After acquiring your first bitcoins you might want to swap the digital asset for another token or test your luck for some quick profits with one of the many cryptocurrency exchanges. And even though you don’t need to be an expert to begin trading cryptocurrencies, some people want to know the very basics on how to get started.

Also read: How to Spend and Give Bitcoin Cash Over the Holidays

Reviewing a Cryptocurrency Trading Platform’s Reputation and Registering for an Exchange Account

Cryptocurrency trading has become extremely popular these days and there’s a large swathe of individuals who swap digital assets every day to make more money. In the early days there were only a few trustworthy trading platforms available for people who wanted to exchange cryptocurrencies, but nowadays there’s a great number of reputable exchanges in most countries.

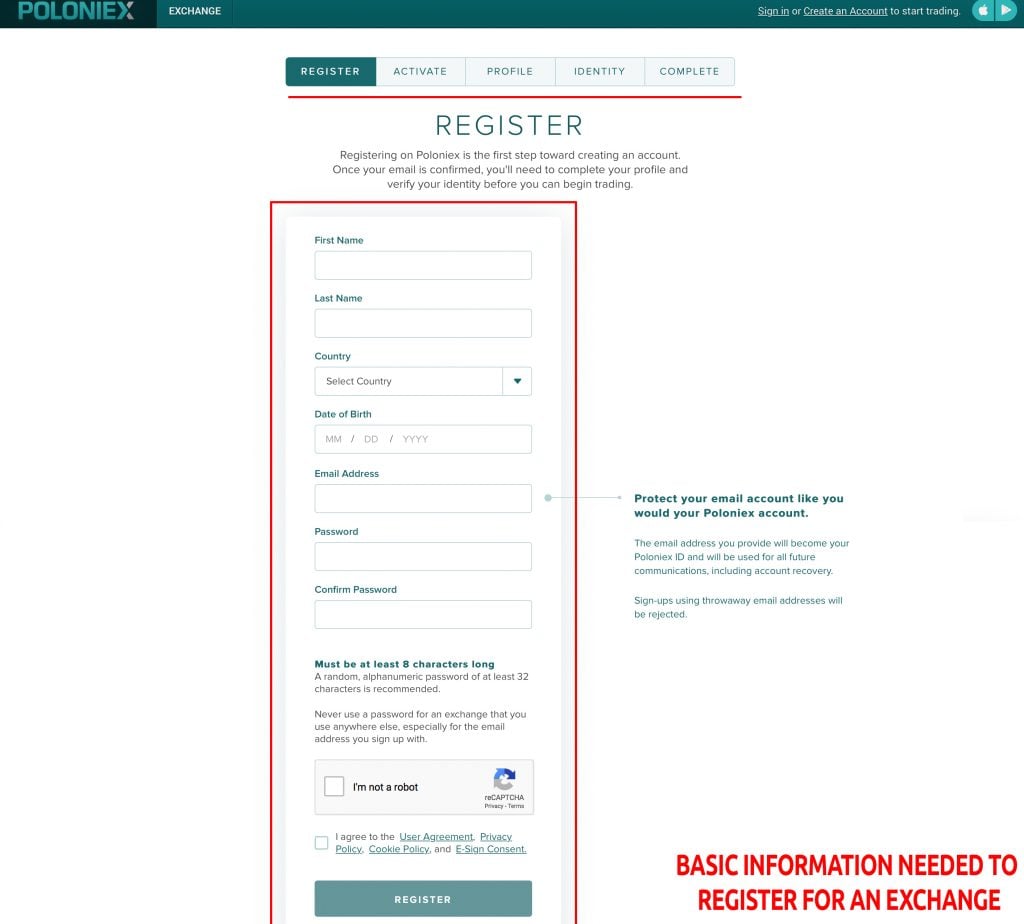

In order to begin trading, you will need a verified account on one of the many global digital asset exchanges in existence. Beginners should know that most trading platforms require the user to verify their identity in order to withdraw fiat, and some businesses also mandate this rule for withdrawing large amounts of digital currencies.

