Investors pumped a total of $95 million into digital asset products last week, more than double the prior week’s pace, according to a CoinShares weekly report.

With the headwinds that digital assets have faced recently, such as the widened China ban, the continued inflows suggest the price declines may have been seen as buying opportunities.

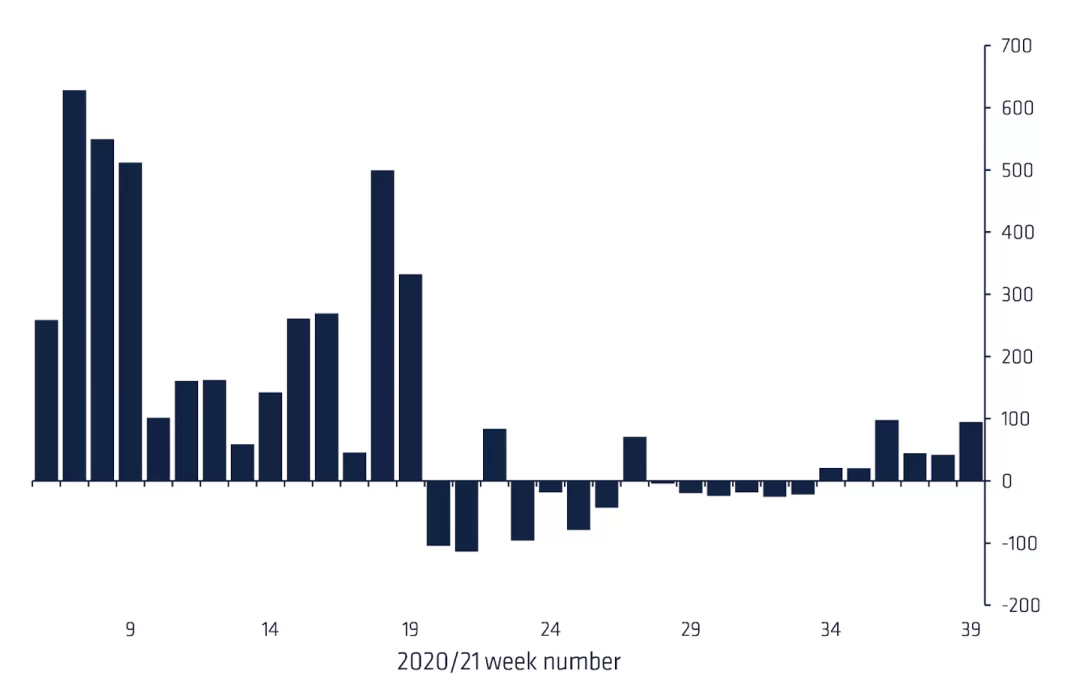

The flows into crypto funds during the week ended Sept. 24 were the most since the $98 million in the week through Sept. 3, and brought total inflows over the last six weeks to $320 million.

Bitcoin saw the largest inflows of any investment product, totaling $50 million, also the most in three weeks. This is despite the fact it has experienced the brunt of negative investor sentiment over the last two quarters, said the report. Funds focused on the largest cryptocurrency have suffered outflows in all but four of the past 17 weeks.

For Ethereum, sentiment has remained relatively buoyant; funds focused on the blockchain’s native cryptocurrency, ether (ETH), followed bitcoin with inflows totaling $29 million last week. The prior week, ether-focused funds saw $6.6 million in inflows.

The report estimates 6.6% of Ethereum’s total supply is staked to Eth 2.0 – a planned upgrade of the blockchain network that aims to increase transaction capacity, reduce fees and make the network more sustainable and efficient.

“Growth in staking is essential for investor sentiment,” said the report. “Investors see it as a potential environmentally alternative to other proof-of-stake digital assets.”

For assets under management (AuM), both Solana and Polkadot continued to attract interest from investors. Solana-focused funds brought in $3.9 million, representing 4.5% of assets under management, while Polkadot-focused funds attracted $2.4 million, or 3.2%