Ethereum has seen its transaction volumes soar, active addresses hit new all-time highs and daily fees surpass Bitcoin, but the price of ETH/USD has failed to spike in past weeks

Ethereum, cryptocurrency’s second-largest by market cap, has added just over 1% to its value in the past 24 hours.

At the beginning of the month, ETH/USD rose to highs of $252 but sideways trading has seen bulls fail to post a major move.

Price weak despite massive fundamental growth!

June saw an explosion of activity on the Ethereum blockchain, thanks in part to a DeFi boom. The last month’s DeFi assets performance was reminiscent of that seen during the 2017 bull market when initial coin offerings (ICOs) took the market by storm.

Ethereum has also seen a surge in active addresses to all-time highs of over 492,000, with more Ether leaving exchanges as hodlers increase or users lock up value in DeFi protocols.

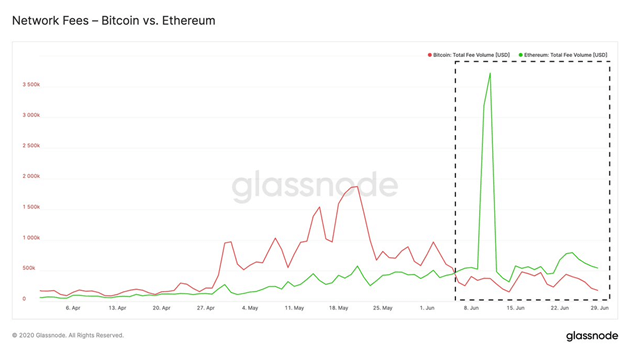

The network of the second-largest coin has also seen a record transaction volume spike, with network fees hitting multi-year highs to surpass those of Bitcoin. Although some of the volumes were linked to spamming by miners, usage has been hitting new levels to suggest massive fundamental growth.

However, the price of the cryptocurrency has failed to follow the skyrocketing bullishness as indicated by the fundamentals. Rather, ETH/USD is more bearish at the moment and a breach below crucial support levels could see sell-off pressure push prices lower.

Ethereum technical short term technical outlook

On the technical side of things, ETH/USD continues to battle seller rejection that is preventing a break above the key boundary at the $230-$250 range.

Over the past week, Ethereum touched price levels near the major resistance at $250. However, buyers could not sustain momentum and ETH/USD plunged more than 6% to touch lows of $215 marked by the 23.6% Fib retracement.

The coin could still break above the rising trend line to post a monthly close above $230. However, if sellers push harder, prices could test last week’s lows at $215 and beyond that, towards the 200 EMA at $200.

On the upside, immediate resistance is found at the psychological $230 and above that $240 and then $245.90 marked by the 61.8% and 78.6% Fib retracement levels respectively. A break above this level opens up $250 and a rally to June highs.

The RSI is currently flatlining below 50, suggesting Ethereum faces bearish momentum.

As of press time, the pair is trading at $225, having gained 1.57% in the past 24 hours. The cryptocurrency is also posting similar gains against Bitcoin as the pair exchanges hands at 0.02477.

The post Ethereum’s price is bearish despite massive fundamental growth: here’s what’s next appeared first on Coin Journal.