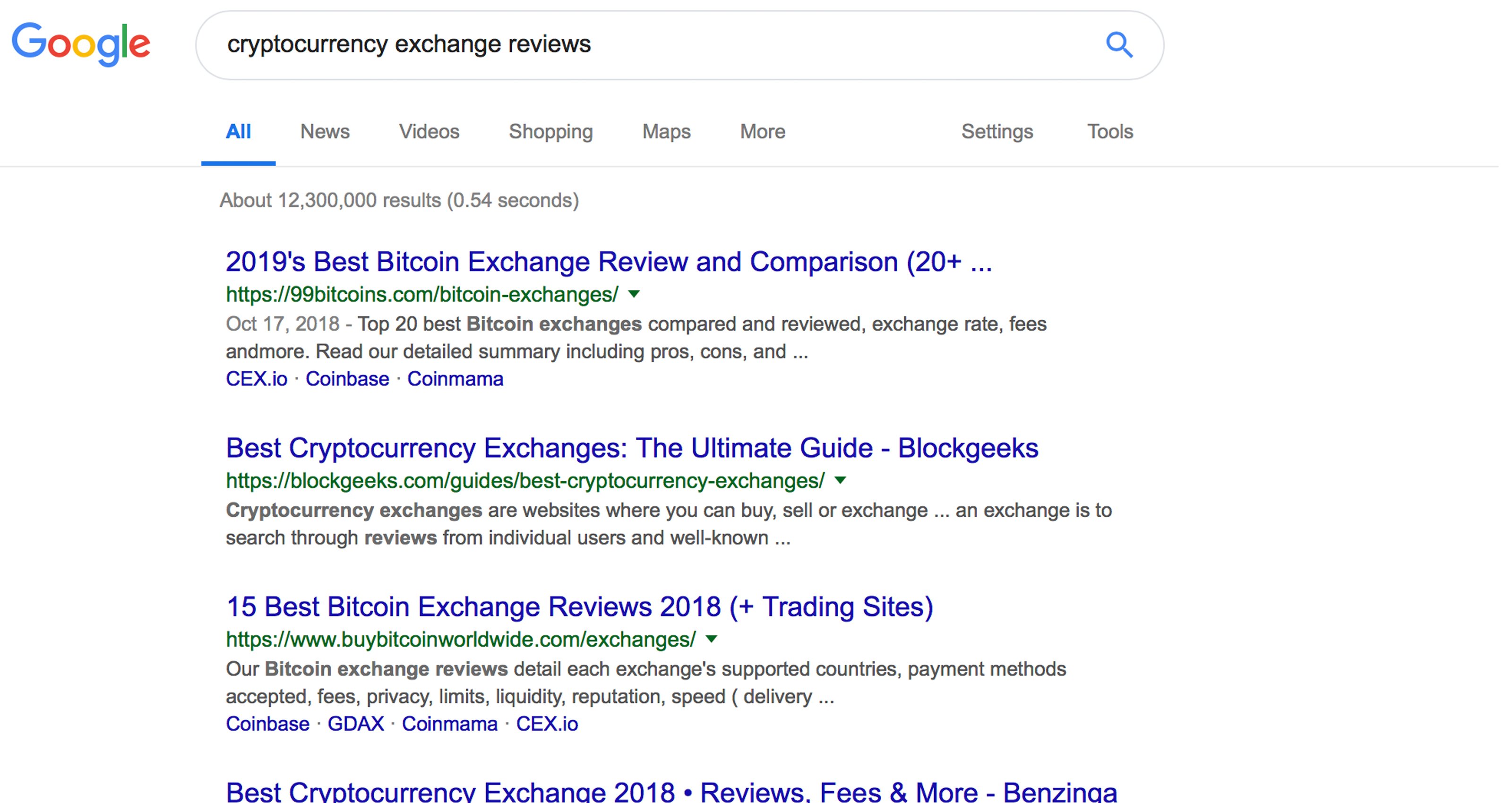

If you are new to trading you should research the variety of exchanges that allow residents from your region to swap digital assets and make sure the trading platform is reputable. There will definitely be reviews on most of the well-known cryptocurrency exchanges available today and people will describe their experiences with the business. After being verified by an exchange most traders like to keep a noncustodial wallet on the side in order to store coins for long-term savings. If traders plan to flip their assets on cryptocurrency platforms for some quick bucks, then keeping funds on an exchange for a temporary period is ideal. However, most veterans know and beginners should forever remember: “If you don’t store your own private keys you don’t own cryptocurrencies.”

If you are new to trading you should research the variety of exchanges that allow residents from your region to swap digital assets and make sure the trading platform is reputable. There will definitely be reviews on most of the well-known cryptocurrency exchanges available today and people will describe their experiences with the business. After being verified by an exchange most traders like to keep a noncustodial wallet on the side in order to store coins for long-term savings. If traders plan to flip their assets on cryptocurrency platforms for some quick bucks, then keeping funds on an exchange for a temporary period is ideal. However, most veterans know and beginners should forever remember: “If you don’t store your own private keys you don’t own cryptocurrencies.”

