Dogecoin (DOGE) traders lost more than $11.69 million to liquidations in Asian morning hours as the memecoin surged 14% in the past 24 hours. The figures were much higher than liquidations on bitcoin or ether futures, which usually see the most losses among all cryptocurrencies.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position as a safety mechanism due to a partial or total loss of initial margin. That happens primarily in futures trading, which only tracks asset prices, as opposed to spot trading, where traders own the actual assets.

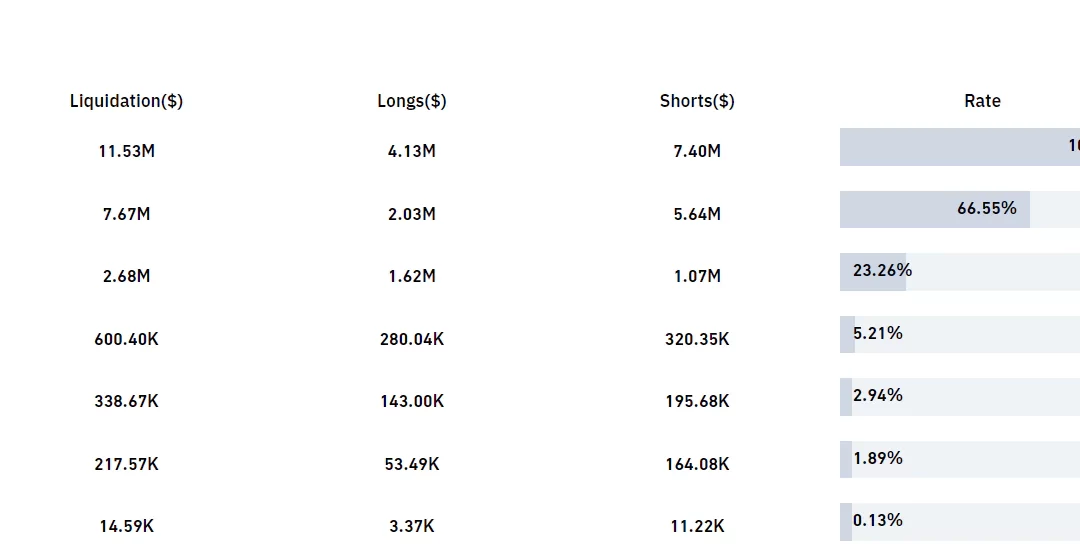

Nearly 65% of the liquidations stemmed from short trades, or from those betting on the downside, accounting for over $7.66 million in losses. Leveraged traders betting on an upside lost another $4 million on margin calls.

Data from analytics tool Coinglass showed 60.81 million dogecoin was liquidated across various crypto exchanges. Futures products tracking the memecoin on OKEx saw over $7.71 million in liquidations, while similar products on Binance saw $2.75 million in liquidations.

The price rally came as electric-car maker Tesla went live with dogecoin payments for merchandise early Friday. Tesla fans can now purchase beltbuckets, whistles, chargers and a quadbike using the memecoin on the official store, as reported.

Tesla CEO Elon Musk has previously lent support to dogecoin development and adoption even as the memecoin’s creators abandoned the project back in 2015. In a tweet in May 2021, Musk stated he was working with dogecoin developers to improve system efficiency.

In December, the Dogecoin Foundation, a nonprofit organization that oversees developments on the network, introduced a roadmap for the project’s revival and rebrand from a mere joke cryptocurrency to a more technical project. It was the first roadmap in Dogecoin’s eight-year history and explored eight new projects, including the launch of LibDogecoin and GigaWallet, as reported.

Dogecoin trades at $0.19 from lows of $0.16 in early Asian hours. Prices reached as high as $0.20 in European morning hours before a brief selloff at the time of writing.