Margin trading allows investors to borrow stablecoins or cryptocurrency to leverage their position and improve the expected return. For example, borrowing Tether (USDT) will allow one to buy Bitcoin (BTC), thus increasing their Bitcoin long position.

Investors can also borrow BTC to margin trade a short position, thus betting on price downside. This is why some analysts monitor the total lending amounts of Bitcoin and Tether to gain insight into whether investors are leaning bullish or bearish.

Are analysts flipping bearish based only on Bitfinex’s margin data?

This week, some prominent analysts cited a surge in Bitcoin short positions on Bitfinex, peaking at 6,621 BTC on June 7. As Cointelegraph reported, independent researcher Fomocap found a visible correlation between margined short positions and the May 19 price crash.

However, when analyzing a broader scope of data — including the margin longs, perpetual contracts funding rate and protective put options — there is no evidence of prominent players preparing for a surprise negative move.

A single instance of Bitcoin margin shorts spiking ahead of the negative price swing should not be considered a leading indicator. Furthermore, one needs to factor in Bitcoin margin longs — an opposing, usually larger force.

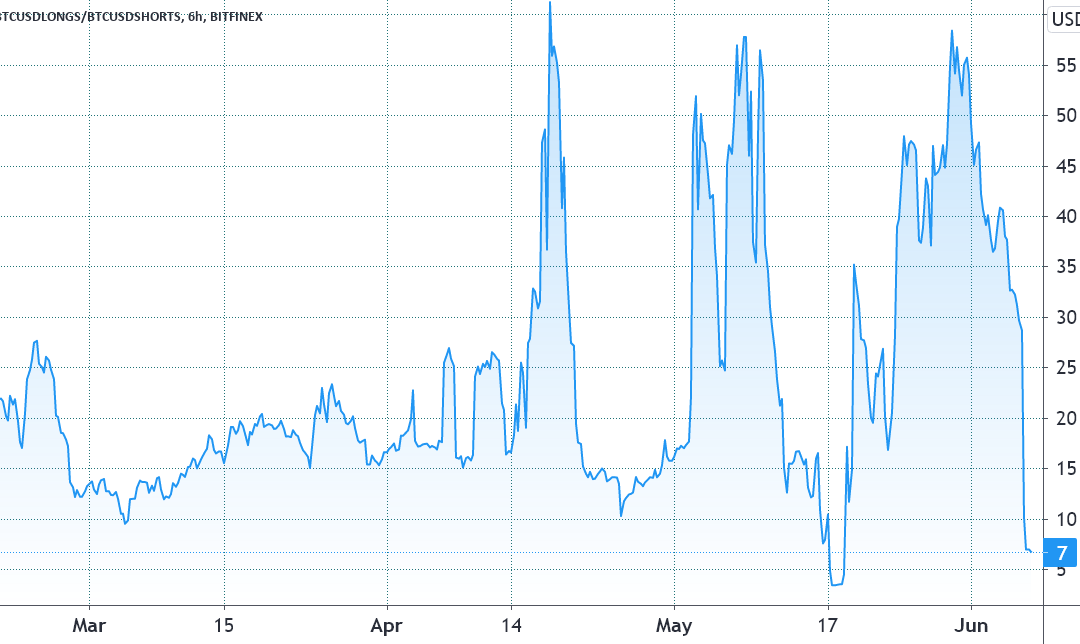

As the above chart indicates, even on May 17 the number of BTC/USD long margin contracts outpaced shorts by 3.6, at 39,000 BTC. In fact, the last time this indicator dropped below 2.0, favoring longs, was on Nov. 26, 2020. The result was not good for the shorts, as Bitcoin rallied 64% over the following 30 days.

Whenever traders borrow Tether and stablecoins, they are likely long on cryptocurrencies. On the other hand, BTC borrowing is mainly used for short positions.

Theoretically, whenever the USDT/BTC lending ratio goes up, the market is angled in a bullish manner. The ratio at OKEx bottomed at 3.5 on May 20, favoring longs, but it quickly returned to the 5.5 level. Therefore, there is no evidence of a significant movement favoring shorts on margin markets.

The perpetual futures funding rate is still flat

Perpetual futures prices trade very close to regular spot exchanges, making the lives of retail traders a lot easier because they no longer need to calculate the futures premium.

This magic can only be achieved by the funding rate charged from longs (buyers) when demanding more leverage. However, when the situation is reversed and shorts (sellers) are over-leveraged, the funding rate goes negative, and they become the ones paying the fee.

As displayed above, the funding rate has been mostly flat since May 19. Had there been a massive surge for shorting demand, the indicator would have reflected the move.

The options put-to-call ratio remains bullish

The call (buy) option provides its buyer with upside price protection, and the put (sell) does the opposite. This means traders aiming for neutral-to-bearish strategies will typically rely on put options. On the other hand, call options are more commonly used for bullish positions.

Take notice of how the neutral-to-bullish call options outnumber the protective puts by nearly 90%. Had professional traders and whales been anticipating a market crash, this ratio would have been positively impacted.

Investors should not make trading decisions based on a single indicator, as the remaining markets and exchanges may not corroborate it. For now, there is absolutely no indication that heavy players are betting on Bitcoin short positions.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.