Markets, Wallets, and Orders

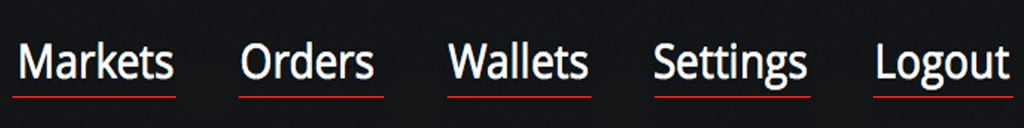

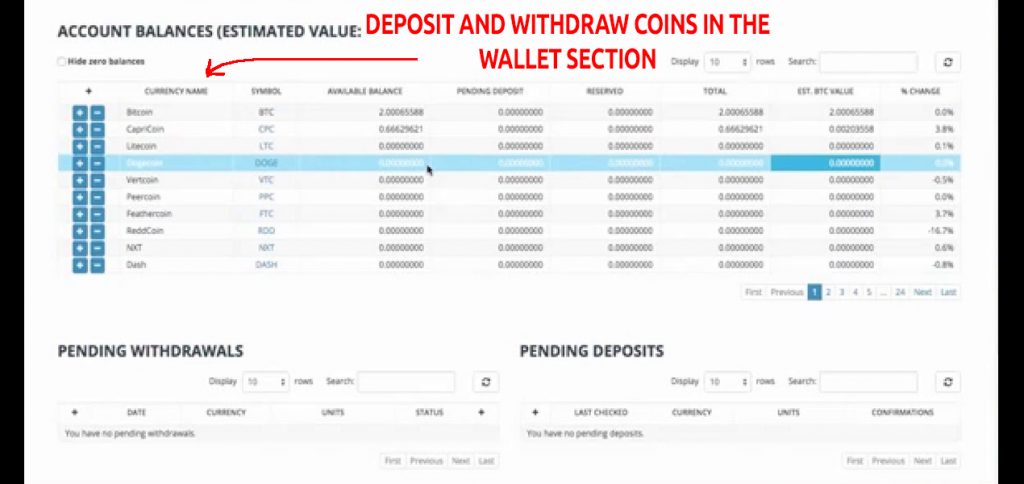

After a trader is verified they can begin trading on the exchange, but they will need some funds to get started. If you already own a popular cryptocurrency like BCH, ETH, or BTC then you can deposit the money into the wallet section located on the exchange. Some exchanges will allow you to make cryptocurrency purchases and sell coins using fiat. This is a good time to get a feel for the exchange dashboard and user profile. New traders should learn how to activate two-factor authentication on the platform and review all the options available. Most exchanges will have a few sections to choose from like a “markets,” “wallets,” “settings and profile,” and an “orders” section. The “markets” option brings the user to the exchange and shows all the cryptocurrency and fiat pairs available to trade on the platform.

The “wallets” section shows all the wallets available on the exchange and this is where you can deposit, withdraw and store all the digital assets supported by the business. Usually, in the “wallets” area users will find the pending deposit and withdrawals and this can be monitored for confirmations. Traditionally, most exchanges have a confirmation period where traders must wait for a certain amount of confirmations to begin trading the cryptocurrency.

The “settings and profile” area is where the user can customize settings like two-factor authentication, user information, email, and other important data tied to the account. This includes information such as passwords, API keys, UI settings, IP whitelist, and more. The trading platform’s “settings and profile” section will also tell you whether or not your account is verified and show a withdrawal limit as well. In the “orders” area users will find orders they had placed that are unfilled or completed.

Sometimes orders get partially filled too and this is a natural occurrence. This happens if you bid on a cryptocurrency at a certain price and there are not enough coins available at that specific price that you can purchase at one time. In these occasions, an exchange may fill a quarter or some fraction of your order. Typically in this case, when more coins are made available at the same price the exchange will fill the remainder of the order. In the “orders” section you should find your trade history and all the buys and sells that have been completed on your account.

