The price of bitcoin has seen some corrections over the years, but really there have only been a few deep cuts. With the bearish dips in price over the past five weeks it’s always good to look at the historical view of value drops and the long-term achievements of the cryptocurrency economy in general.

Also read: Nassim Nicholas Taleb vs David Birch on The Bitcoin Standard

Mainstream Media Assumes the Cryptocurrency ‘Bubble Has Popped,’ But In Reality This Economy Is Just Getting Started

If you look at all the headlines across mainstream media publications today, lots of these ‘news sources’ claim “bitcoin is dead” and the “digital asset bubble has burst.” Cryptocurrency prices have been on a downward spiral since BTC/USD markets reached an all-time high above $19K in December of 2017. Of course, since that point, there’s been many predictions to how low values will fall as some predicted BTC markets to stop at $10,000, while a lot of speculators forecasted today’s low of $7,625, and some individuals think the value will still sink even lower. Since reaching a global average of $19,600 USD per BTC, the digital asset had lost approximately 61.22 percent when it arrived at its lowest point today. However, bitcoin markets have rebounded, and the loss is only 56 percent at the time of publication.

If you look at all the headlines across mainstream media publications today, lots of these ‘news sources’ claim “bitcoin is dead” and the “digital asset bubble has burst.” Cryptocurrency prices have been on a downward spiral since BTC/USD markets reached an all-time high above $19K in December of 2017. Of course, since that point, there’s been many predictions to how low values will fall as some predicted BTC markets to stop at $10,000, while a lot of speculators forecasted today’s low of $7,625, and some individuals think the value will still sink even lower. Since reaching a global average of $19,600 USD per BTC, the digital asset had lost approximately 61.22 percent when it arrived at its lowest point today. However, bitcoin markets have rebounded, and the loss is only 56 percent at the time of publication.

Bitcoin’s Recent Five Week-Long Drop In Value Has Come Close to a Few Outlier Corrections

A lot of people are looking at prior bitcoin price corrections to figure out where this one will lead. Historically bitcoin markets have seen a number of broad cuts in value, but this particular drop overwhelms four previous corrections. On December 16, 2017, BTC markets touched an all-time high and lost 61 percent in just five weeks leading to today. Even with the rebound, the dip outpaces the June 2012 Linode hack scare where bitcoin markets lost 36 percent. Additionally, the past month’s decline has been more prominent than the 2014 Mt Gox bankruptcy plunge (49%), and the value drop that was correlated to Chinese exchange bans back in September of 2017 (40%).

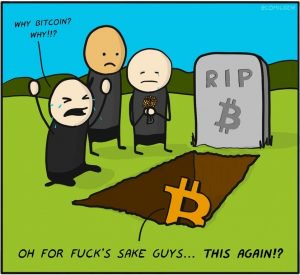

However, there are three significant bitcoin market outlier corrections that have been far larger than this past drop. In 2011 the BTC market lost 94 percent of its value during the first hack of the Japanese exchange Mt Gox. Further, Mt Gox spurred another 79 percent selloff in 2013 when the platform halted trading. Lastly, bitcoin’s value sunk over 87 percent from November 2013 to January 2015 as the cryptocurrency experienced the longest ‘bear run’ in its history. There’s also been quite a few ‘major corrections’ over the 35 percentile mark, and every one has led the mainstream media and many newcomers to believe it’s time to close the casket on this ‘magical internet money.’

After the Big Dip, Bitcoin’s 70,000% Increase Is Far from Being ‘Dead’

What these pundits don’t realize is even after this current price drop since bitcoin’s inception, the cryptocurrency has gained roughly 70,328 percent. Since last February BTC/USD markets are still up 720 percent and many other digital assets have seen even more substantial price gains year-over-year. Historically, for every two steps back, the value of bitcoin has leaped seven steps forward after nearly every correction.

Will this be the case again? We really don’t know, but cryptocurrencies have never ‘died’ and many believers feel the value of this economy will likely continue to rise over the long term. Those who say cryptocurrencies are in a death spiral have not looked at the whole picture.

Where do you see cryptocurrency market values going from here? Let us know in the comments below.

Images via Shutterstock, Reddit, Trading View, and Barrons.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post Dead again? In Reality Bitcoin Is Up 729% Since Last February appeared first on Bitcoin News.