Europe’s Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT) watchdog, MONEYVAL, has listed monitoring the crypto sector along with “gatekeeper” professionals, such as lawyers and accountants, as priorities in European nations’ push to combat money laundering.

In a media release based on the findings of its annual report, MONEYVAL called upon European jurisdictions to assess compliance with international standards and implement stricter regulatory policies to combat money laundering facilitated by crypto assets.

Elżbieta Frankow-Jaśkiewicz, chief of MONEVYAL, cited the Pandora Papers as an example of how professionals serving as “gatekeepers” could aid the rich and corrupt to launder their money. She also claimed that the popularity of crypto assets for money laundering is on the rise:

“A newer money laundering trend is related to the emerging virtual assets sector, the increasing global use of cryptocurrencies, and other components of the rapidly evolving ecosystem of so-called “decentralized finance” (DeFi).”

Moneyval is an AML oversight body of the Council of Europe, spanning 47 European jurisdictions. The task force is responsible for reviewing and recommending policy changes that influence national legislative reforms.

Related: Blockchain and crypto can be a boon for tracking financial crimes

The report concluded that the median level of compliance with the Financial Action Task Force (FATF) standards is below the satisfactory threshold among its supervised jurisdictions. Eighteen out of the 22 jurisdictions evaluated by MONEYVAL showed an insufficient level of compliance with AML standards.

The European watchdog will also conduct a separate study to examine money laundering trends related to virtual assets later this year.

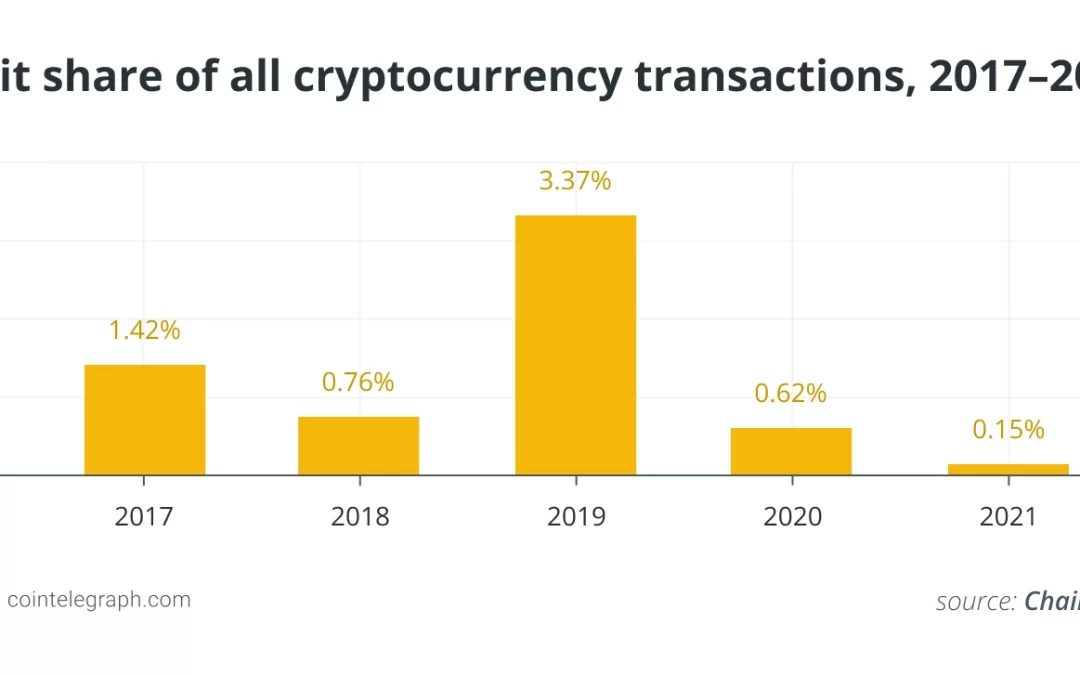

While regulatory authorities continue to raise concerns around the use of cryptocurrencies for money laundering and other illicit activities, the latest data from blockchain analysis firm Chainalysis suggest that less than 1% of the total circulating supply of crypto was used for illegal activities in 2021.