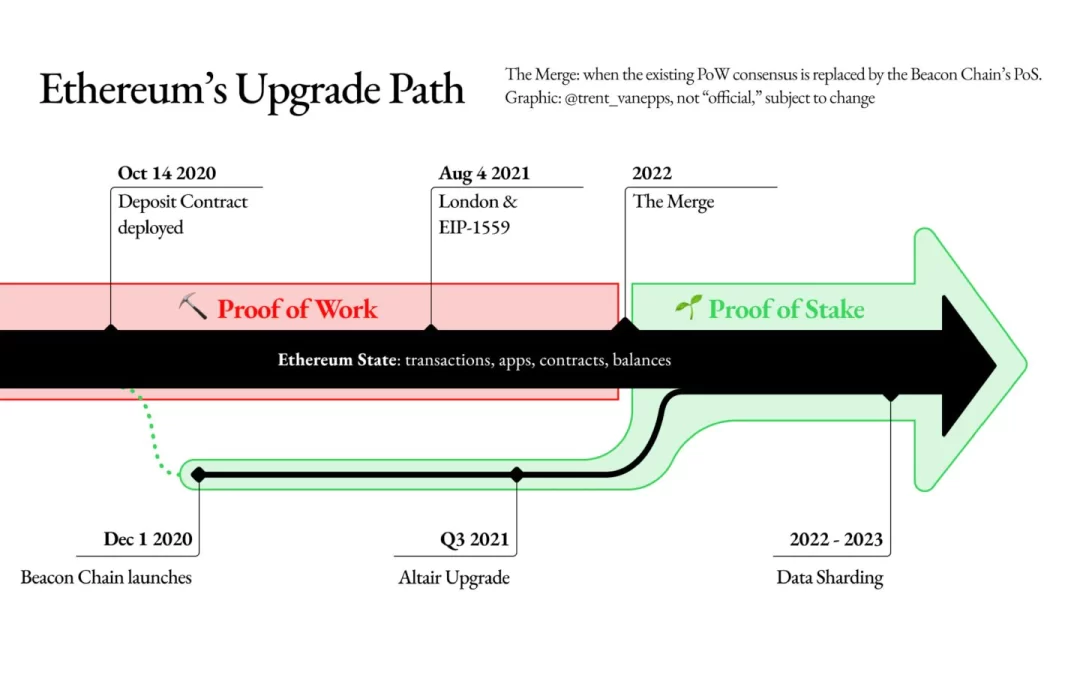

The Ethereum Foundation announced in a blog post that it is nearly time to put an end to “ETH2” and the nomenclature that seems to separate the proof-of-stake chain from the proof-of-work chain. While it made sense when Ethereum’s roadmap looked to build out a separate proof-of-stake chain and simultaneously destroy the proof-of-work chain as we know it, the roadmap now involves a Merge between Eth 1 and Eth 2, pairing the current execution (application) layer on the proof-of-work chain with the consensus layer of the Beacon Chain.

In the foundation’s own words:

- Eth 1 → execution layer

- Eth 2 → consensus layer

- Execution layer + consensus layer = Ethereum

So much focus on the terminology for the technical specifications of Ethereum may seem like overkill. However, making the large distinction between Ethereum 1.0 and Ethereum 2.0 can be confusing, leaving some everyday users wondering if Ethereum 2.0 will come with a new token or if they will have to migrate their balances to a new chain and plenty of other implications that scammers would love to use to their advantage.

Additionally, it will only become more inaccurate to refer to the execution and consensus layers as separate versions of Ethereum the closer we get to integrating the two layers.

If you are interested in taking a stroll through the history of Ethereum, I recommend reading the March 28, 2021, edition of Ben Edgington’s What’s New In Eth2. Ben breaks down how Eth 2 came to be and how changes in the roadmap have made naming clarity nearly impossible over the years.

As we move closer to the Merge (fingers crossed for early this summer) and Eth 2 and Ethereum become synonymous, we at CoinDesk will also begin to step back from using Eth 2 without additional context. Instead, we will follow the Ethereum Foundation’s lead in referring to it primarily as the consensus layer.

Welcome to another issue of Valid Points.

Pulse check

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

- Popular cross-chain bridging application Multichain was hacked for over $3 million in user funds. BACKGROUND: Cross-chain bridging continues to be one of the riskier subindustries in DeFi, especially as demand for alternative chains grows. As users look to import non-native tokens to other layer 1 platforms, bridging contracts will take on more and more risk. The DeFi industry looks to developers to find better solutions for layer 1 cross-chain bridging.

- An OpenSea bug allowed attackers to purchase NFTs at old listing prices and immediately sell them for profit. BACKGROUND: While users may have changed or increased their listing prices, old listings still existed at the blockchain level. Listings are only unapproved once they are canceled or expired, leaving several NFT holders exposed for attack and wondering why their NFTs sold below market value.

- The chain split on Kintsugi, Ethereum’s proof-of-stake test network, has been resolved and finality was restored. BACKGROUND: Marius van der Wijden released a fuzzer on the test network to battle-harden it for future user activity; this caused a three-way chain split between execution clients Geth, Besu and Nethermind, which were also followed by two of the consensus side clients as well. Ethereum-facing teams stepped back to watch the chain split instead of immediately addressing the problem, thereby gaining further insight on how to react to future issues on mainnet.

- Ether issuance from block rewards fell below that of bitcoin, as a result of EIP 1559. BACKGROUND: The non-technical excitement around EIP 1559 was the possibility that transaction fee burns would offset the native asset’s inflation. Block rewards are an important mechanism to financially incentivize miners and validators to secure the chain in good faith. The fee burn allows the network to continue paying block rewards in perpetuity without worrying about alienating ether holders and block space consumers via inflation.

Factoid of the week

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.