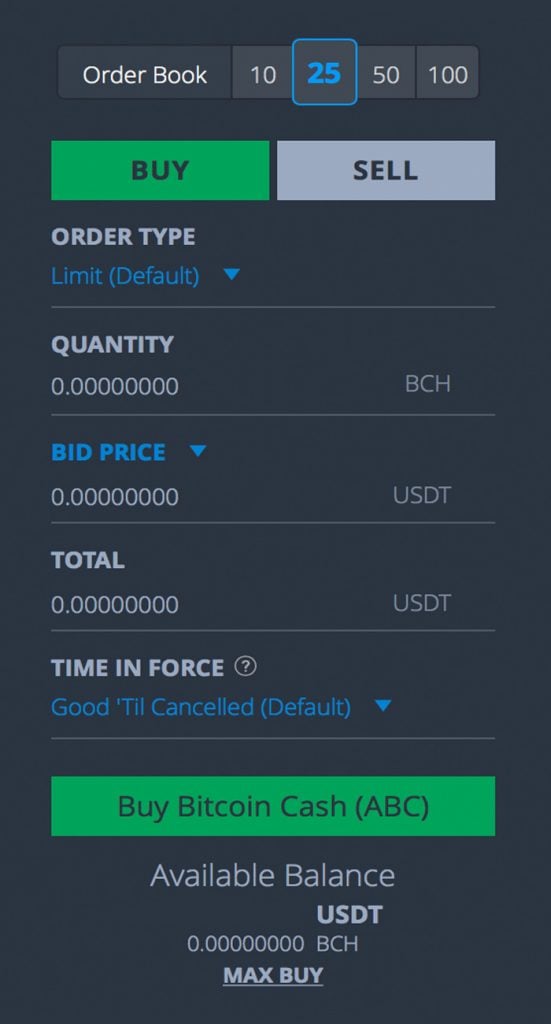

Placing an order on a cryptocurrency exchange, whether it is a buy or sell, is fairly intuitive. For instance, if you are planning to sell 10 ETH on an exchange for USD there usually is a limit (default) order type or a conditional order. A limit order is a traditional buy and sell while a conditional order has to meet certain conditions in order to execute. Most beginners should choose a traditional limit order when attempting some of their first crypto-trades. In the “quantity” window, you would enter 10 ETH or the amount of cryptocurrency you want to purchase or sell. After that comes choosing the price you want to sell the ETH at, and a limit order consists of a few choices. The user can sell the asset for the current “bid” price which is the highest price the market is willing to pay for the coin. Then there’s the “ask” price that represents the lowest price the market is willing to pay for the cryptocurrency at the time. Then the last choice is the “last” price which is essentially the price of the last executed trade. Of course, users can customize the price to anything they want but traditionally beginners will choose between these three options.

Placing an order on a cryptocurrency exchange, whether it is a buy or sell, is fairly intuitive. For instance, if you are planning to sell 10 ETH on an exchange for USD there usually is a limit (default) order type or a conditional order. A limit order is a traditional buy and sell while a conditional order has to meet certain conditions in order to execute. Most beginners should choose a traditional limit order when attempting some of their first crypto-trades. In the “quantity” window, you would enter 10 ETH or the amount of cryptocurrency you want to purchase or sell. After that comes choosing the price you want to sell the ETH at, and a limit order consists of a few choices. The user can sell the asset for the current “bid” price which is the highest price the market is willing to pay for the coin. Then there’s the “ask” price that represents the lowest price the market is willing to pay for the cryptocurrency at the time. Then the last choice is the “last” price which is essentially the price of the last executed trade. Of course, users can customize the price to anything they want but traditionally beginners will choose between these three options.

After completing the type of order, quantity, and price the exchange will show the total cost of the trade including the fees the exchange charges to execute the swap. After confirming that everything looks good as far as the order is concerned the trader can also set a “time in force” option which is usually set to “good until canceled” by default or it can be changed to a specific time frame.

The markets page should show you all the choices available for orders including the current market orders, history, and the user’s trade history as well. This page will likely show a depth chart which is a graphic visualization of the current market order book, a written log of the order book, and a customizable trading chart showing the cryptocurrency’s performance. The order books and the charts set at different time frames can give a trader a little insight on the current market sentiment and may indicate whether or not its bearish or bullish.

