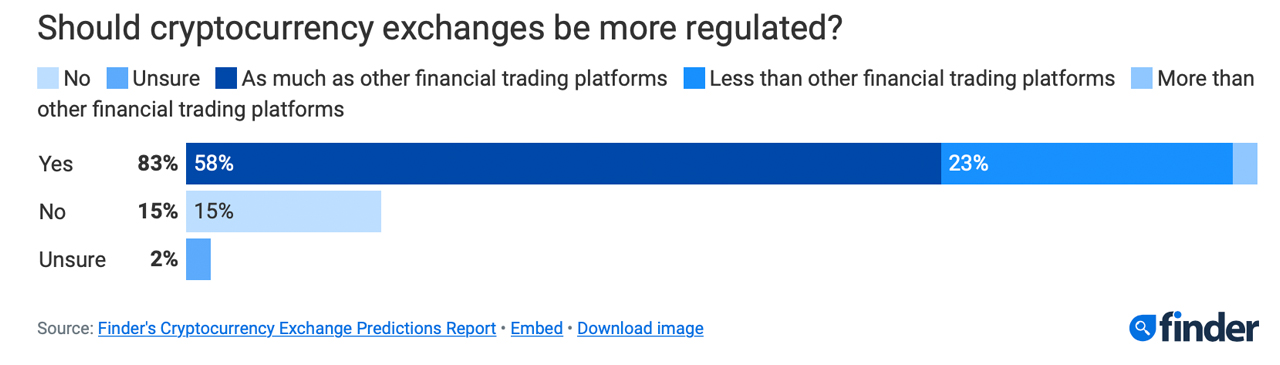

Following finder.com’s reports on bitcoin and ethereum predictions, the product comparison site polled 56 specialists in the fintech and cryptocurrency industry to gauge their thoughts on future regulation of crypto exchanges. The experts predict that virtual currency trading platforms will be regulated, but not until 2025 or 2030. When regulation does occur, 76% of Finder’s panelists expect the trading platforms to be treated similarly to traditional financial institutions.

87% of Finder’s Fintech and Crypto Experts Believe Exchanges Must Disclose Proof-of-Reserves Audits

A recently published report from finder.com, which polled 56 experts in the fintech and cryptocurrency industry, shows that 87% believe exchanges will need to disclose proof-of-reserves audits and liability records. The specialists reveal that standard regulations for crypto exchanges will not occur until 2025 or 2030.

While 76% of the panelists believe crypto trading platforms will be regulated similarly to traditional finance platforms, 17% expect this to happen by 2024. 22% predict regulation by 2025, and 35% expect it to take place in 2030.

“Any exchanges that remain need to get with the program, proof of reserves and liabilities should be prerequisites and non-negotiable for people selecting where they trade,” Swyftx’s head of strategy Tommy Honan said.

Honan believes, alongside 87% of the panelists, that exchanges need to provide a record of liabilities and proof-of-reserves. “Exchanges also need to continue to upskill their users on self-custody and lean into new and innovative products that support it,” Honan added.

Split Views on Crypto Regulation: 15% Buck Tradition, Half Believe Industry Will Weather the Storm

About 15% of Finder’s panel, including Cryptoconsultz CEO Nicole DeCicco, do not believe crypto exchanges should be regulated similarly to traditional financial institutions. However, DeCicco predicts that standard regulations will be enforced throughout the crypto industry by 2024.

“It’s imperative though we warn investors about the risks involved,” DeCicco said in a statement. “At Cryptoconsultz we teach our clients to think of cold storage and self-custody solutions as their bank account and centralized exchanges similar to the money one might pull out of an ATM and walk around with in their pocket,” the executive added.

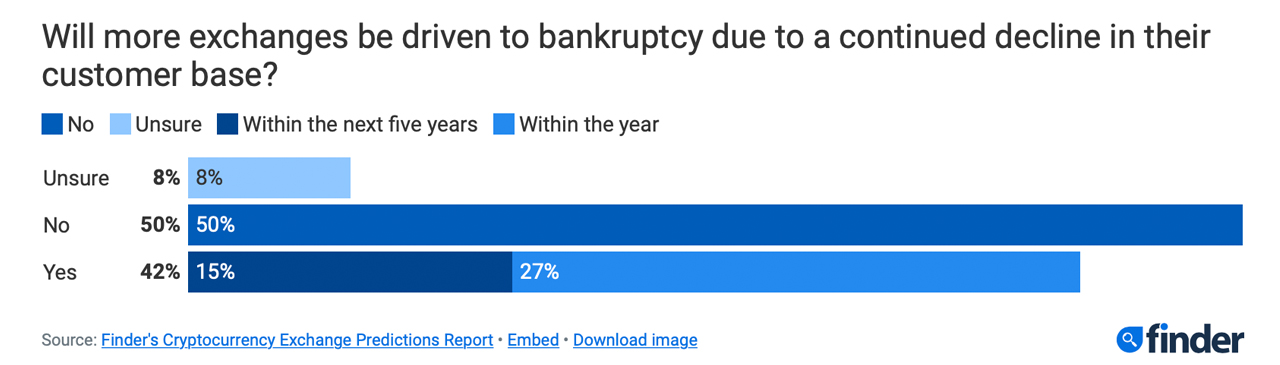

Approximately 42% of Finder’s experts believe that the number of customers for crypto exchanges will continue to decline following several bankruptcies in the industry, including the FTX collapse. 84% of the panelists emphasized that the cryptocurrency industry will survive the FTX implosion that occurred in November 2022.

42.31% predict that more crypto trading platforms will go bankrupt due to customer losses, with more than 15% thinking this will happen in five years and 26.92% within a year. However, exactly half of Finder’s panelists believe that no such event will occur.

You can check out Finder’s crypto exchange regulation prediction report in its entirety here.

What do you think about the predictions of Finder’s experts on the future of crypto exchanges? Do you agree or disagree with their views on regulation and the potential impact on the industry? Share your thoughts in the comments below.