Bitcoin (BTC) bulls are probably quite disappointed with how the start of 2022 has shaped up, especially since the cryptocurrency plunged over 20% in the first 25 days of the year. Even more shocking is the fact that the supposed $32,930 bottom on Jan. 21 was the lowest level BTC price had seen in six months, while equity markets as measured by the S&P500 reached an all-time high on Jan. 4.

The sell-off in risk markets accelerated after the U.S. Federal Reserve announced its plan to raise interest rates in the coming months, a measure intended to hold back the escalating inflation. For example, Invesco China Technology ETF (CQQQ) traded below $58 on Jan. 22, which was a 20% drop from its peak on Nov. 12.

Regulatory uncertainties continue to weigh on the sector as United States Congressman Patrick McHenry called the “inconsistent treatment and jurisdictional uncertainty” on crypto as a problem. McHenry essentially suggested that Congress should take crypto regulation away from executive agencies and courts.

Bitcoin price recovered, but bulls are still in troubled waters

Bitcoin bulls have little to celebrate after the 12% partial recovery to $38,100 on Jan. 26. First, BTC price is down 35% over the past two months, and more importantly, if Bitcoin trades below $38,000 by the Jan. 28 monthly options expiry bears are set to profit by $350 million.

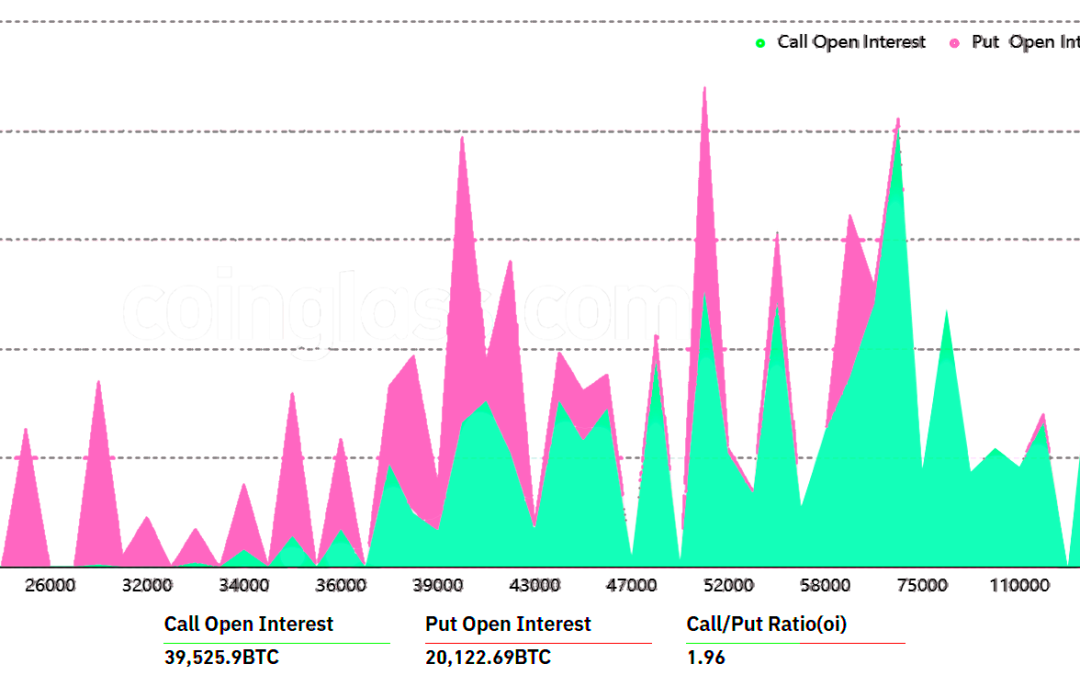

At first sight, the $1.52 billion call (buy) options overshadow the $760 million in put options, but the 1.96 call-to-put ratio is deceptive because the recent price drop will likely wipe out most of the bullish bets.

For example, if Bitcoin’s price remains below $38,000 at 8:00 am UTC on Jan. 28, only $72 million worth of those call (buy) options will be available at the expiry. There is no value in the right to buy Bitcoin at $38,000 if BTC is trading below that price.

Bears bag a $315 million profit even with Bitcoin near $39,000

Here are the three most likely scenarios for the $2.3 billion options expiry on Jan. 14. The imbalance favoring each side represents the theoretical profit. In practice, depending on the expiry price, the quantity of call (buy) and put (sell) contracts becoming active varies:

- Between $35,000 and $37,000: 660 calls vs. 13,550 puts. The net result is $450 million favoring the put (bear) options.

- Between $37,000 and $39,000: 1,300 calls vs. 13,100 puts. The net result is $315 million favoring the put (bear) options.

- Between $39,000 and $41,000: 3,710 calls vs. 8,170 puts. The net result favors bears by $180 million.

This crude estimate considers call options being used in bullish bets and put options exclusively in neutral-to-bearish trades. However, this oversimplification disregards more complex investment strategies.

For instance, a trader could have sold a call option, effectively gaining a negative exposure to Bitcoin above a specific price. But unfortunately, there’s no easy way to estimate this effect.

$40,000 is still a stretch

It might seem relatively easy to move Bitcoin price up by 3% and bring the expiry price above $39,000 on Friday’s expiry. However, considering the negative news flow regarding regulation and monetary policy tightening, bulls will likely have a hard time pulling it off.

Therefore, if the current short-term negative sentiment prevails, bears could easily pressure the price down 3% from the current $38,100 down to $36,900 and secure a $450 million profit.

In short, bears completely dominate Jan. 28 monthly options expiry, giving little hope for a $40,000 price recovery in the short-term.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.