Digital asset investment products saw inflows totaling $42 million last week, signaling another week of improved sentiment among investors. This marks the fifth consecutive week of inflows.

“This improved sentiment could be a seasonal phenomenon, but we are not seeing a commensurate rise in volumes in investment products,” said a CoinShares report published Monday. “This suggests that some investors are taking advantage of recent price weaknesses and the continued rise in alt-coin popularity,” added the report.

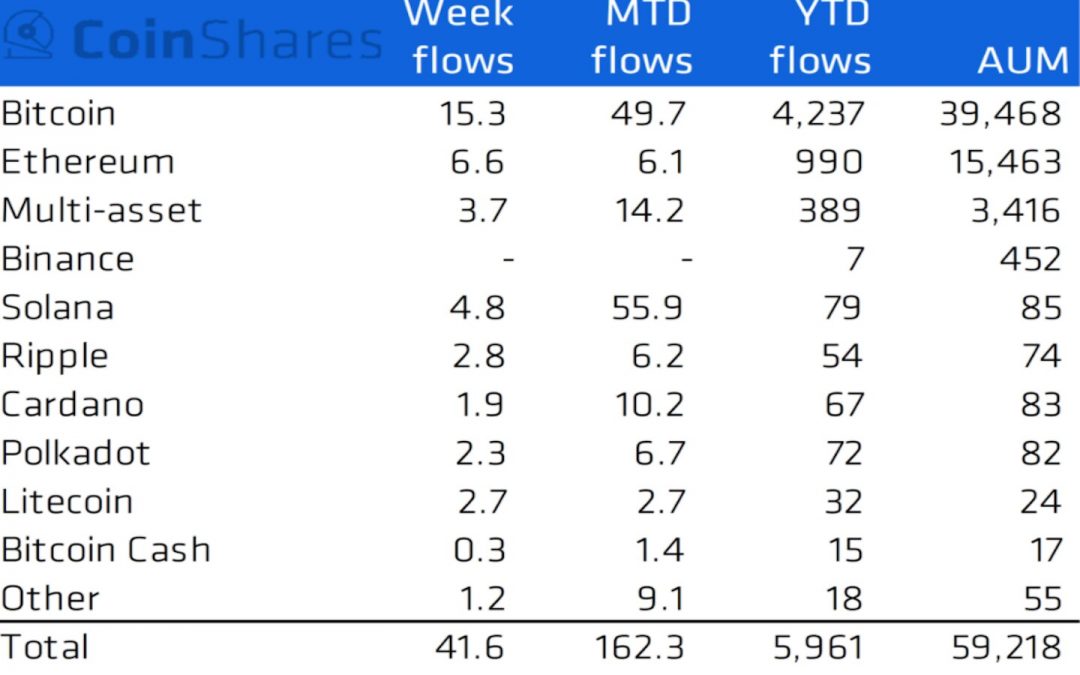

Solana, which suffered a network outage that lasted nearly 20 hours last week, saw inflows of $4.8 million. Ethereum and multi-asset investment products saw inflows of $6.6 and $3.7 respectively.

“This suggests investors were happy to shrug-off the attack, seeing it as teething problems rather than something more inherent with the network,” said the report.

Despite inflows of $15 million over the last week, the world’s largest cryptocurrency has suffered the most from negative investor sentiment with inflows in only 3 of the last 16 weeks.

Over the course of this year, bitcoin’s total market share of assets (AuM) has fallen from 81% in January to 67% on Monday.

Bitcoin is down 8% on the day, and is decisively below its 50-day moving average. At press time, bitcoin was trading at $43,784.