Fantom overtook Binance Smart Chain (BSC) over the weekend to become the third-largest decentralized finance (DeFi) ecosystem by total value locked, data from analytics tool DeFiLlama showed.

DeFi broadly refers to smart contract-based financial services such as trading, lending and borrowing offered by blockchain projects to users.

As of Monday morning in Europe, more than $12.2 billion worth of Fantom’s FTM and other tokens are locked on 129 protocols geared towards Fantom users. That’s just over $94 million locked per project on average. This is a 52% increase in the past week, and a greater-than 170% increase over the past month, the data showed.

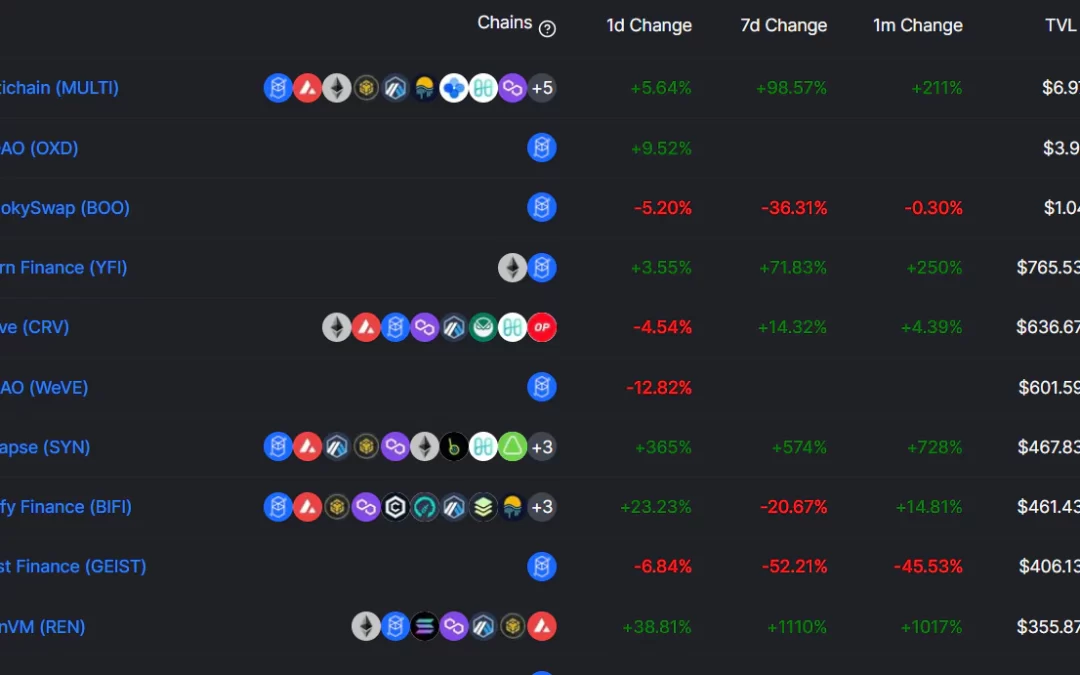

Cross-chain swap Multichain is the biggest protocol by value locked on Fantom, with over $6.97 billion worth of assets in its smart contracts. In second place is the relatively new 0xDAO, which locks over $3.91 billion, while decentralized exchange SpookySwap takes third place with just over $1 billion in locked value.

BSC slipped to the fourth-largest DeFi ecosystem with $11.96 billion in locked value over 294 projects. Terra, which displaced BSC in December 2021 to become the second-largest DeFi ecosystem, retains its second place with $16.54 billion in locked value. Ethereum retains the DeFi crown with over $116 billion in locked value over 415 projects, more than any other blockchain.

Tokens of Fantom have emerged as the top performers in recent months as investors bet on the tokens of layer 1 projects – protocols with their native blockchains, such as Fantom or Solana – as an alternate to Ethereum.

FTM prices rose from $1.30 in mid-December to approach all-time highs of $3.46 in earlier this month, before tumbling with the broader market in the past week.