Now What?

Other voices: Milken Institute Virtual Forum: Stablecoins: A Conversation with Industry Experts

Said and heard

“The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.” (The Federal Reserve) … “Blockchains represent a terrific opportunity to erase the data silos between companies with standardized and integrated information.” (EY Global Blockchain Leader Paul Brody) … “The U.S. has learned to adapt to the new world of variants and continues to produce.” (S&P Global Ratings Chief U.S. Economist Beth Ann Bovino to the Wall Street Journal)