Charts, Tools, and Indicators

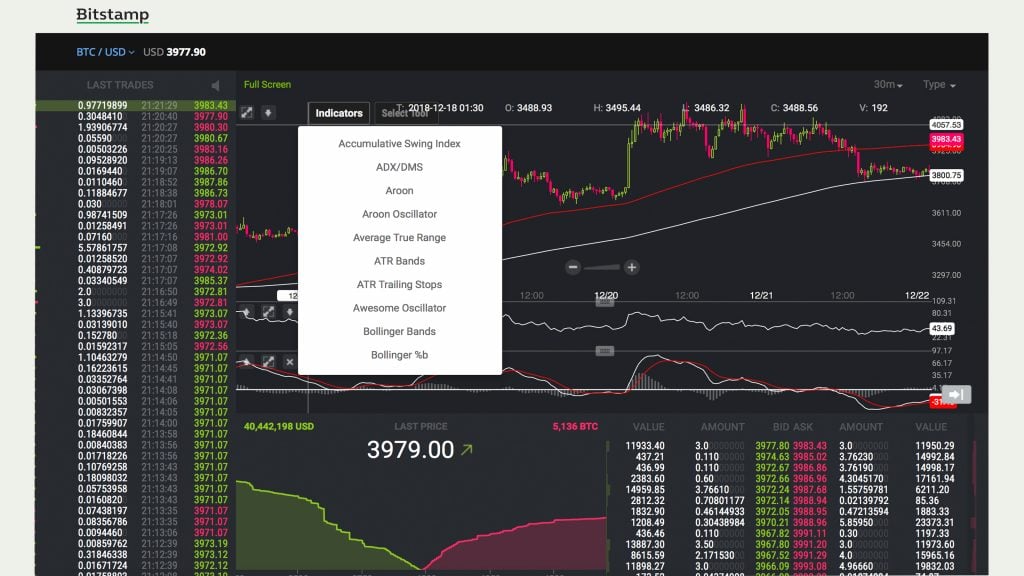

With the charts showing trends, certain charting tools available on the exchange may help a trader better predict short-term and long-term cryptocurrency market movements. After getting acquainted with an exchange and making a few simple trades you might want to learn about some of the technical indicators and charting tools. For example, the Relative Strength Index (RSI) measures both speed and the strength of a market’s price volatility. The RSI will give traders some insight into whether or not the market is “oversold” or “overbought.” The sister to the RSI oscillator is the stochastic indicator that measures current momentum within the markets and collects data on the digital asset’s support and resistance. Another relative of the two oscillators is the Moving Average Convergence/Divergence (MACd). This particular indicator consists of two exponential moving averages and uses them to track momentum as well. In fact, these three technical indicators will often look similarly placed on a chart and move in corresponding directions.

Following learning about momentum indicators it is good to learn about moving averages and there are all kinds of moving averages on the charts like “exponential moving averages (EMA)”, and “simple moving averages (SMA).” Moving averages collect data on a series of time frames in order to smooth out a visualized look at long and short-term trends. With trading statistics moving averages can be set to all kinds of data points by creating a trendline of averages and most traders look at moving averages like the 50, 100, and 200-day averages. The momentum oscillators and moving average trend lines are some of the basics of technical analysis and there are many more tools like Bollinger Bands, Aroon oscillators, ATR bands and trailing stops, fractals, medians, and Fibonacci ratios.

Check out these four articles after understanding the basics of trading digital assets:

- Trading Cryptocurrencies Like a Boss Takes Time and Research

- An Introduction to Bitcoin Trading and Technical Charts

- A Look at Leverage Trading: Learn to Run With the Bears and Ride the Bulls

- A Look at Some of 2018’s Most Popular Cryptocurrency Traders

You Don’t Need to Know Technical Analysis or Charts to Understand the Very Basics of Trading Cryptocurrencies

When you are just a beginner learning how to deposit and withdraw funds, as well as execute a very basic trade, this is all you really need to know in order to swap cryptocurrencies. Having a noncustodial wallet available to send funds to for long-term storage is a good idea to have handy when using cryptocurrency trading platforms. This way you are in control of your private keys and if you ever want to sell those assets you can simply deposit the funds into the exchange at any time. The basics of trading cryptocurrencies are fairly easy and after a few times messing around it’s not too hard to understand. In time, if you are good enough, you could use the cryptocurrencies’ price swings to make a few bucks selling high and buying low. Getting a feel for using the digital assets exchange and making a couple of simple trades is the best way to get started.

A quick recap of required items and things you might need to begin trading cryptocurrencies:

- A valid email, and username & strong password

- Proof-of-identity; license, state ID, residential address information.

- Funds; such as a cryptocurrency or fiat deposit.

- Two-factor authentication (2FA); some exchanges require the use of 2FA platforms such as Authy or Google Authenticator.

- A noncustodial wallet; in addition to an exchange account, it’s good to have a wallet on the side that can store digital assets for long periods of time.

- Research; it’s a good idea to research the reputations of exchanges, how the trading platform works, and eventually you can study technical analysis and methods on how to trade like a pro.

Have you ever traded on a cryptocurrency exchange? What kind of tips would you offer to first time traders attempting to exchange digital assets on a trading platform? Let us know what you think about this subject in the comments section below.

Disclaimer: Price/trading articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Poloniex, Bittrex, Bitstamp, Google, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Everything You Need to Know to Start Trading Cryptocurrencies appeared first on Bitcoin News.