Earlier this week, Evan Van Ness of Starbloom Ventures and Josh Stark of the Ethereum Foundation released an Ethereum year-end report, The Year in Ethereum 2021, diving into activity on the network last year. Here are some of the report’s most promising developments and trends within the current Ethereum ecosystem.

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum 2.0 and its sweeping impact on crypto markets. Subscribe to Valid Points here.

Adoption from all angles

Demand for blockspace on Ethereum skyrocketed during 2021, with $9.9 billion in transaction fees being paid throughout the year. Since fee per transaction is vastly different chain to chain, the metric is not great for comparing usage on layer 1s and 2s, but it does provide insight into how eager users were to access DeFi, NFTs and DAOs.

On basically every metric, Ethereum showed adoption: total value locked in DeFi, active addresses on the network, OpenSea volume and application developer activity all grew exponentially.

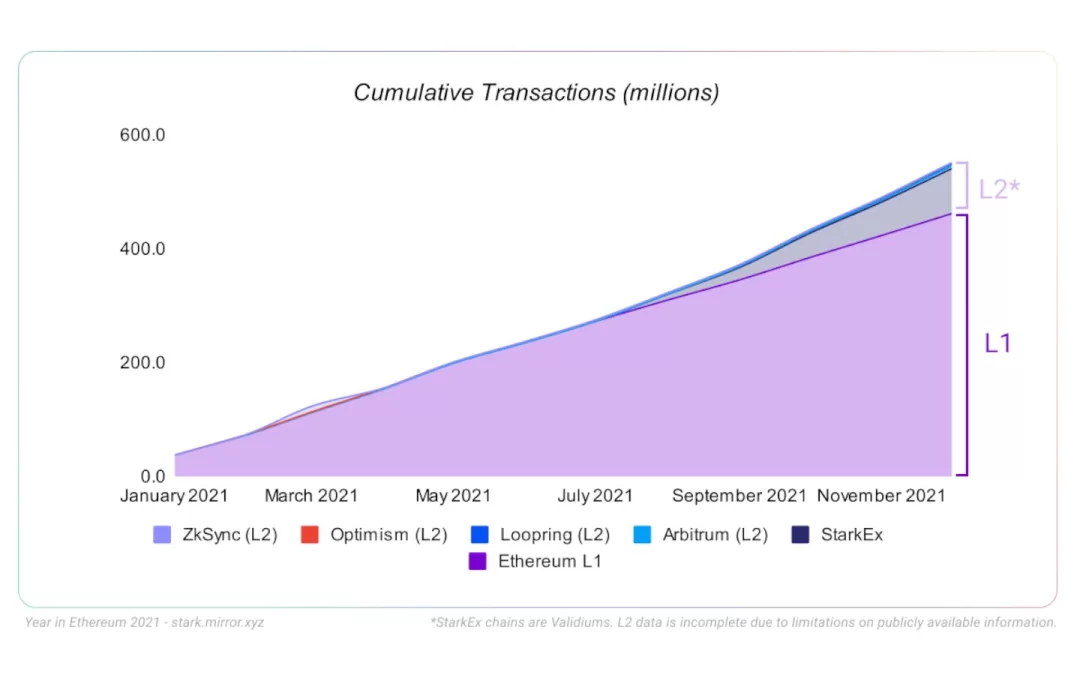

More important, the report highlighted that Ethereum is no longer a one-chain ecosystem. In order to achieve scalability, the Ethereum community will need to offer layer 2 technologies capable of handling transactions from billions of users. 2021 proved to be the first step in experimentation with both optimistic and zero knowledge proof rollups, and the two finally began to take significant market share in daily transactions away from Ethereum L1.

As a technology, Ethereum and other smart contract chains have proved to be an exciting and profitable platform for creators and developers to build and share their work. DeFi developers have created billions of dollars in value by building financial products open and accessible to the world, and artists have found amazing success with creating digital, liquid art in the form of NFTs. That being said, Ethereum’s “creator economy” is competing with top platforms like YouTube, Spotify and OnlyFans, delivering $3.5 billion in earnings to those building on top of the network.

The report also focused on the technical state of the network, diving deep into the pending transition to proof-of-stake, EIP 1559’s effect on the network and the issue of client diversity on the Beacon Chain. A full look at Van Ness and Stark’s work can be found here.

Welcome to another issue of Valid Points.

Pulse check

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

- Mechanism Capital launched a $100 million fund focused on play-to-earn blockchain-based gaming. BACKGROUND: Excitement around Axie Infinity and DeFi Kingdoms has investors looking to support the next generation of on-chain gaming. The non-fungible yet composable aspects of NFTs make the digital assets an interesting experiment throughout the gaming industry.

- North Korean hackers were responsible for exploiting around $200 million in ETH throughout 2021. BACKGROUND: According to Chainalysis, a North Korean hacking group was able to exploit Kucoin and other centralized exchanges using phishing, malware and code exploits. The funds were linked to addresses controlled by the Democratic People’s Republic of Korea and are laundered through Tornado Cash and other popular mixers.

- Smart contract network Near Protocol raised $150 million from investors to develop an ecosystem war chest. BACKGROUND: Near followed in the footsteps of other major chains like Avalanche and Polygon, raising a large sum of capital to incentivize ecosystem growth via DeFi grants and liquidity mining. The massive raise was completed in less than two weeks, showing the hunger for exposure to the “next layer 1” opportunity.

- Recent client diversity numbers show Ethereum’s Beacon Chain is still heavily reliant on Prysm. BACKGROUND: A client is “the implementation of Ethereum that verifies all transactions in each block, keeping the network secure and the data accurate.” Diversity in client software allows the network to overcome bugs that may negatively impact a percentage of the nodes validating the network. While there are several high quality clients available, Prysm currently accounts for 68% of all nodes on the network.

Factoid of the week

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CoinDesk Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site.